The Asset to Income Method (AIM) tackles retirement financial planning in a strategic way through fundamental principles. AIM consists of creating a structured financial mindset that is based on fundamental investment and risk pooling principles. Individuals who employ AIM can construct a financial plan they can count on throughout their retirement. This framework will take into account major future unknowns such as life span and investment returns.

Bruno Caron

Some of the major advantages of employing AIM include control, ease of execution, ability to manage unknowns, avoiding negative consequences of longevity risk and shifting the traditional dilemma of “spending rate vs. probability of ruin” to “spending rate vs. expected bequest.”

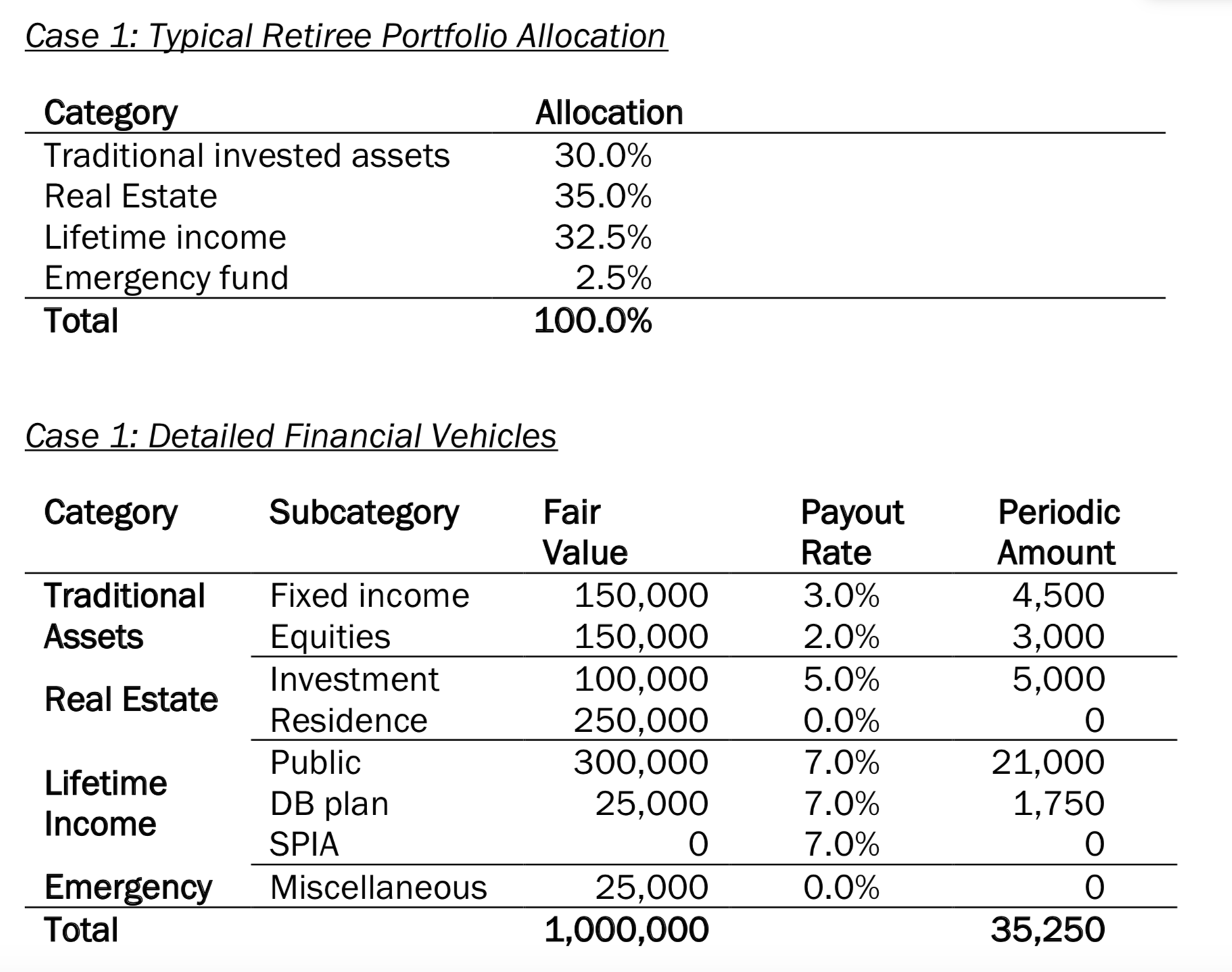

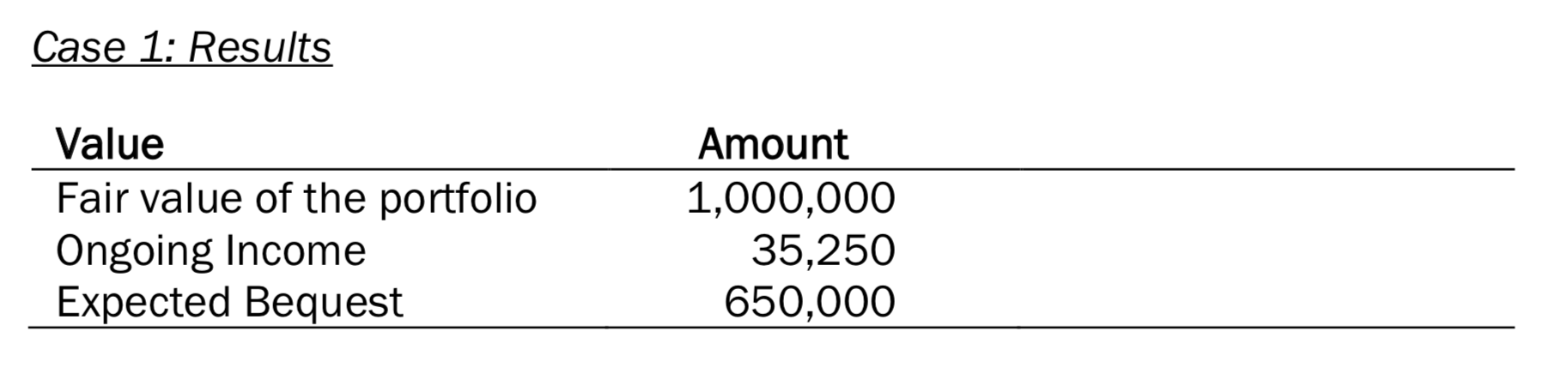

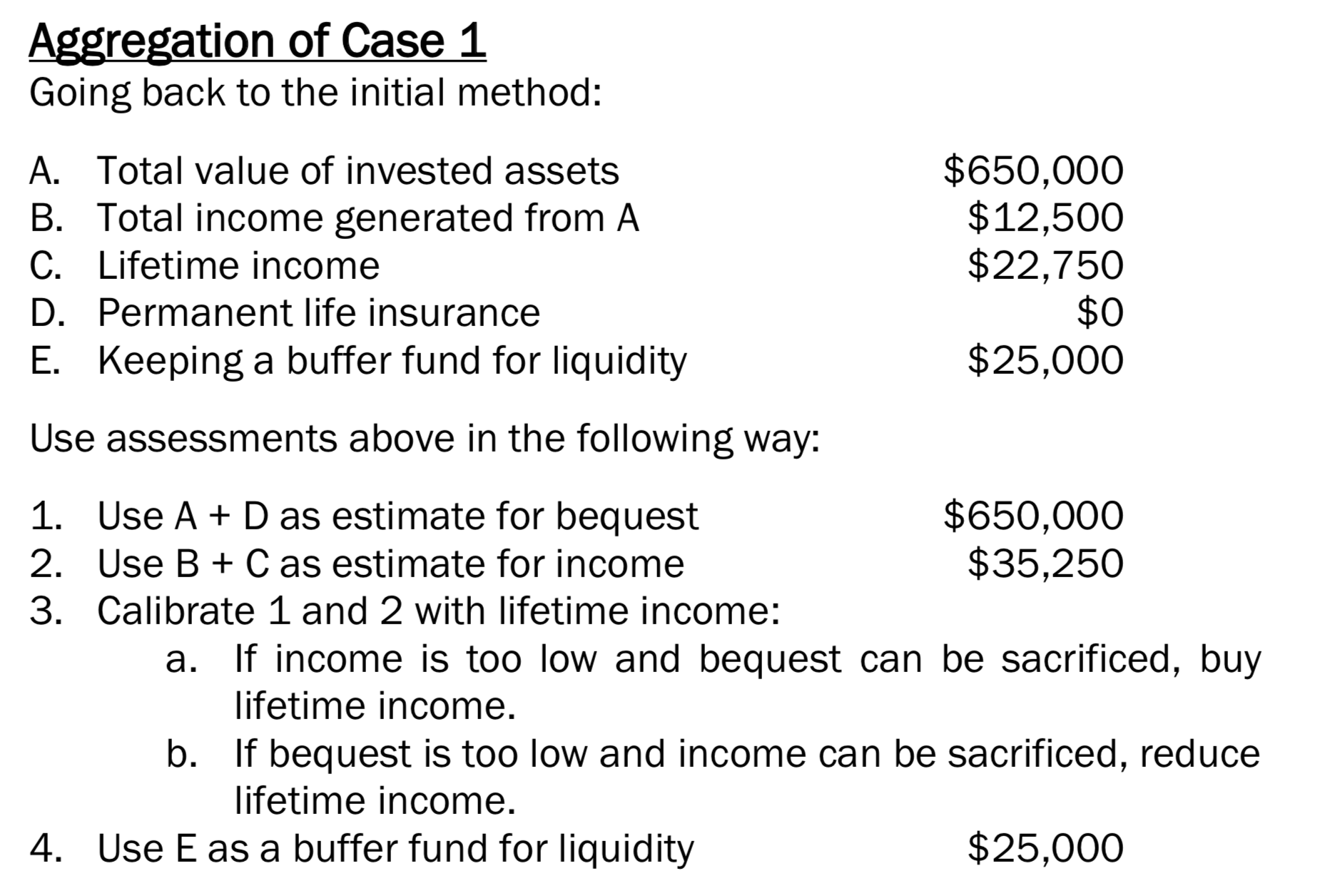

Here we present two hypothetical, illustrative and practical examples that will evaluate the tradeoff of lifetime income and bequest through the AIM. Case I assumes a typical portfolio with a fair value of $1 million, including all financial vehicles. Case II will illustrate the impact of the purchase of lifetime income on each component.

Case I

In Case I, the portfolio consists of traditional asset classes such as fixed income, equities and real estate. It also includes the retiree’s main home as well as lifetime income: a small defined benefit plan and Social Security. It does not include a SPIA. Finally, it has a small emergency fund.

