Featured

The Harvard-trained economist teaches, consults, writes scholarly and popular books, created ESPlanner, and is the champion of “consumption smoothing.”

Early Reviews of PIMCO’s Payout Funds

Immediate reactions from advisors, retirement income consultants and academics ranged from skepticism to enthusiasm to uncertainty about the costs.

Sales of Indexed Annuities Soar in 2nd Qtr, Says Beacon

For the entire fixed annuity market, 2009 has been a bumper year so far. On a year-to-date basis, total market sales were an estimated $62.6 billion, 39% above first...

Retired Americans, Up Close and Personal, Via PBS

“The fact that there haven't been more television pieces taking a look at retirement is remarkable,” said documentary filmmaker Brian Boyer.

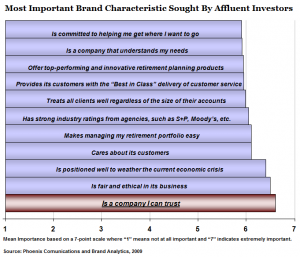

What Affluent Investors Want

About one-third of affluent investors make all their own retirement decisions, the Phoenix study showed.

Will Boomers Pony Up for these Riders?

Deferred annuities have lapse rates as high as 40% to 70%, but the lapse rates of LTCI/annuity hybrids could shrink to as low as one or two percent—the rates...

IRI: Not Just NAVA by Another Name

Where NAVA might have been described as inward-looking, IRI seems to be outward-looking. Some members think that's a refreshing change.

Banks Reap Record Annuity Income

The steep yield curve enabled fixed annuities to outperform CDs, and drove fixed annuity sales to a new record in the second quarter.

One-Stop Shopping for Retirement Risk

Steve Zaleznick sells insurance direct to the elderly online. But can his call center reps offer more than piecemeal planning?

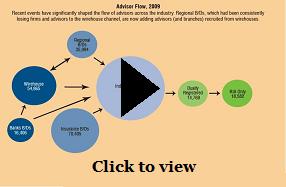

‘Breakaway Broker’ Is A Myth

Wirehouse reps still manage almost half of the assets in all retail advisory channels, according to Cerulli Associates' exhaustive annual study.

Nationwide and MSSB Ink SALB Deal

A Nationwide income guarantee will be offered to Morgan Stanley Smith Barney's Select UMA holders. The wirehouse expects to use up the initial $250 million capacity in six months.

Will SEC Rustle Insurers’ Cash Cow?

A federal appeals court has ruled that index annuities are risky enough to be called securities, but it also gave insurance forces time to pursue a legislative remedy...

Martin Weiss on the CalPERS Suit

There have been 'egregious manipulations and conflicts of interest that go beyond what is generally known,' Weiss told RIJ.

Hold Brokers and Advisors to One Standard, SEC Chief Says

Mary Schapiro told Congress she favors requiring broker-dealers and investment advisers to act solely in the interests of their clients when providing advice.

Investing Enlightenment At A Glance

This up-to-date "Periodic Table of Returns" shows that in financial markets, what goes up always comes down, and vice-versa.

Separation Anxiety

Steve Sass and his co-researchers at Boston College were surprised to find no employers making plans to accommodate workers who can't afford to retire and want to remain on...

In Washington State, a ‘State 401(k)’ Is Rejected

When it comes to designing public-private retirement savings programs, Sandy Matheson has been there and done that.

Details of the Auto-IRA/Saver’s Credit Plan

David John of the Heritage Foundation, and the Treasury's J. Mark Iwry, hope to see years of work finally bear fruit.

Obama Calls for ‘Office of National Insurance’

While the administration's June 18 report, "Financial Regulatory Reform," did not offer the “optional federal charter” that large insurance companies support as an alternative to state-by-state regulation, it did...

Target Date Funds: A QDIA That’s DOA?

Last week, federal officials tried to locate the blame for 2008 TDF losses: Was it marketing hype by TDF makers, a flawed concept, Americans' weak financial literacy, regulatory lapses,...