So many annuities, so little time. For 401(k) plan sponsors who feel inclined to add a guaranteed income option to their plans, the learning curve is likely to be steep and high. In-plan or out-of-plan annuity? Fixed, fixed indexed, or variable? Which life/annuity company?

A new whitepaper aims to flatten and shorten that curve. The 39-page document, “Prudent Practices for Retirement Income Solutions,” is sponsored by companies with both long experience and substantial stakes in the growth of the 401(k) annuity phenomenon.

Led by Broadridge Financial Solutions, the group includes Broadridge’s fi360 service for plan fiduciaries, annuity product data providers CANNEX and The Index Standard, internet “connectivity” provider, Micruity, and ERISA lawyer Fred Reich of Faegre Drinker Biddle & Reath.

Broadridge is not alone in anticipating the need for guides to assessing 401(k) annuities. “[The National Association of Plan Advisors] has already developed an education program for plan advisors to help them understand the process for evaluating lifetime income options. PSCA [Plan Sponsor Council of America] is in the process of doing the same for plan sponsors to be launched toward the end of this year,” Brian Graff, CEO of the American Retirement Association, the umbrella organization that includes NAPA and PSCA, told RIJ last week.

The Broadridge whitepaper suggests a process that plan “fiduciaries”—consultants whom the Employee Retirement Income Security Act of 1974 requires to act solely in the best interest of plan participants when recommending or managing plan investments or administering a plan—can use if and when selecting one or more decumulation strategies for the plan.

“We’re focused on increasing consideration of retirement income in 401(k) plans. A rising tide will lift all ships, so it benefits everyone [to] have a standard way of looking at it and educating the market,” Broadridge’s John Faustino told RIJ in a recent interview. “Plan sponsor advisers will be able to use our technology to identify the options and needs of a given plan and monitor it on automated basis.”