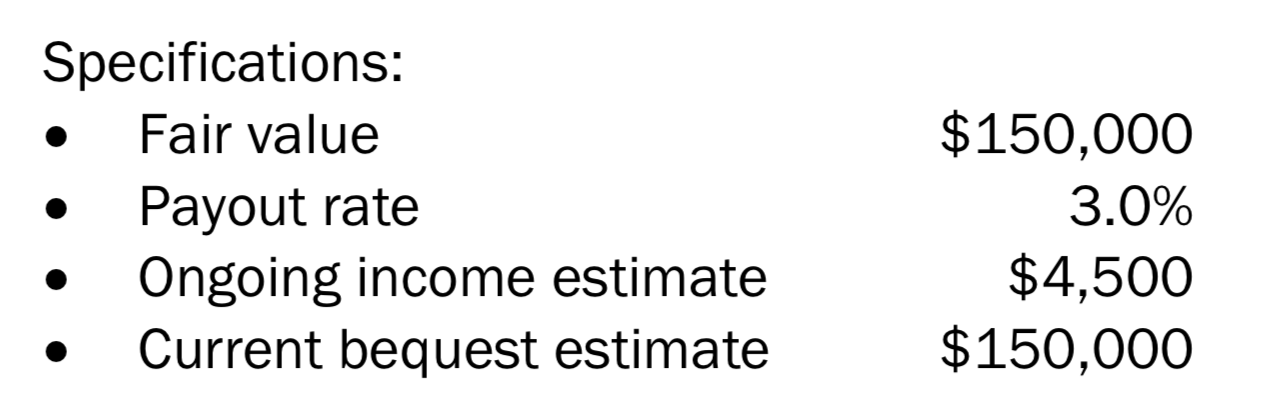

Fixed Income

Fixed Income

The client’s portfolio of bonds is worth $150,000 and yields 3%. This may be invested in the form of the aggregation of a few bonds or it can be held within a fund. Regardless, the plan should involve retaining the bonds until maturity while periodically spending the coupons.

Selling or buying bonds could be done opportunistically, depending on change in need or appetite but such potential sell is not designed to cover living expenses. Further, as these securities mature, individuals can reassess their appetite for each specific class. That way, retirees can leave the face amount as a bequest and the coupons generated from these securities can be used as ongoing income.

