By Kerry Pechter

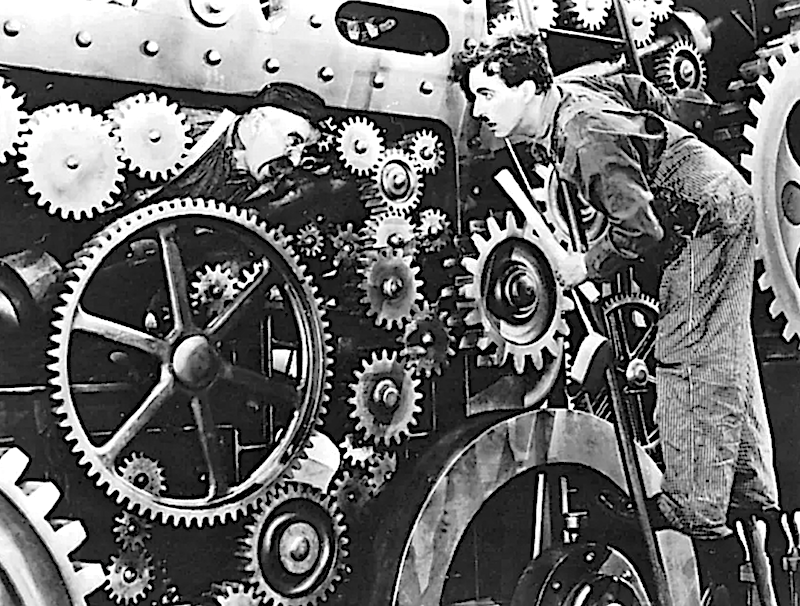

Life insurers used to be known as champions of 'asset-liability matching,' or ALM. Today, many of them are doing the opposite by 'funding short.' Here's a transcript of RIJ's recent conversation with ChatGPT about the risks and rewards of funding short, and its role in today's annuity business.

Read more

|

|

What a Mighty Joy That Would Be

By Kerry Pechter More than a million Americans receive artificial hip, knee or shoulder joints every year. This month, after years of procrastination, I became one of them. Joint surgery is now routine, friends told me. 'For the surgeons,' I said.

Read more

|

|

Crypto no longer requires ‘extreme care’ from plan sponsors: DOL

'The Biden administration’s Department of Labor made a choice to put their thumb on the scale,' said U.S. Secretary of Labor Lori Chavez-DeRemer in a May 28 release. 'We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not DC bureaucrats.'

Read more

|

|

The Wheelhouse

Connecticut seeks buyers for insolvent PHL Variable; Offshoring of life insurer liabilities tops $1 trillion. News from: Empower and Sagard, MetLife, WinkIntel, Midland and Dimensional Fund Advisors, Brighthouse Financial, Jackson National Life, iCapital, and The Standard.

Read more

|

|

Debt, Defaults, and the $36 Trillion Question

By Jason Hsu 'The government blows through more money than we save. Fortunately, the enormous gain in asset value more than offsets the difference,' writes Hsu, founder of Rayliant Global Advisors and adjunct professor in finance at UCLA Anderson School of Management.

Read more

|

|

Crypto-Blitz: A Timeline of Presidential Emolument

By Kerry Pechter As president, Donald Trump is in a unique position to connect the public purse to his own purse, and so far he's shown no resistance to temptation. The Wall Street Journal has wondered if he understands money. But he clearly understands crypto.

Read more

|

|

Get the Whole Story. Subscribe Today

to Retirement Income Journal.

Now reaching 7,000 thought-leaders a week!

|

|

|