Of the three legs of the Bermuda Triangle strategy, reinsurance might be the most opaque and arcane. That’s saying a lot, because the other two parts—fixed indexed annuities (FIAs) and collateralized loan obligations (CLOs)—are mysteries of their own.

True, big reinsurance deals between unrelated insurers are regularly reported. But when one holding company owns both a life insurer and a “captive” reinsurer, or the deal happens offshore, or involves a certain type of reinsurance—all typical of the Bermuda Triangle strategy—it can be hard for an outsider to know how substantive the deal actually is, or if its just an accounting maneuver.

Certain data is available. In each FIA issuer’s 2021 statutory filing, lengthy documents, you can see its gross annuity sales, the amount of premium reinsured, the annuity products that were reinsured, the type of reinsurance used, the reinsurance partner, and the partner’s headquarters.

In our June 23 issue, RIJ shared some of that data, with a focus on FIA issuers with ties to a big private equity firm. For this week’s story, we interviewed insiders about the purpose of reinsurance within the Bermuda Triangle strategy. Some sources spoke on the record; most asked for anonymity.

Cross-border, captive reinsurance capitalizes on differences in accounting standards between the US and Bermuda, enabling what some have called regulatory arbitrage. The transfer of risk from annuity issuer to reinsurer can reduce the insurer’s liabilities, release surplus capital, and lower risk-based capital requirements. The reinsurer can reimburse the issuer’s distribution expenses (e.g., FIA commissions) and, through special purpose vehicles, sell its own risks to third-party investors.

“The move to ‘capital light’ is based on reinsurance,” one annuity issuer executive told RIJ, referring to the life insurance industry’s ongoing drive to become annuity retailers while outsourcing risk to reinsurers and investment chores to global asset managers—often, but not always, within the same holding company. “It’s a wholesale change in the structure of the life insurance industry.”

Not your grandpa’s reinsurance

With conventional reinsurance, a life insurer sells a block of asset-intensive insurance business—in-force variable annuity contracts with living benefits, say—to an unrelated life insurer or reinsurer. The block includes assets and the risk that the assets will not perform well enough to cover the liabilities (in this case, deferred annuity principal and gains accrued per the contract).

