_Position: Cover

At the Retirement Income Industry Association's 2017 Summer Conference, founder Francois Gadenne asserted that advisors can protect themselves from automation, regulation and commoditization by advising in three dimensions. ...

On the Case: An Income Plan from ReLIAS

To solve for one couple’s retirement income needs, Mark Warshawsky of ReLIAS LLC proposed SPIAs and 7.5% annual withdrawals from an all-equity portfolio. RIJ will publish solutions from other...

A High-Tech Challenge for High-Touch Advisors

Wealth management firms know they need next-gen ‘fintech.’ But many of them don’t know exactly which digital tools to buy or where to apply them in their businesses, tech...

T. Rowe Price Reopens the Market for Payout Funds

Managed payout funds haven't gotten much traction in the last decade. But T. Rowe Price hopes that its target-date fund/payout fund hybrid, the Retirement Income 2020 Fund, will help...

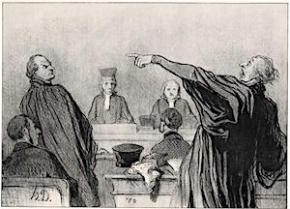

Cloudy with a Chance of Lawsuits

If the fiduciary rule and its Best Interest Contract Exemption are here to stay, will they trigger a wave of lawsuits against advisory firms? No one seems to know...

This Couple Needs Your Advice

These two people, ages 64 and 63, have a combined net worth of about $2.5 million. They're looking for ways to generate income in retirement. Here are some specifics...

Morningstar Enters the Indexed Age

Just in time for the activation of the DOL fiduciary rule, Morningstar has expanded its Annuity Intelligence resources to include indexed and fixed annuities.

Complex Annuities for a Complex Era

Indexed variable annuities (IVAs) offer a potential solution for paralyzed clients—perhaps for those who feel baffled by a market where both bond and stock prices are at all-time highs....

Fiduciary Rule Hurts First Quarter Annuity Sales

Sales of certain fixed annuities were lifted by the recent uptick in the Fed's benchmark interest rate, but sales of variable and indexed annuities were depressed in the first...

What to Do About Low Returns

The anticipated low return environment doesn't have to ruin your retirement plans, according to industry and academic speakers at the Pension Research Council's annual symposium, held May 4-5 at...

Overcoming Hurdles in the Variable Annuity Race

Prudential and AXA have remained among the perennial leaders of the variable annuity space by patiently tweaking existing products and exploiting niche opportunities.

Mortality Credits: Sweet and Sour

'The only way to get closer to meeting your spending goals is through some sort of partial annuitization strategy,' said Michael Finke, dean of The American College of Financial...

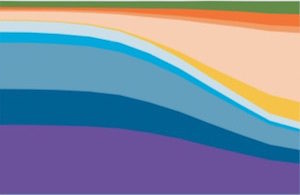

In Target-Date Space, It’s Vanguard, Et Alia

Vanguard’s domination of TDF flows in recent years has paralleled its domination of overall mutual funds flows. Competitors search for ways to be different, but not too different.

This Is How You Sell Annuities

'This works really well with couples, where the husband is a risk taker but the wife is worried that she’ll be left without any money,' said Curtis Cloke about...

The Case for ‘Behavioral’ Portfolio Theory

In his latest book, 'Finance for Normal People: How Investors and Markets Behave,' Prof. Statman describes the behavioral-wants frontier. He contends that people seek 'utilitarian, expressive and emotional' benefits...

Time for Retirement ‘SeLFIES’?

The Nobel Prize-winning economist and his colleague propose a new way to turn DC savings into retirement income. It involves 'Standard of Living Indexed, Forward-Starting, Income-Only Securities' (SeLFIES),...

Survivor Funds: Not for the Faint of Heart

“Survivor funds,” which offer mortality credits but aren’t annuities, could provide investors with enhanced returns, these authors claim. But, for some, loss of principal would be certain. (Painting of...

Savings Pros Meet in City of Big Spenders

At the NAPA 401k Summit in Las Vegas this week, nearly 2,000 plan sponsor advisors et al worried about policy threats to their industry. At nearby slots and gaming...

The Best of Recent Economic Research

The six academic papers cited here identify several points where, even when we don’t realize it, macroeconomics and personal finance intersect.

No Quick End to Fiduciary Rule Story

The DOL wants your comments again. It wants to know how much companies have spent on adapting to the rule, and whether it would be cheaper to abandon the...