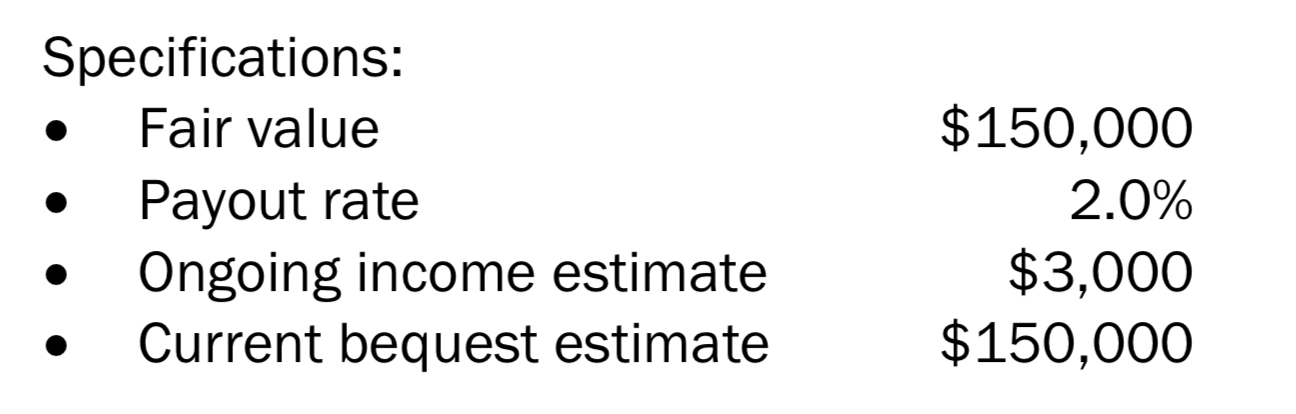

Equities

The client’s portfolio of stocks is worth $150,000 and the dividend yield is 2%. This may be invested in the form of the aggregation of a few stocks or it can be held within a fund. Regardless, the plan should be to hold on to shares forever and periodically spend the dividend.

Selling or buying stocks could occur opportunistically, depending on changes in need, appetite or market conditions. However, buying and selling is not designed to occur to fund expenses. That way, retirees can leave shares as a bequest and the market value of these shares can be used as a current estimate for such an inheritance.

While not a guarantee, the current market value of assets can serve as an order of magnitude of bequest and income. Both value of assets and income can fluctuate over time.

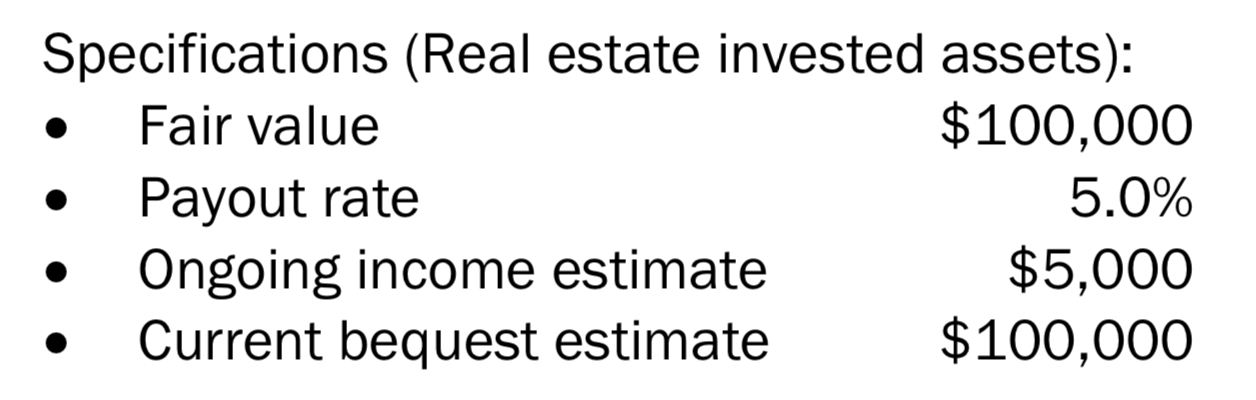

Real Estate

The client’s real estate portfolio is worth $100,000 and yields 5%. This may be invested in the form of the aggregation of shares in a real estate fund or direct ownership of a portion of a building held as an investment generating revenues. Regardless, the plan should be to hold on to the property and periodically spend the investment income.