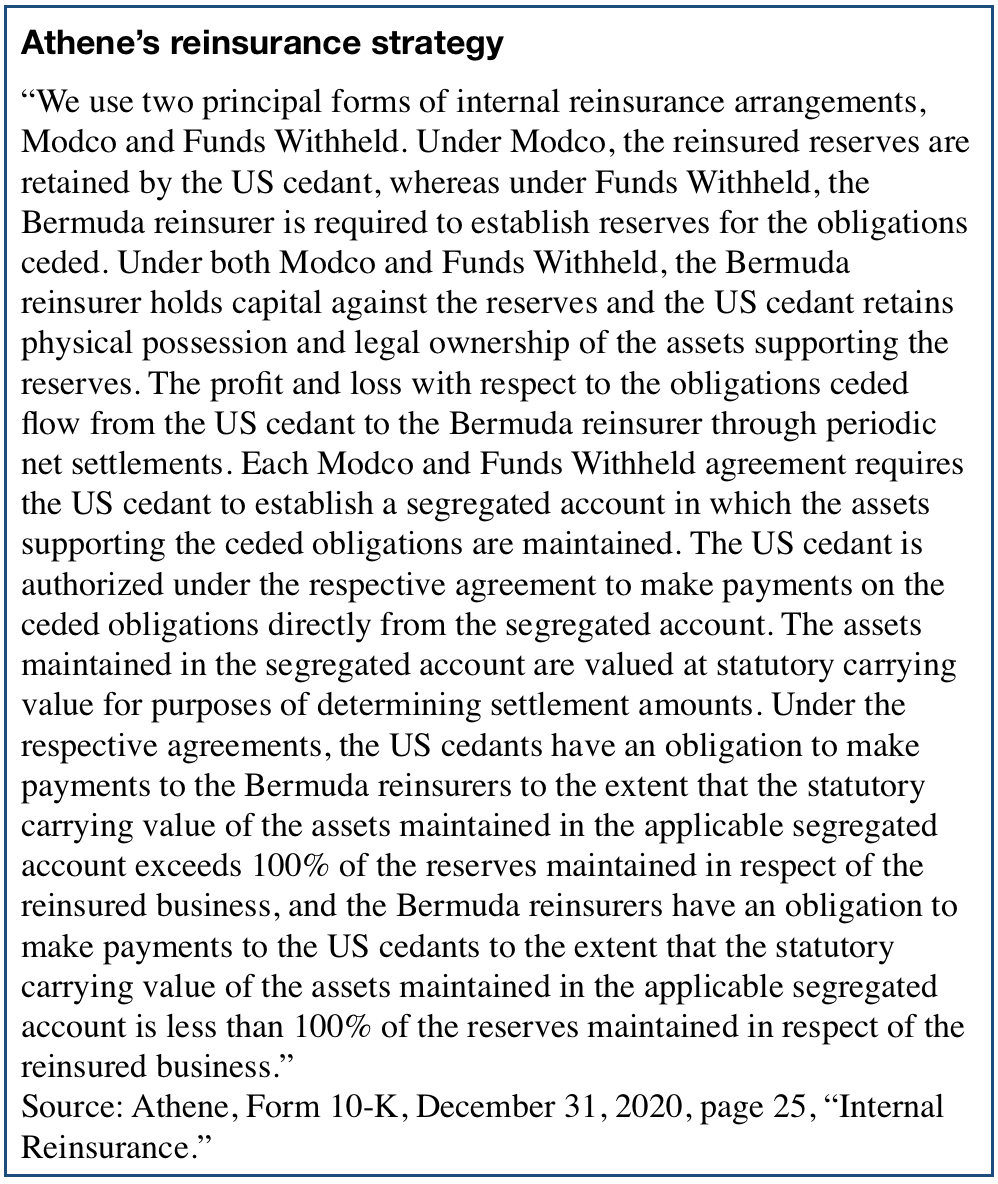

Reinsurance in the Bermuda Triangle works differently. A US-domiciled annuity issuer “co-insures” a block of old (or new) annuity business with an affiliated reinsurer in a different jurisdiction, like Bermuda or Vermont. “Modified” coinsurance (modco) or “funds withheld” coinsurance may be used.

With modco, the first insurer (the “ceding” company) transfers the risk on a block of business while keeping the assets and reserves (liabilities) on its own balance sheet. In a “funds withheld” arrangement, the ceding insurer transfers reserves (liabilities) and specified risk to the reinsurer, but maintains control of the assets.

The amount of risk ceded, the amount of capital the reinsurer (or its investors) puts up, the riskiness of the investments backing the guarantees—these all vary from one deal to another Wherever the money is, or whatever an asset manager—maybe the owner of the insurer and reinsurer, maybe a strategic partner—manages it for a fee and sometimes part of the profit.

‘Regulatory arbitrage’

Different jurisdictions use different accounting standards, which translate into different ways of calculating an insurer’s liabilities, assessing the riskiness of its assets, and determining the amount of excess assets (surplus) it needs to hold as a buffer against either a spike in liabilities or a crash in the value of its assets.

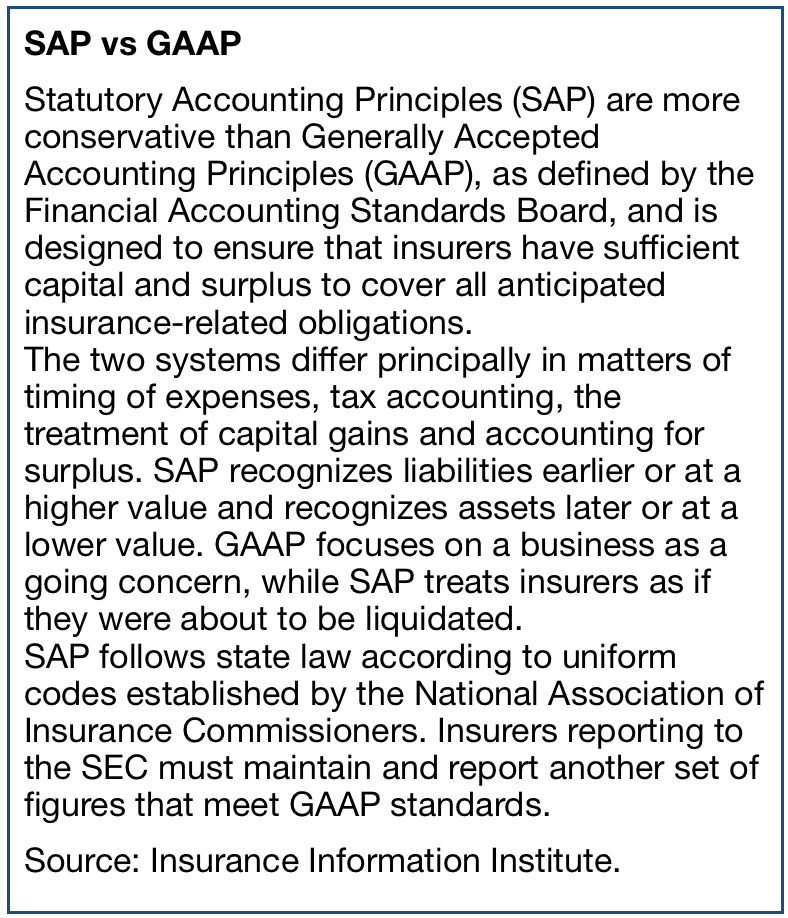

In the US, state regulators require domestic life insurers to use Statutory Account Principles. In certain states or countries (Arizona, Vermont, Bermuda, Cayman), reinsurers can use Generally Accepted Accounting Principles. Publicly traded life insurers use SAP with state regulators and GAAP with the Securities & Exchange Commission. [See box from Insurance Information Institute.]

