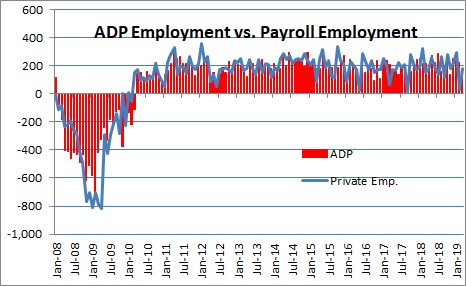

The ADP survey (see chart below) shows an impressive correlation with the private sector portion of the payroll employment data to be released a couple of days later. And well it should. ADP, or Automatic Data Processing, Inc. is a provider of payroll-related services. Currently, ADP processes over 500,000 payrolls, for approximately 430,000 separate business entities, covering over 23 million employees. The survey has been in existence since January 2001, and its average error has been 65 thousand. So while it is not perfect, it does have a respectable track record.

The ADP survey said that employment jumped 275,000 in April after having risen 151,000 in March after having climbed by 220,000 in February. In the most recent 3-month period employment has risen 215,000. On Friday we expect the BLS to report that private sector employment rose about 190,000 in April.

Jobs in goods-producing industries rose 56,000 in April after having fallen 1,000 in April. Construction employment rose 49,000, mining fell by 2,000, and manufacturing rose 5,000. Service providers boosted payrolls by 223,000 in April after having climbed 152,000 in March. The April increase was led by an increase of 59,000 in professional and business jobs, 46,000 in health care, 25,000 in administration and support, 9,000 in education, 53,000 jobs in leisure and hospitality, 37,000 jobs in trade, transportation, and utility workers, and 6,000 in financial services.

With the labor force rising very slowly, employment gains of 200,000 or so will continue to slowly push the unemployment rate lower. The unemployment rate currently is 3.8%, well below the full employment threshold. As a result we are beginning to see more and more shortages of available workers.

However, at this point most of the upward pressure on wages is being countered by a corresponding increase in productivity. Over the past year unit labor costs, or labor costs adjusted for the increase in productivity rose 1.0%. Despite the seemingly tight labor market there is little upward pressure on the inflation rate.

The stock market has rebounded and is now at a record high level. Interest rates will remain steady through the end of the year. Consumers remain confident. Corporate earnings are solid. The economy is still receiving some stimulus in the form of both individual and corporate income taxes. Thus, our conclusion is that the economy will expand by 2.7% in 2019 after having risen 3.0% last year.

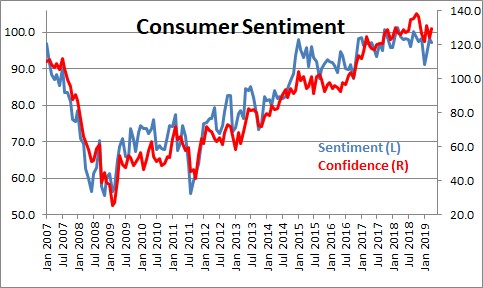

The Conference Board reported that consumer confidence jumped 5.2 points in April to 129.4 after falling 7.2 points in March. This series reached a high of 137.9 in October. It is somewhat lower than that currently, but its level remains solid and is roughly in line with where it was for most of last year.

Lynn Franco, Director of Economic Indicators at the Conference Board said, “Overall, consumers expect the economy to continue growing at a solid pace into the summer months. These strong confidence levels should continue to support consumer spending in the near-term.”

Confidence data reported by the Conference Board are roughly matched by the University of Michigan’s series on consumer sentiment. As shown in the chart below, trends in the two series are identical but there can be month-to-month deviations. Both series remain at very lofty levels.

The consumer should continue to provide support for overall GDP growth in 2019. The stock market struggled for several months late last year but has rebounded and reached a new record high level. The economy continues to crank out 190,000 jobs per month. Consumer debt in relation to income remains low. Interest rates remain low and the Fed has now ceased its series of rate hikes. We anticipate GDP growth of 2.7% in 2019 after having risen 3.0% last year.

The employment cost index for civilian workers climbed at a 3.0% rate in the first quarter after climbing at a 2.7% pace in the fourth quarter. Over the course of the past year it has risen 2.8%. Thus, the labor market continues to get tighter, and to attract the workers that they want firms are having to work employees longer hours, and offer higher wages and/or more attractive benefits packages.

With the unemployment rate at 3.8% and full employment presumably at 4.5%, it is not surprising that we are beginning to see a hint of upward pressure on compensation.

Wages climbed at a 3.0% race in the first quarter following a 2.4% gain in the fourth quarter. Over the course of the past year wages have been rising at a 2.8% pace. Benefits climbed at a 2.6% pace in both the fourth quarter of last year and in the first quarter of 2019. As a result, the yearly increase in benefits is now 2.7%.

What happens to labor costs is important, but what we really want to know is how those labor costs compare to the gains in productivity. If I pay you 3.0% more money but you are 3.0% more productive, I really don’t care. In that case, “unit labor costs”—labor costs adjusted for the change in productivity—were unchanged.

Currently, unit labor costs have risen 1.0% in the past year as compensation rose 2.8% while productivity increased by 1.8%. We expect compensation to climb to about the 3.7% mark this year, but at the same time we expect productivity to rise by 1.9%. Thus, unit labor costs at the end of 2019 to be rising at a 1.8% rate which means that there will be little if any upward pressure on the inflation rate in 2019 stemming from the tight labor market. A 1.8% increase in ULC’s is clearly compatible with the Fed’s 2.0% inflation target.

© 2019 Numbernomics.