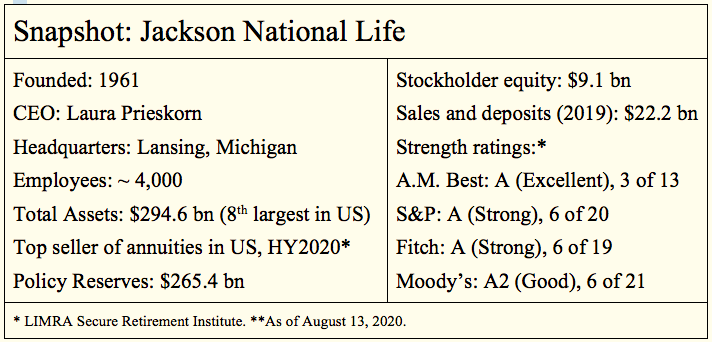

As it prepares to de-merge from UK-based Prudential plc after 35 years and begin trading on the New York Stock Exchange (as JXN), Jackson National Life—the leading issuer of variable annuity contracts in the US—has named new top management.

Laura Prieskorn, most recently Jackson’s Chief Operating Officer, was named CEO. Marcia Wadsten, who joined Jackson 29 years ago and had been Chief Actuary, was named Chief Financial Officer. They replace Michael Falcon and Axel Andre, respectively.

A 31-year Jackson veteran, Prieskorn was responsible for developing the company’s operating platform and has been a member of its executive, investment and product committees, according to a February 10 SEC filing. Wadsten has been a leader in product design, pricing and risk management.

Falcon, whom Prudential plc hired in January 2019, had been CEO of JP Morgan Asset Management in Asia. He had no previous life/annuity company experience. Steve Kandarian, the former chairman and CEO of MetLife, who helped engineer the spin-off of Brighthouse Financial from MetLife in 2017, will be Jackson’s chairman.

Rather than hold a conventional initial public offering, Prudential plc will use a demerger, “whereby shares in Jackson would be distributed to Prudential shareholders,” the ratings agency AM Best said on January 28. Pending regulatory approval, this “would lead to a significantly earlier separation of Jackson than would have been possible through a minority IPO and future sell-downs,” the release said. Prudential plc will retain a 19.9% share of Jackson.

Jackson had about $205 billion in fee-earning variable annuity (VA) assets on Sept. 30, 2020, according to Morningstar. That’s more than any other US individual annuity issuer. (Only TIAA has more VA assets, with $500 billion, but primarily in its group annuities.) Full-year 2020 financial results will be announced on March 3, 2021, the company said. The spin-off is expected to be completed in the second quarter of this year.

Jackson sold $11.7 billion in VAs in the first three-quarters of 2020. Of that, its top-selling Perspective II contract accounted for about $8.6 billion. Among distribution channels, Jackson is currently the top seller of VAs in the independent broker-dealer channel, the bank/credit union channel and the wirehouse channel.

The context

The US life/annuity industry has seen waves of reconfiguration and consolidation since the 2008-2009 financial crisis. Foreign owners like AXA, ING, and Aviva divested their US annuity businesses, as did MetLife and The Hartford domestically. Opportunistic private equity and buyout firms like Apollo, Blackstone, KKR and others have picked up the pieces and used their esoteric investing skills to raise yields on the assets backing the annuity contracts.

The drivers behind all this creative destruction have been ultra-low interest rates. Starved for yield and seeing the assets behind their liabilities weaken, annuity issuers have derisked, either by divesting, raising prices, switching their product mix or reinsuring distressed blocks of in-force contracts. European owners of US insurers are affected by the implications of Solvency II, a new regulatory regime that is changing the economics of the global life/annuity industry.

Changing strategies

Over the past several decades, Jackson has charted its own distinct path through industry turbulence. Started in 1961 in Jackson, Michigan, Jackson National was a regional life company that sold fixed-rate annuities and term life issuer directly through insurance agents, bypassing big distributors. It was purchased by Prudential plc in 1986.

