Efforts to restore actuarial balance to the Social Security system should include an increase in the program’s retirement age, the public interest committee chairperson of the American Academy of Actuaries told a congressional panel last Friday.

Tom Terry of the AA explained to members of the House Ways and Means Subcommittee on Social Security that the program’s retirement age has not kept pace with longevity improvements, noting that that life expectancy for a 65-year-old today is about 50% higher than it was in 1937, when Social Security was created.

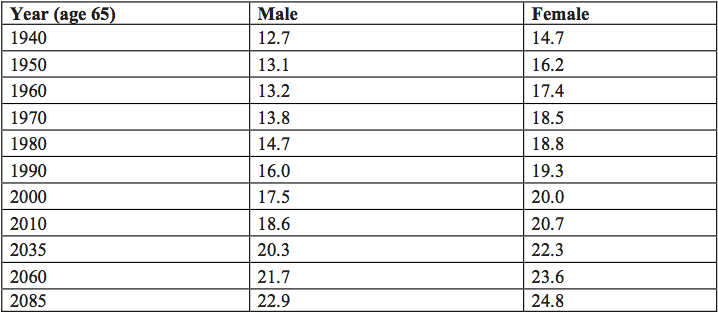

Even in 1940, however, men who reached age 65 had an average life expectancy of 12.7 years—meaning that half lived longer than that. A chart introduced by Terry showed that by 2010, an American man’s average life expectancy at age 65 had increased to 18.6 years. Women live about two years longer.

By 2060, it’s estimated that average life expectancy at age 65 will be 21.7 years for men and 23.6 years for women. (See chart below. Source: 2011 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds).

Some of Terry’s approaches to adjusting Social Security for rising life expectancies were:

- Increase the normal retirement age gradually to age 70.

- Pay benefits for the same number of years.

- Keep the ratio of working years to retirement years the same.

- Decrease the benefits formula as longevity increases.

- Automatically adjust the retirement age to maintain actuarial balance.

Terry also suggested in written testimony that slowing the increase in benefits would help solve a big part of Social Security’s actuarial problems.

“If Social Security benefits increased by 0.5% per year less than under the current program, the cumulative reduction would be about 5% after 10 years, and almost 10% after 20 years. This change would eliminate about 40% of Social Security’s 75-year deficit according to a 2009 study done by the Social Security Office of the Chief Actuary,” he wrote.

© 2011 RIJ Publishing LLC. All rights reserved.