_Position: Cover

Medicare counseling can be an excellent marketing tool for advisors, especially those who are positioning themselves as retirement specialists. Just ask Ash Toumayants of State College, Pa.

The Essence of Goal-Based Investing

Goal-based investing is more than just mental accounting that assigns labels like “house,” “college” or “retirement” to different pots of money. It's ultimately about risk management, as we learned...

AIG Tops Annuity Sales Chart Again

Eight years after collapsing under the weight of CDS losses and four years after emerging from federal ownership, AIG is again atop the annuity sales charts, with $9.78 billion...

Yale, MIT and NYU Sued over Retirement Plan Fees

The universities' retirement plans were the latest to be sued by the law firm of Jerome Schlichter (pictured at his office in St. Louis) for violations of fiduciary duty....

Advisors: Give this ‘Tilt’ a Whirl

Last month, we reported on John Walton's "tilt" method of fine-tuning systematic withdrawals in retirement. New research by the Texas hydrologist-turned-retirement income specialist combines tilting and income annuities. ...

With ‘Fidelity Go,’ Fido Goes Robo

Although Schwab and Vanguard have a head start in this space, “I don’t think Fidelity has lost anything by waiting,” William Boland, an analyst with Aite Group, told RIJ....

Off the Grid

As the DOL rule changes the role of the employee-advisor, the mode of compensating and incentivizing advisors may need to evolve. And that may spell changes in the almighty...

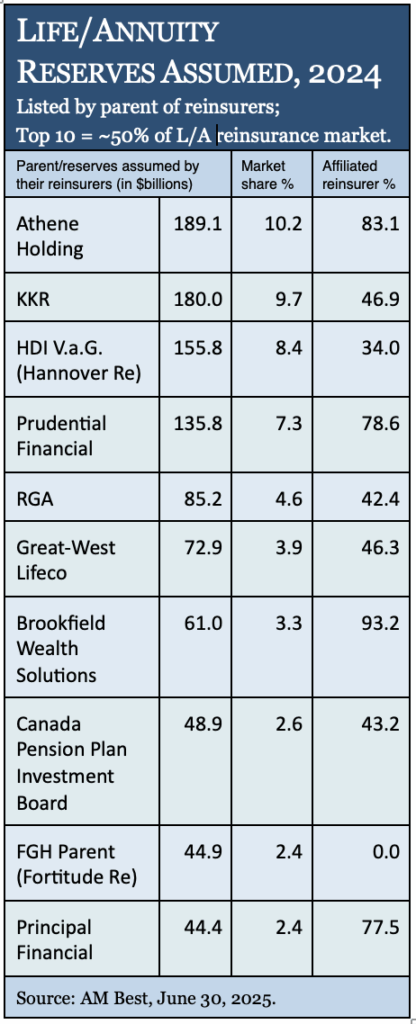

Great Hopes Ride on Great-West’s New Annuity

Great-West Financial's new Smart Track II variable annuity contract has four different income riders. Will it help Bob Reynolds achieve his goal of making Great-West a top-five retirement company...

Surrender to Lapse Risk? Not These Insurers

Over-estimates of variable annuity lapse rates have cost life insurers billions. A group of VA issuers is now working with actuaries at Ruark Consulting to predict those rates more...

Robos Take Manhattan

In New York last week for InVest, a fin-tech conference, I learned that advisors of the future won't be robots. They will be less sexy: Phone reps who help...

The Cinderella Annuity

Has the time finally arrived for the variable income annuity? At TIAA, where the VIA was invented, they say it never left. New research from the TIAA Institute compares...

At IRI Legal Conference, Lawyers Parse the “Fiduciary Rule”

The Department of Labor decided not to send an invited panelist the Insured Retirement Institute's Government, Legal and Regulatory Conference on Monday--perhaps because the IRI is party to a...

Test Your Reverse Mortgage IQ

To benchmark the public’s level of knowledge about HECMs, The American College’s New York Life Center for Retirement Income sponsored a survey that included a 10-question quiz. We invite...

Expect Sharp Drop in VA Sales: LIMRA

'We are seeing a significant shift in the annuity market,” said Todd Giesing, assistant research director at LIMRA's Secure Retirement Institute. 'We have to go back 20 years—to 1995—to...

No Retirement Account Left Behind

"Auto-portability" would consolidate a plan participant's old accounts into his or her current account, automatically. Spencer Williams and Tom Johnson of Charlotte-based Retirement Clearinghouse have spent three years trying...

Three Advisor-Friendly Reverse Mortgage Strategies

In this installment of our HECM series, we review three strategies that should entice advisors: the HECM-for-purchase, the HECM-LOC for liquidity in down markets, and the HECM-LOC created at...

The ‘Kosher’ Reverse Mortgage (IV)

A kosher reverse mortgage lender will share what he or she earns when selling the loan by waiving or reducing the borrower's costs, says Wharton emeritus professor Jack Guttentag,...

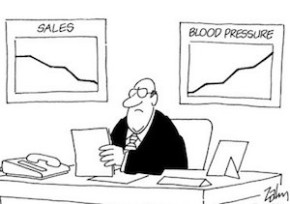

First Sign of Blood from DOL Fiduciary Rule

'The unexpected change regarding FIAs in the final DOL rule and the related Best Interest Contract Exemption has cast a cloud over our future growth rate,' said John Matovina,...

The Reverse Mortgage Puzzle: Part III

“There’s still a dark cloud over HECMs,” said Michael Banner, a long-time advocate of reverse mortgages who has a CE-accredited business devoted to teaching financial advisors about HECMs.

The Reverse Mortgage Puzzle, Part II

Last week we focused on the HECM product, and how it became less generous after the financial crisis. This week we examine the role of the banks—large ones and...