As many of us are painfully aware, our 83-year-old Social Security system faces a deadline. Only 16 years remain before its revenues will cover only about 75% of its promised payouts. Unless a credible fix emerges soon, we could end up with a hasty, 11th-hour patch-job in 2034. Even now, many Millennials expect a lump of coal at retirement.

One fresh proposal—among seven winning responses to a 2016 “AARP Policy Innovation Challenge”—calls for the creation of new savings accounts that would give Americans enough money to delay Social Security claiming until age 70 and thereby reap higher annual benefits for life.

One fresh proposal—among seven winning responses to a 2016 “AARP Policy Innovation Challenge”—calls for the creation of new savings accounts that would give Americans enough money to delay Social Security claiming until age 70 and thereby reap higher annual benefits for life.

(For a look at the seven (out of 20) winning proposals, click here.)

Warning for those sensitive to government-led solutions: The following proposal entails a government mandate, slightly higher payroll taxes, notional individual accounts, and a centrally managed, federally supervised pool of target date funds with limited pre-retirement liquidity.

The new accounts are called Supplemental Transition Accounts for Retirement, or STARTs. (They were conceived by Gary Koenig (below right), vice president of Financial Security at AARP’s Public Policy Institute, and developed with assistance of Jason Fichtner, a former Social Security official now at the conservative Mercatus Center at George Mason University, and William Gale of the liberal Brookings Institution.

developed with assistance of Jason Fichtner, a former Social Security official now at the conservative Mercatus Center at George Mason University, and William Gale of the liberal Brookings Institution.

Big picture: There’s a battle shaping up over retirement policy, and whether the public sector or the private sector can, will, or should address the fact that as many as half of U.S. workers have no retirement savings option at work. California and Oregon have moved ahead with state-sponsored “auto-IRAs.” The private sector wants industry-led “open multiple-employer plans.”

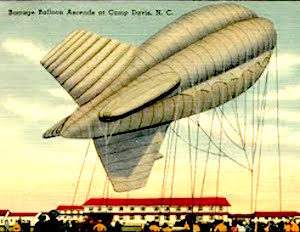

STARTs are just one policy trial balloon, and here’s they would work:

- The accounts would be funded by employees and employers. There would be an additional government contribution for low-income households, paid for by taxing START distributions.

- Each worker and employer would contribute 1% of earnings (2% combined), up to the annual maximum subject to Social Security payroll tax ($127,500 in 2017), to the worker’s START. The federal government would contribute up to 1% to the STARTs of low-income workers. Employee contributions would be after-tax and employer contributions would be pretax.

- The self-employed would make required contributions as both employer and employee. For married couples, total contributions would be split equally between each spouse’s START.

- Retirees could only receive what they put in, plus investment gains. As a result, people closer to retirement would have smaller START accounts. The investment gains would not be “smoothed” or “buffered.” Individuals could have different outcomes and experience sequence-of-returns risk.

- Beneficiaries could begin to receive monthly START benefits at the earliest eligibility age (62, in most cases) but would not be required to do so. Each worker would be required to exhaust START assets before receiving Social Security benefits.

- The amount of monthly START benefits payable under the proposal would be limited to the Social Security benefits that the beneficiary would have received under current-law claiming rules.

- At full retirement age (age 67 for people born in 1960 or after) and up to age 70, beneficiaries could use START assets without restriction (e.g., taking a lump sum). At age 70, account holders with START assets would be required to take a full lump-sum distribution, or roll the balance into a retirement account or a beneficiary’s START. Any money remaining in a START at the time of the account owner’s death would go to a designated beneficiary.

In an interview this week with RIJ, AARP’s Gary Koenig said that the proposal is primarily intended to increase the adequacy of Social Security benefits through delayed claiming. But the STARTs would also reduce Social Security’s anticipated funding shortfall by about 12%.

“We’re not guaranteeing any specific return,” Koenig said. “An independent board would set the glide path. Then the funds would be privately managed, the way BlackRock manages the target date funds in the federal employees’ Thrift Savings Plan (TSP), but with multiple managers. We allow access to the account only if you have one of the serious health conditions that qualify for Social Security disability.”

Eugene Steuerle, a Social Security expert at the Urban Institute, said the START proposal would publicize the advantage of delaying Social Security benefits until age 70. “The proposal clearly tries to steer people to recognize what a good deal the current actuarial formulas provide for retirement,” he said.

“I like the idea of convincing people, at least under the current regime, that many of them ought to spend down existing monies (or, in the case of STARTs, mandatory monies) first so as to get the benefit of the delayed retirement credits and the actuarial benefits from not withdrawing before the normal retirement age.

“My main worry rests locking in parameters for decades into the future, e.g., on an early retirement age of 62 or even a normal retirement age in a world where we soon are expect to have 1/3 of adults retiring for close to 1/3 of their adult lives. Another issue is that the delayed retirement credit formula ought to be fixed and made more actuarially fair.”

Alicia Munnell, director of the Center for Retirement Research at Boston College, was skeptical about the likelihood of raising taxes, telling RIJ in an email that “Social Security deficits preclude spending money elsewhere.” In her column today at Marketplace.com, she wrote this about STARTs:

“Despite all the strengths of the proposal, it faces a tough future. Essentially, it raises the payroll tax rates by 2 percentage points and uses that money to start a new program rather than to close [Social Security’s] 2.83% [of taxable payroll] 75-year deficit. That is a tough sell.

“But STARTs made me think about other ways to use the proposal. What if, up until the full retirement age, people could not claim their Social Security benefits until they exhausted some portion—say, half—of their 401(k)/IRA balances? That requirement would counter people’s resistance to drawing down their nest egg and enable them to purchase the best annuity in town!”

About those government contributions: The maximum would be 1% of earnings for married couples filing jointly with adjusted gross income (AGI) less than $40,000, single filers with AGI less than $20,000, and head of household filers with AGI less than $30,000.

The government contribution would be phased out over an AGI range of $10,000, $7,500, and $5,000 for joint filers, head of household filers, and single filers, respectively. For example, the government contributions for joint filers with AGI of $42,500 would be 0.75% and with AGI of $45,000 would be 0.5%.

Workers in low-income households would receive a total START contribution of up to 3% of earnings. The government contribution would be treated like an employer contribution and would not be included in current taxable income.

© 2018 RIJ Publishing LLC. All rights reserved.