Ten short years ago, the annuity developers at AXA Equitable (now Equitable Financial) faced a dire challenge. Their flagship variable annuity had become an albatross, thanks to volatility and low rates in the wake of the Great Financial Crisis. They needed to create a new vehicle for the new environment.

So they invented the “structured” or “indexed” variable annuity (IVA). For gains, it relied on the purchase of options on an equity index. It posed a risk of loss for the client—but a “buffer” broke the fall. It was essentially a structured note in an annuity wrapper.

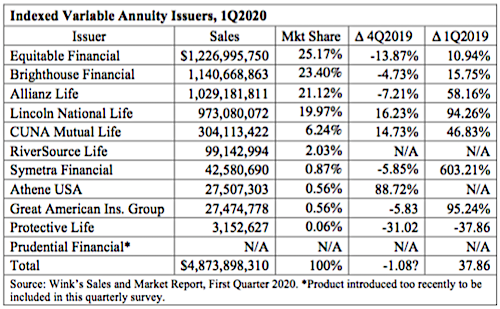

Sales of the quirky product blossomed, breathing life into Equitable Financial’s bottom line. Other annuity issuers took notice. They created IVAs of their own, gradually eating into AXA’s market share. So far, 11 life insurers have launched IVAs, most recently Prudential.

The IVA is now the darling of annuity issuers and distributors. At less than $5 billion, its 1Q2020 sales were still much less than sales of fixed indexed annuities (FIAs) ($16.4 billion) or variable deferred annuities ($25.6 billion). But, year over year, only IVA sales have risen.

“Structured annuities are the new shining star of the annuity market,” said Sheryl Moore, CEO of Wink, Inc., the Des Moines-based annuity market analysis firm. “There’s a perfect storm fueling sales for this product, as there was for fixed indexed annuities after 2008. This is where life insurers will start focusing their product development resources.”

For the second consecutive June, Wink and RIJ are collaborating on a four-week series of articles about the indexed annuities market. This year we’re drilling down on IVAs, but we won’t ignore other parts of the market. In this article, we’ll use IVA data from Wink’s Sales and Market Report for first-quarter 2020 as a framework for discussion.

Top IVA Issuers

For the past five quarters, the same companies in the same order have been the top five sales leaders: Equitable Financial, Brighthouse, Allianz Life, Lincoln National and CUNA Mutual. These five companies alone account for 95% of annual sales. While scores of life insurers sell variable deferred or fixed deferred annuities, only 11 companies sell IVAs so far. Equitable has led in sales since 2010, and has had the largest share of the indexed variable annuity market since creating the category in 2010. But that market share has gradually slipped from 100% to 50% to the present 25%. Among its competitors, the fastest follower seems to be Lincoln—whose high sales growth rate reflects its relatively recent entry into the market, in 2018.

The upward trend in IVA sales is expected to continue this year. After IVAs sold $11.2 billion in 2018 and $17.4 billion in 2019, LIMRA Secure Retirement Institute (SRI) expects another bump in 2020—for a near doubling in two years. “We’re expecting registered index-linked annuities (IVAs) sales of $19 billion to $21 billion this year,” Todd Giesing, senior annuity research director, SRI, said in an interview.

Top-selling IVA contracts

We’ll look more closely at the five best-selling contracts. In most cases, they offer links to the performance of the S&P 500 Index, the Russell 2000 Index, and the MSCI-EAFE global index; options on these popular indexes are liquid and priced efficiently. A few other indexes are offered for variety, as noted below. All of the products are registered securities, but, as retirement savings products, they offer tax-deferred growth.

Most of these contracts allow owners to opt (in advance) for a fixed, positive rate of return if the index return is zero or positive. This feature goes by multiple names; it is variously called a Step Rate, a Step Up, a Precision Rate, and a Trigger Rate. It tends to be available only when the one-year term crediting option and -10% buffer are chosen, and ranges varies from 7.75% to as much as 14%. Contract owners can divide their principal among different crediting strategies.

The leading contracts all offer the client some protection against downside risk through their buffers. All feature a -10% downside buffer; Allianz Index Advantage also offers a floor. Deeper levels of protection, such as -15%, -20%, -25%, and -30% buffers, are offered in different combinations within different contracts. Lincoln Level Advantage offers 100% downside protection, which matches the protection of an FIA. With a buffer, investors lose nothing until market losses exceed the buffer limit. With a floor, investors can’t lose more than the floor limit.

These five contracts include death benefits and six-year surrender-charge periods (typical of products sold by commission). Enhanced death benefits are sometimes available for a surcharge, and the first-year penalty (e.g., 7%) for withdrawals greater than 10% of the contract varies by company.

(We wish we could describe or at least mention many of the other indexed variable annuities offered by the 11 life insurers in this niche. We’ll try to make up for that in a future article. Please note that, while we’ve tried to publish up-to-date rates, the rates available on new products change frequently. )

Lincoln National Life Level Advantage B-share. “Uncapped” crediting strategies are a big sales hook in the (fixed and variable) indexed annuity market, implying that the client will earn 100% of the index return (dividends excluded), however high it goes. Lincoln’s Level Advantage offers an uncapped strategy on four indexes, but only when clients leave their money in for six years, accept a -10% buffer, and link their investment to the performance of the Capital Strength Index, which invests in 50 stocks hand-picked by First Trust Advisors for favorable cash-on-hand levels, debt ratios and volatility. The contract also offers “100% participation” crediting methods on three-year holding periods with a -10% buffer.