“The reason to be in Bermuda is to take advantage of regulatory arbitrage,” a global insurance consultant told RIJ. “Bermuda is not going to require the same level of capital, simply because their models are different. But it’s hard to make blanket statements about how the regulatory arbitrage is done. The exact processes are pretty well guarded.”

Just as it can be cheaper to manufacture offshore, it can be cheaper to insure annuity liabilities in a state or country where GAAP can be used to price liabilities instead of SAP. SAP is more conservative, requiring high, “statutory” reserves—enough to weather a financial crisis. GAAP requires only “economic” reserves—enough for the most likely business environment.

“If you sell $1 worth of annuities, the current regulations might say that premiums will only cover 90 cents of the liabilities, and the regulators ask you to post 10 cents of capital to back all the claims,” a post-doc in finance at an Ivy League business school told RIJ.

“But you might believe that the risk is really just five cents. So you find loopholes in the code and manage to post five cents. Regardless of how you arranged to guarantee the contract—through swap arrangements or whatever—you’ve still posted just five cents of capital instead of 10 cents,” he added.

Life insurers, he suggested, may regard SAP as too conservative, especially with respect to a low-risk product like fixed indexed annuities, and get around it with GAAP reinsurance in Bermuda. “After 2008, the regulators wanted more liabilities. They said, ‘If the reserves are $1, the liability is $2.’ Now the insurers are finding ways to deflate the liabilities. They will tell you that they are just deflating them down them to what they should be. They say, ‘Let’s find a way to normalize the liabilities and use the capital surplus we generate for share repurchases.’”

Capital release

Release of surplus capital is perhaps the most important benefit of reinsurance. In a multi-billion dollar reinsurance deal, it can, virtually overnight, unencumber hundreds of millions of dollars and turn it into shareholders equity.

Nonetheless, the mechanics can be gnarly. “If [the reinsurer] is a Bermuda-domiciled captive, the captive might hold a lower reserve than the reserve credit taken [by the ceding company]. Sometimes they would set up an asset for the difference, instead of stating that they’re holding a lower reserve. But they were effectively holding a lower reserve,” a former chief actuary at a state insurance commission told RIJ.

“Typically on funds withheld, the ceding company will end up replacing the reserve liability with the funds withheld,” he added. That difference, between the statutory reserve and the economic reserve, will be capital released to the ceding company. Their rationale in doing these transactions—they want the surplus release of course. They’re trying to get rid of redundancies from their surplus. Their thinking is that economic reserves with margins are adequate.”

When US companies reinsure in Bermuda or Cayman Islands, they may have no choice but to use “modco” or “funds withheld” reinsurance in order to get the capital release they’re looking for.

An actuary at S&P Global Markets Intelligence, publishing on LinkedIn, wrote, “Why would you want to use mod-co? Suppose the reinsurer is not admitted in your jurisdiction. You can’t take credit for those reserves. You don’t want to have to worry about that, so you just don’t give the reserves up.

“Most ceding companies prefer to control and invest their own assets,” he explained. “They don’t want to give money away to the reinsurer. With modified co-insurance, you give the experience on the assets which is the transfer of risk. You don’t give the actual assets. It’s the same with co-insurance funds withheld. I may keep my stocks and bonds and just hand an IOU to the reinsurer. It’s no different financially, but I still get to control my own stocks and bonds.”

But the fairness and reasonableness of such an arrangement is unclear when the reinsurer is in Bermuda (where disclosure is limited) and the insurer and reinsurer are within the same holding company, said Tom Gober, a forensic accountant and certified fraud examiner, in an interview.

“If it’s an opaque, affiliated transaction, all we can see is that they’re just moving money from one pocket to another” for the sake of capturing Bermuda’s accounting advantages, he said.

Lower ‘RBC’

Bermuda differs from most US states not just in the quantity of capital it requires in support of a block of annuity business, but also in the quality of the investments purchased with that capital.

Some years ago, state regulators created a yardstick for the riskiness of a carrier’s investment portfolio. They use it to calculate a minimum capital requirement (the RBC) for the carrier. If the ratio of a carrier’s total capital to its RBC falls too low, regulators have grounds to investigate.

As US insurers reach for yield by investing in riskier assets, they risk a penalty that adds to their capital requirement. Bermuda’s RBC formula differs from that of the US states, and may not add the same penalty, thus making Bermuda an attractive place for an insurer to put risker assets.

