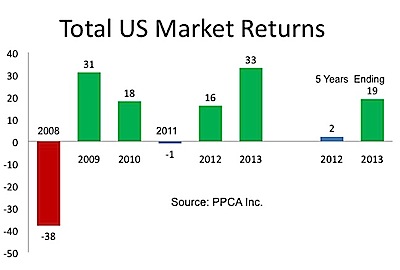

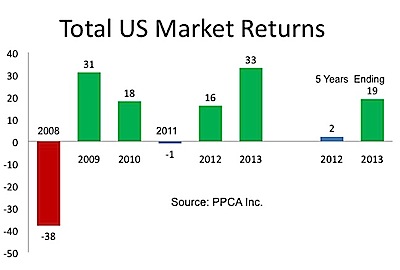

The Equities Outlook for 2014

Even though stock prices have surged, both dividends and earnings have kept pace. Prices therefore appear to be reasonable going into 2014, according Ron Surz, who analyzes the markets from San Clemente, Calif. Check out these fabulous charts and heat maps.