Owners of this contract can also invest part of their balances in any of 14 investment options. They can access Lincoln’s patented i4Life lifetime income option, for an extra fee of 40 basis points per year. This contract gives the client the option to lock in gains at the end of each contract year of a six-year term, rather than waiting six years to lock in gains.

Brighthouse Life Shield Level 6. Not to be outdone on offers of upside potential, this contract offers a 300% participation rate on the performance of the large-cap S&P 500 Index, the MSCI-EAFE Index and a 90% participation rate on the small-cap Russell 2000 Index. But that option requires a six-year holding period and acceptance of net losses beyond the first 10%. “Level 6” refers to the six-year surrender period; there’s also a Level 3 product with no surrender penalties after a three-year holding period.

Equitable Structured Capital Strategies Plus. Only a few weeks ago, Equitable enhanced this product with a new optional feature called “Dual Direction.” If, at the end of the six-year term, the index return is between zero and -10%, the client will receive a gain equal to the loss. That is, if the S&P 500 was down 6% after six years, the client would earn 6% over six years. Structured Capital Strategies also offers uncapped upside on the six-year term option linked to the S&P 500 Index and MSCI-EAFE.

Allianz Index Advantage. Unlike the other leading contract, the Index Advantage includes an 1.25% “product fee.” This annual fee, paid by the contract owner, gives the product a bigger hedge budget. This presumably allows the purchase of more upside-potential from the options sellers. Another version (“Index Advantage NF”) has no product fee. This contract also has a $10,000 minimum initial premium—considerably less than the $25,000 some competitors require. This product is alone in offers “floor” in addition to a buffer. The floor protects the contract owner from losses in excess of 10%.

Allianz Index Advantage Income. Otherwise identical to Index Advantage, this contract offers a rider that guarantees income for life. The income rider costs 70 basis points of the contract value per year. At age 67, for example, a contract owner could receive 5.70% of the contract value each year for life (5.20% for a couple). An inflation-averse contract owner can opt for an annual increase in the payout percentage but the first-year payout percentage will be lower. For instance, at age 67, the payouts would be only 4.90% for a single owner (4.40% joint) but the payout percentage would go up by 40 basis points every year thereafter. The minimum initial premium for the contract only $5,000.

Where IVAs are sold, and who sells them

Annuity products may be complex and hard to understand, but annuity “distribution” is arguably even harder to grasp. Different annuity contracts travel different routes from manufacturer to wholesaler to distribution firm to adviser to client. Depending on product design, certain annuities can be sold by certain kinds of advisers in some venues but not others.

Because investors can lose money on them, IVAs must be registered with the Securities and Exchange Commission and only securities-licensed advisers can sell them. IVAs are typically sold by commission, so representatives of RIAs (Registered Investment Advisors), can’t sell them; RIAs charge a percentage of the value of the assets they manage.

Consequently, most IVAs are sold by investment advisers at either independent broker-dealers (55%) or at banks (27%). Insurance agents without securities licenses—who are the biggest sellers of fixed indexed annuities—can’t sell them. Wealth managers at full-service brokerages (aka “wirehouses”) generally do not sell them, preferring to sell their companies’ proprietary structured products, according to Giesing.

Most popular contract structures

In their search for higher yields, more contract owners appear to be opting for the longer-term versions of these products, according to Wink’s data. In 1Q2019, 95% of the IVA contracts (by premium volume) used one-year point-to-point crediting methods. In other words, clients locked in gains (or losses) on each contract anniversary. (This particular data was based on responses from two-thirds of companies surveyed and covered 51% of premium.)

But a year later, in 1Q2020, 37% of premium volume went to contracts where investors chose to keep their money invested for terms longer than one-year. The six-year term is popular because it offers some of the highest and most alluring potential gains. Generally, the longer the holding period, and the smaller the downside buffer, the higher the upside potential for the crediting method, regardless of the index selected.

“The pricing will be more favorable with the longer-durations,” according to SRI’s Giesing. “Investors are also opting for more downside protection. As market volatility has increased, issuers are seeing more flows into the larger buffers—the -20% and -30% buffers.”

Wink’s survey suggests that investors are comfortable with the buffer concept. For more than three-quarters of premium, the contract owner chose a downside buffer (where the owner’s losses don’t start until the account value has dipped by at least 10%), 13.8% chose a downside floor (where the owner absorbs losses up to 10%, but no farther), and 9.9% chose 100% protection—thereby turning their IVA into the equivalent of a super-safe FIA with a maximum upside of only about 3.4% per year.

Additional sales patterns

Qualified sales (where the premium is paid with tax-deferred money) represented 62% of total first quarter structured annuity sales, with 64% of the premium coming from Individual Retirement Accounts (IRAs) and 36% from employer-sponsored retirement plans. The average issue age from all contracts was 62. The evidence suggests that older investors are buying this product to protect their assets during the so-called “red zone” around the retirement date, when they are vulnerable to losses that they don’t have time to recover.

The average structured annuity sales premium reported was $138,685 a decline of nearly 3%, compared to the previous quarter. The average structured annuity premium ranged from $43,786 to $677,524. The policy count overall was 18,982 policies for the quarter, an increase of more than 6% as compared to the previous quarter. The average policy count per issuer was 2,109.

© 2020 RIJ Publishing LLC. All rights reserved.