_Position: Cover

A forthcoming research article suggests that the concept of the efficient frontier should be replaced—and in practice is often replaced by planners—by the more flexible concept of the 'efficient...

The Borzi Ballet

In this 3-min. video, Assistant Sec. of Labor Phyllis Borzi responds to IRI CEO Cathy Weatherford's question about Borzi's anticipated re-proposal of a "fiduciary rule" for retirement plan advisors....

Disaster Flick

"Broken Eggs" is a forthcoming film about Boomers and retirement, produced by Chad Parks, founder of The Online 401k. You might learn a lot about your target market by...

Don’t Call Them Investments

It’s not rational self-interest that makes retirees avoid life annuities. It’s how we ‘frame’ life annuities that puts them at a disadvantage.

Sign of the Times

A 'grey market' phenomenon in more ways than one, Airbnb’s lodging website allows Boomers and others to boost their retirement incomes and, conversely, to afford their dreams of retirement...

A DIA with Dividends

The distinctive aspect of Northwestern Mutual's Select Portfolio deferred income annuity is that the contract owner can earn income-enhancing, inflation-protecting dividends over the life of the contract. (Photo: Northwestern...

Do Annuities Reduce Bequest Values?

Your clients can reduce their risk of running out of money without sacrificing bequest values if they purchase an annuity with part of their savings and aggressively invest the...

The Kreppa that Almost Melted Iceland

Iceland's economy and pension system has come back from the "kreppa" or banking crisis that struck five years ago. This country of the aurora borealis and matronymic last-names is...

Spiritual Advisor

Good advisors think of themselves as healers, in a way. Larry Ford takes that concept to a new level. Has he totally lost his mind, or is he onto...

The Efficient Frontier for SPIAs

Traditionally, planners like income annuities as much as Sky Masterson likes church bingo. Wade Pfau’s ability to draw a crowd at the “Paris” resort may have been a leading...

The FIA ‘Loophole’

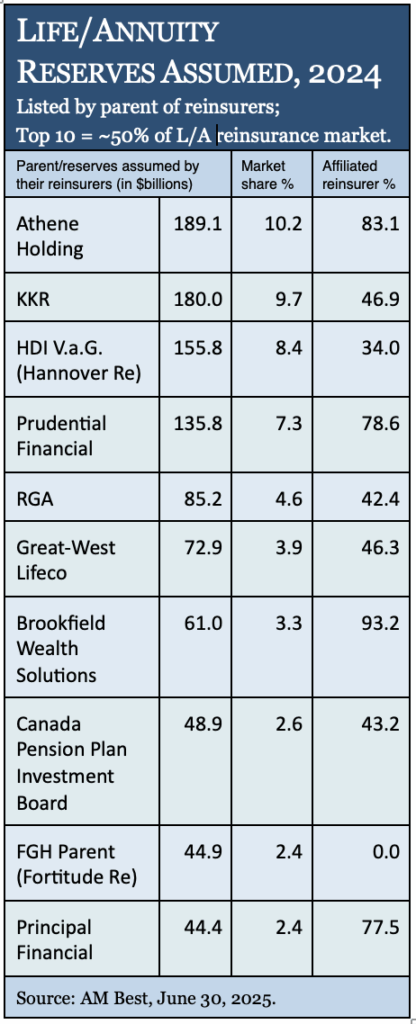

At the Society of Actuaries Life & Annuity Symposium in Toronto this week, the invasion of the fixed indexed annuity market by private equity firms was of keen interest....

Buenos DIAs

It’s morning in America for manufacturers of deferred income annuities, or DIAs. Are they a passing fancy, or do they offer the perfect balance between risk and reward?

Beware of Pension-Buying Funds

Pension-buyout deals, which rip off veterans and others with certain types of pensions, are often financed by investors who are looking for higher yields on their savings. Don't let...

Roll Over, Rollovers: ‘Roll-Ins’ Have Arrived

Retirement Clearinghouse (formerly RolloverSystems) CEO Spencer Williams wants people to consolidate (roll in) their retirement accounts in their current 401(k)s. It would mean fewer ‘stranded’ retirement accounts and less...

A Man of Conviction

How did Matthew Hutcheson, once a poster boy for fiduciary rectitude, turn into the wanted-poster man for fiduciary misconduct? But his ill-fated deal for the Osprey Meadows golf course...

Dialing the Right Withdrawal Rate

The 4% withdrawal rate (adjusted annually for inflation) is the basic chassis that advisor/researcher Michael Kitces builds his income strategies on. But that's just the beginning.

Obama’s Budget Too Austere for Retirement Industry

There’s outrage and indignation over the administration’s call for a $3 million cap on lifetime accumulations in tax-favored accounts, but only a tiny number of accounts would be affected.

Pick and Roll(over)

Hundreds of TV ads for financial services have appeared during the 2013 NCAA men's basketball tournament so far. None was an absolute slam dunk, but all were good. Read...

Software, Software Everywhere

Welcome to a series of articles on financial planning software (FPS). This one will sum up the “literature” on the topic. Future stories will focus on tools that are...

VA Net Flows ‘Grim’ in 4Q 2012: Morningstar

“A spike in outflows from group contracts and continued large outflows from companies that have exited the business were the major components of the precipitous drop," wrote Morningstar's Frank...