Selling or buying ownership in the property may be done opportunistically and depending on change in need or appetite but not to provide for expenses. That way, retirees can leave the property as a bequest and the market value of these properties can be used as a current estimate for such an inheritance. While not a guarantee, the current market value of properties can serve as an order of magnitude of bequest and income. The income generated from this real estate investment can be used as revenue. This example could apply for various other investments, including family or side businesses.

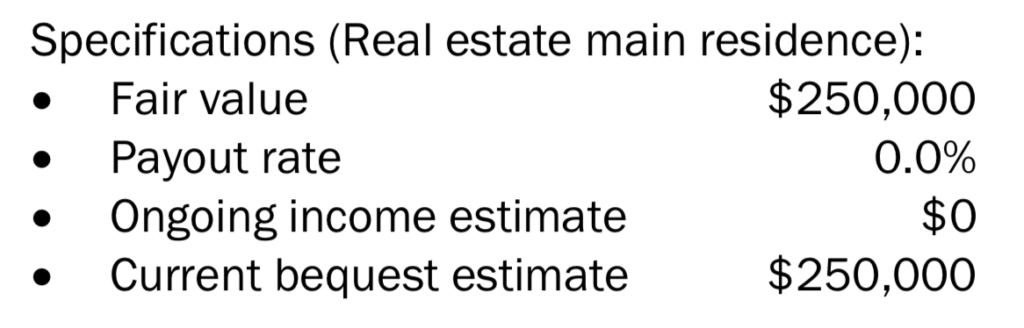

As for a retiree’s home, assuming the mortgage is paid off, the assumption is that no revenues are generated from the main residence, although some do rent their main residence from time to time. It is further assumed that the residence will be left as a bequest.

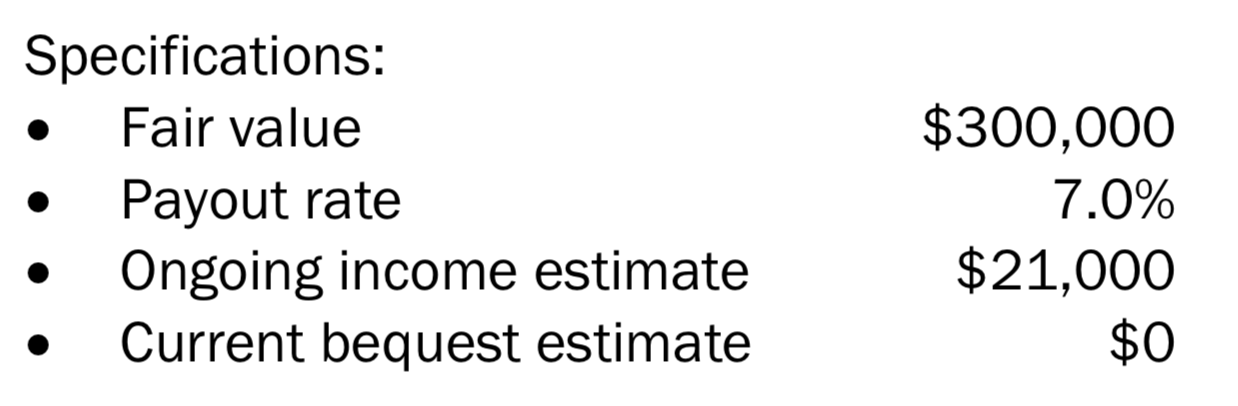

Public Old Age Pension Program

The client’s public old-age pension program pays $1,750 per month, hence $21,000 per year. Using the proxy income annuity payout of 7%, the estimated the value of this benefit is $300,000. It is important to note that the $300,000 fair value is an estimation of the value of the benefit; it is not a market value or a cash value as these benefits are usually not tradable. This benefit ceases when the retiree passes away and the income generated from this benefit is ongoing income.