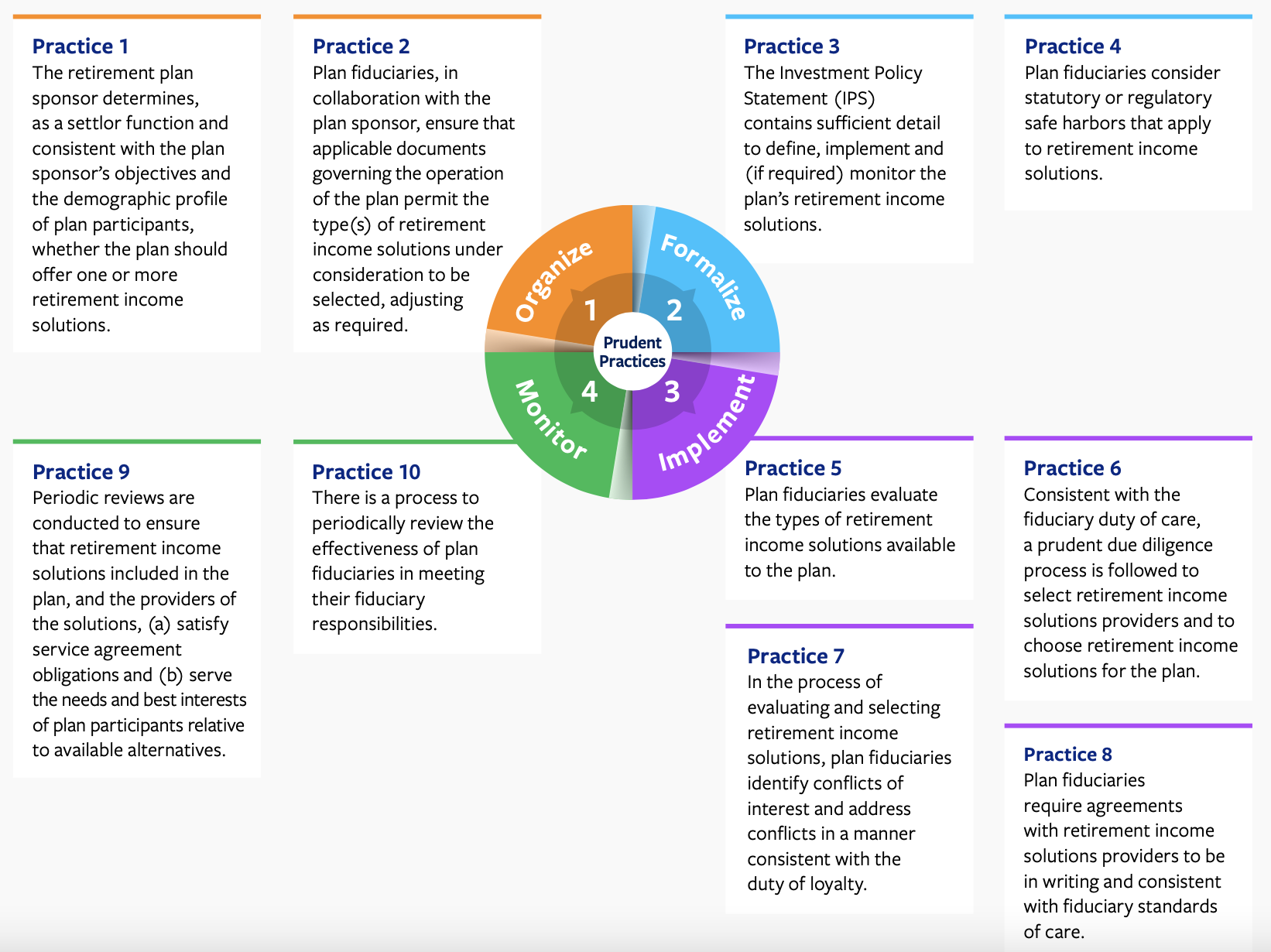

The ten-step process is described in the table below, reprinted from the whitepaper.

According to Faustino, three types of income tools are available to plan sponsors: fixed income annuities, target date funds with flexible lifetime withdrawal benefit riders, and managed payout programs without guarantees.

“A lot of our work is focused on hybrid and insurance side. But the consortium advocates for consideration of introducing retirement income while purposely staying away from making recommendations,” Faustino told RIJ. Broadridge intends to involve other retirement trade groups in the consortium’s work. Faustino mentioned LIMRA, SPARK Institute, and the American Retirement Association.

Together, these groups are encouraging and preparing themselves for a world made achievable by the SECURE Acts, passed by Congress in 2019 and 2022. The first SECURE Act introduced a new “safe harbor” that was meant to “remove the plan fiduciary’s fears that it would have to make a determination as to the viability of an insurer to provide lifetime benefits, and the concern that it could be liable for the future insolvency of an insurance carrier the plan fiduciary may select,” according to the white paper.

If, as appears to be the case, the push for annuities in 401(k) plans has come mainly from insurers and asset managers—more than from plan sponsors or plan participants—then it’s not surprising to see the push for education about annuities and retirement income coming from the same source. The Broadridge initiative bears that out.

Some surveys have shown that participants want retirement income tools, at least in principle. But most participants aren’t asking plan sponsors for annuities. At the most recent national conference of the Plan Sponsor Council of America, a panel took up the question of retirement income solutions in plans.

In a report on the PSCA website’s news page, the author wrote, “A refrain heard a few times throughout the conference was ‘retirement income products are like automatic enrollment, participants weren’t asking to be auto-enrolled, but the solution was developed to meet a need and is now commonplace.’ This refrain seems to be pushing back against the notion that there isn’t a need for retirement income solutions because no one is asking for them.”

The largest plan sponsors are likely to be the first to adopt income solutions, to be among the first to be approached by annuity providers, and to be able to dedicate the most resources to educating participants about retirement income. Of some 710,000 defined contribution plans in the US, about 1,200 have at least 10,000 participants. These large plans account have 42.1 million participants (42% of the total participant population) and $3.6 trillion in plan assets (46% of total DC assets).

© 2024 RIJ Publishing LLC. All rights reserved.