“That affords a bit more room to earn more yield on investment assets without onerous regulatory capital penalties,” said an Ernst & Young actuary who asked not to be identified by name.

Modified co-insurance “allows insurers to transfer all the RBC components— if the assuming company is willing to take all of that risk. That’s why the ceding company doesn’t need as much surplus,” Gober told RIJ. He considers nearly all modco deals with offshore affiliates to be transferring risk in appearance only, leaving fewer and inferior assets backing American’s annuity contracts.

Here’s how an article on the subject described Bermuda’s advantage:

“Private equity firms are drawn to Bermuda partly because asset-backed securities, such as collateralized loan obligations (CLOs), are treated more favorably [there] than in the US and Europe,” financial reporter Will Hadfield wrote at Risk.net. “The Bermuda Solvency Capital Requirement (BSCR) requires insurers to hold similar levels of capital against both corporate bonds and CLOs, even though some CLO tranches have a larger downside risk than bonds with the same credit rating.

“The Bermuda Monetary Authority (BMA), which sets the BSCR, also allows insurers to use the excess spread of CLOs to reduce their liabilities, which are typically discounted using corporate bond yields. This in turn lowers reserve requirements and increases available capital. That accounting trick is prohibited in the US where insurers can only book the relative outperformance after it is realized. Says a senior risk manager at a large US life insurer, “It’s a big advantage to be able to go to Bermuda and get the extra spread.”

Just as some actuaries believe that SAP is too conservative, more than one suggested that the RBC rules in the US may be out of date.

“RBC is kind of ‘antiquated,’” the Ernst & Young actuary said. “Bermuda capital requirements allow for better recognition of cash-flow matching and long-term value accrual with alternative assets. Using a different jurisdiction does not necessarily mean that policyholders are less protected or the insurer is less-well capitalized.”

Other benefits

Bermuda reinsurance offers another potential advantage to affiliated US annuity issuers: It helps them get faster recovery of their acquisition costs, which include the commissions they pay to agents and brokers to sell annuities. FIA commissions average about 6.5%, according to Wink, Inc., data.

“In the first year [after an annuity sale], the commission expense is heavy, and then it drops gradually,” said Gober. “SAP accounting says that [the money spent on commissions] is gone. But under GAAP, the issuer can amortize it. That’s one reason why there’s a higher surplus (relative to the liability) under GAAP.”

Reinsurance may also create more sales capacity for the ceding insurer. “Technically, reinsurance does allow insurers to write more business because they are getting additional capital from the reinsurer,” said Dennis Ho, CEO of Martello Re, a Bermuda reinsurer part-owned by MassMutual.

“However, reinsurance doesn’t enable insurers to hold more risky assets or reduce the amount of capital supporting the liabilities because the cedant typically requires the reinsurer to invest according to certain guidelines and hold sufficient capital to manage the risk. So total risk and capital in the system shouldn’t change due to reinsurance,” he told RIJ. But, like the S&P Global source quoted above, he appears to be referring to a conventional transaction between unrelated, independent companies, not offshore affiliates.

Yet an accounting consultant told RIJ that Bermuda isn’t the shrouded venue that it once was. “Ten years ago, Bermuda wouldn’t have required much information, and there could have been regulatory arbitrage. But now Bermuda has Solvency II. They’re not just dumping liabilities in the ocean,” he said.

An insurance broker told RIJ, regarding Bermuda as a regulatory haven, “Bermuda is tougher to deal with than certain US states. You’re not necessarily holding riskier and fewer assets in Bermuda. Each US jurisdiction also has its own asset guidelines, and they also cut deals with individual companies on the percentage of risk-based capital they must hold or the ability to move away from the RBC guidelines in some cases.”

Some asset managers appear to be using affiliated Bermuda reinsurers as a special purpose vehicle for attracting third-party institutional investors with opportunities to invest in the reinsurer as a business, buy the asset manager’s bespoke assets, or invest in the publicly traded annuity issuer. This is another variation on the “capital-light” strategy mentioned above. Such structures are beyond the scope of this article, however.

Is there a free lunch here? Does the regulatory arbitrage create value? We asked one consultant whether it was all a wash—Did a reinsurer have to replace all the capital that the ceding insurer was “releasing” and would their parent holding company gain nothing from the transaction? The answer was no, “It doesn’t all even out,” he said. That made sense. Otherwise, why bother setting up a Bermuda Triangle structure?

But if the holding company saves money by outsourcing its annuity risk to a reinsurer in Bermuda, what does that mean for the annuity contract owner? Fans of the Bermuda Triangle strategy claim that the savings from a lighter capital load helps enrich the annuity payouts. Skeptics like Tom Gober insist, however, that modco reinsurance may be returning capital to the shareholders without necessarily reducing risk, leaving the liabilities to contract owners underfunded.

© 2022 RIJ Publishing LLC. All rights reserved.