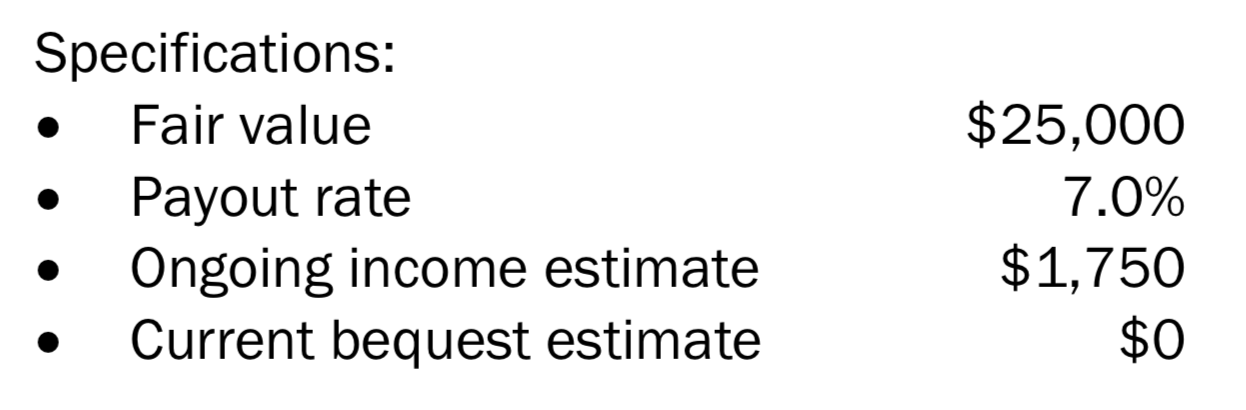

Private Pension

The client’s private pension pays $145.83 per month, hence $1,750 per year. Using the proxy income annuity payout of 7%, the estimated the value of this benefit is $25,000. This benefit is assumed to cease when the retiree passes away — unless there is a spousal survivorship benefits — and the income generated from this benefit is ongoing.