In 1994, new CEO Bob Saltzman changed Jackson’s business strategy. The company started selling variable annuities, beefed up its wholesaling force, and began courting the distributors it once bypassed. In 2008, the year of the Great Recession, Jackson sold about $6 billion worth of VAs and $4 billion worth of fixed annuities.

Not having sold as many VAs with generous lifetime income riders as firms like MetLife, Prudential and then-AXA Equitable did, Jackson’s VA book wasn’t as vulnerable to the subsequent decline in interest rates. Instead of switching its emphasis to indexed products or reducing its VA sales, Jackson doubled down on VA sales and gave advisers lots of flexibility.

“They were the only carrier that didn’t require investment restrictions on contracts with lifetime income riders, and that gave them half the RIA (Registered Investment Advisor) business,” said Scott Stolz, a former Jackson executive who until recently was head of annuity product distribution at Raymond James.

“I think they made a bet after the financial crisis that the market would revert to the mean, and that VA account values would go up faster if they weren’t volatility controlled.” With the huge bull market since 2010, that bet paid off. They also charged 30 to 40 basis points more for their income riders, while other VA issuers found they hadn’t been charging enough to survive a long interest-rate drought, Stolz told RIJ.

Enter Athene

One challenge for Prudential plc in spinning off Jackson National, Stolz said, was the danger of a ratings downgrade when the newly independent US company no longer has the direct financial support of the British company. In August 2020, A.M. Best downgraded Jackson’s financial strength ratings to “a” from a+” and changed its outlook to negative to reflect “the removal of the rating enhancement previously afforded by Prudential plc.”

Last summer’s deals with Athene, the life insurance subsidiary of Apollo Global Management, may give Jackson the capital reinforcement it needs. Bermuda-based Athene Life Re is reinsuring Jackson National’s $27.6 billion book of fixed annuity business, added a $1 billion to Jackson National’s surplus (via a reinsurance ceding commission).

At the same time, Athene Holding, the parent of Athene Life Re, invested $500 million in Jackson, acquiring 9.9% of voting shares and 11.1% of economic shares. Whether Apollo will take over some of Jackson National’s asset management chores has not been made clear.

Besides Jackson, since 2009 Athene Life Re has reinsured blocks of life or annuity or business for American Equity Investment Life, Western United Life Assurance, Universal American, Jefferson National, Liberty Life, Transamerica, Presidential Life, Aviva USA, Sammons Financial Group, Lincoln National, Voya, MassMutual, Brighthouse Financial and Life Insurance Company of the Southwest.

Other personnel moves

Aside from appointing a new CEO and CFO, Jackson made additional updates to its leadership team. Dev Ganguly will assume the role of Chief Operating Officer. Julia Goatley will return to Jackson and assume an interim role as General Counsel effective February 16, 2021, replacing Andrew Bowden, who is leaving Jackson. Goatley previously served as Senior Vice President, Insurance Legal before departing Jackson in early 2019.

Continuing in current roles will be Aimee DeCamillo, Chief Commercial Officer and President, Jackson National Life Distributors LLC (JNLD); Brad Harris, Executive Vice President, Chief Risk Officer; Chad Myers, Vice Chair of Jackson Holdings LLC; Dana Rapier, Senior Vice President, Chief Human Resources Officer; Stacey Schabel, Senior Vice President, Chief Audit Executive.

Myers will assume Investor Relations and Government Relations responsibilities while leading asset management and institutional product teams, including JNAM (Jackson National Asset Management, LLC, and PPM (PPM America, Inc.).

In Jackson’s finance team, Steve Binioris will continue to lead Asset Liability Management and assume responsibility for the Actuarial team, serving as Chief Actuary for Jackson. Mike Costello will remain Treasurer of Jackson and lead Jackson’s Institutional Products and Financial Planning and Analysis teams. Don Cummings, who joined Jackson in December of 2020, will lead the Controller’s Office, serving as Chief Accounting Officer responsible for Financial Reporting.

© 2021 RIJ Publishing LLC. All rights reserved.