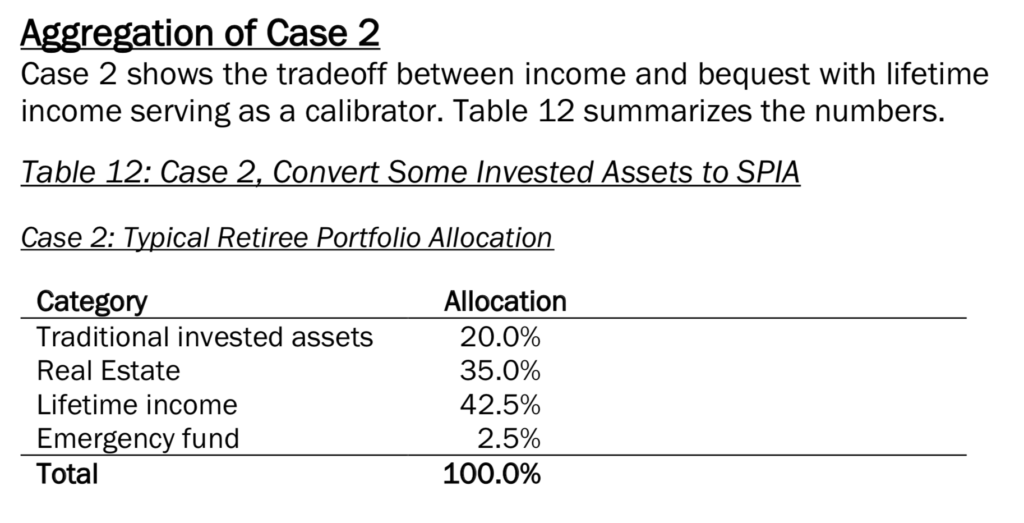

Case II

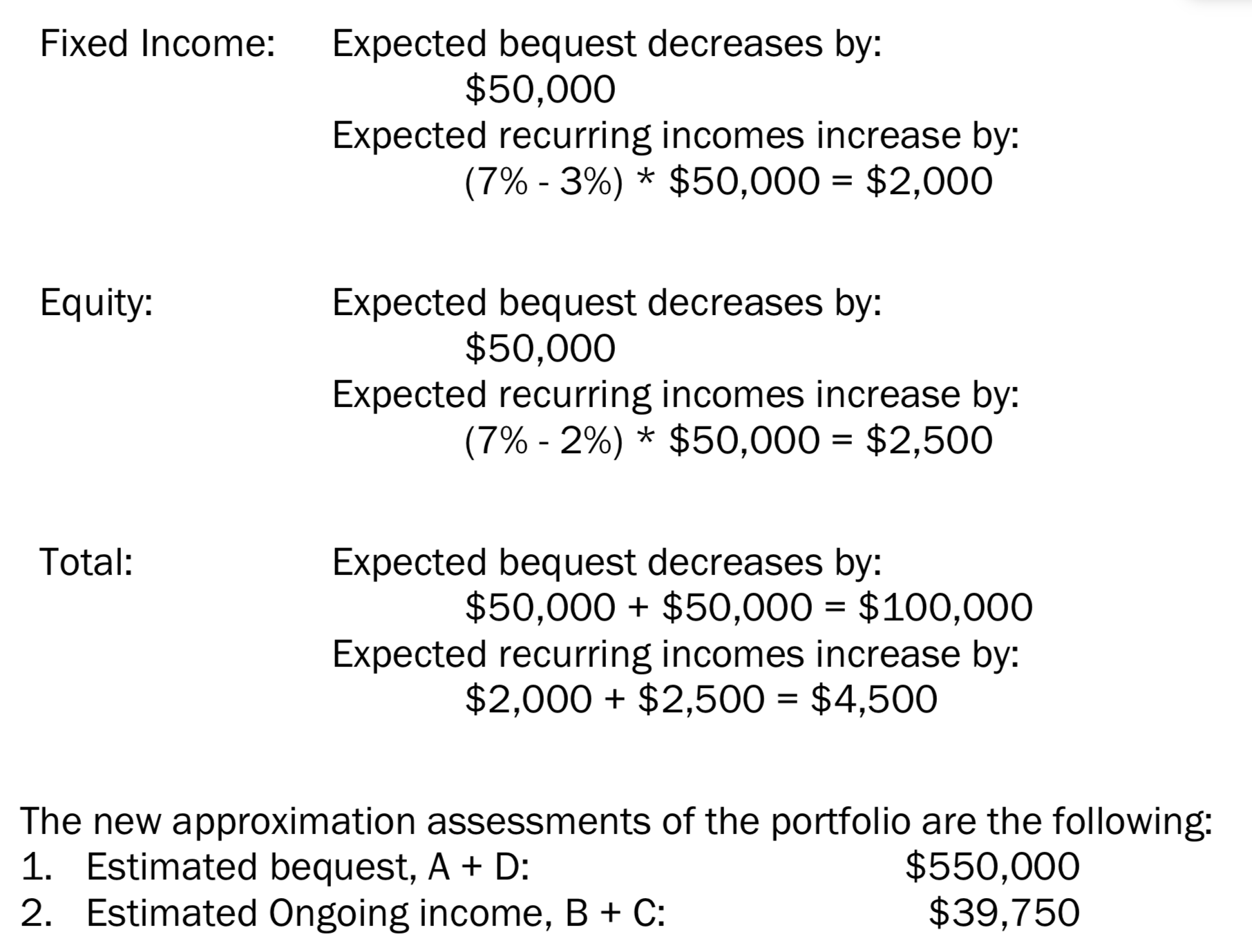

Assuming the retiree is healthy, the question in Step 3A above becomes: is the combination of an estimated bequest of $650,000 and recurring yearly income of $35,250 a good combination? Let’s assume the answer is no, as income is too low and bequest can be sacrificed.

The course of action could be to increase lifetime income. In this illustrative example, we will look at the impact of decreasing assets by $100,000 (decrease equities by $50,000 and decrease fixed income by $50,000) towards the purchase of a $100,000 SPIA. Here is the impact of these transactions:

These simple examples illustrate the mechanics of how lifetime income increases recurring income and decreases legacy over a full portfolio, using the AIM.

Striking the right balance between the income and bequest is a question of preference and need. Lifetime income is the vehicle that helps achieve this balance. Again, the AIM is not meant to be rigid and a guarantee of bequest and recurring income; rather it gives an order of magnitude and a framework for retirees to navigate and recalibrate needs and goals over time from a position of strength.

These illustrative examples broaden the discussion, but individuals should discuss and assess their specific situations with one or more financial professionals in order to evaluate actual asset classes, benefit values, tax implications and personal situations on an ongoing basis.

These examples are not meant to encompass specific nuances of every asset class; fair value, payout rate, ongoing income estimate and current bequest estimate are subject to change continuously and need to be recalibrated frequently, based on personal situation, market conditions and risk appetite, to name a few variables.

Bruno Caron is a Senior Financial Analyst at AM Best. Before AM Best, he held prior roles as an Equity Research Associate at Jefferies and CEO and Founder of Survival Sharing. He also held roles at New York Life and Willis Towers Watson.

© 2020 Bruno Caron, FSA, MAAA. All rights reserved.