For millions of older Americans who bought annuities with living benefit riders over the past decade, the terrible event they were insuring themselves against—a stock market crash during their passage through the retirement ‘red zone’—actually happened over the last two weeks.

But how many of these contract owners exercise those riders and initiate guaranteed monthly payments for life? How many will lapse their policies because they need instant cash? What will their advisers tell them to do?

And will the defensive steps taken by surviving variable annuity manufacturers over the past decade—to de-risk, re-price, re-capitalize, or discontinue product lines and diversify into fixed indexed annuities—help them to weather the current crisis? Or will we see a re-run of the restructurings, benefit buy-backs, and ugly publicity that followed the 2008-2009 crisis?

Life insurers tend to be taciturn during times like these. So, to get some perspective, I called actuary Tim Paris of Ruark Consulting, Gary “The Annuity Maestro” Mettler, and Tamiko Toland, research director at CANNEX, the annuity data and analysis shop that supplies up-to-date contract prices to thousands of advisers in the U.S. and Canada.

The ‘R.U.B’: Rider Utilization Behavior

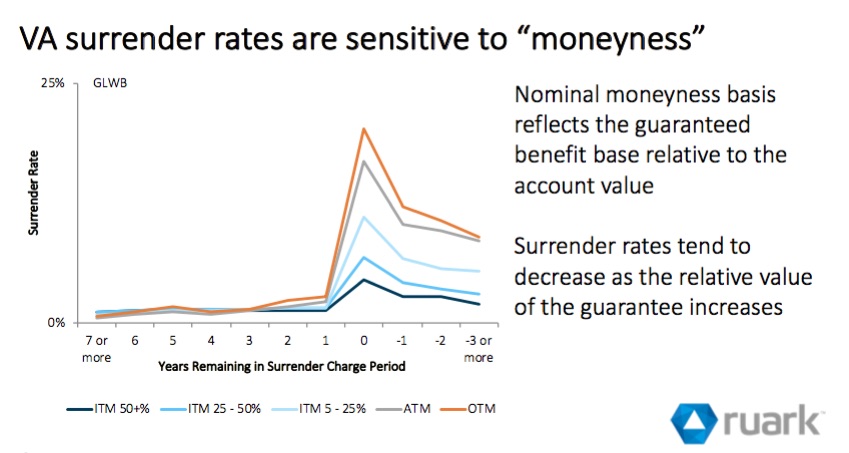

Since the Great Financial Crisis, Ruark Consulting has analyzed data from life insurers to identify utilization behavior patterns among owners of deferred variable and fixed indexed annuities with guaranteed lifetime withdrawal benefits (GLWBs) or guaranteed minimum income benefits (GMIBs).

Many factors determine policyholder behavior. But having studied such data for more than 10 years, he’s learned that policyholders are most likely to activate their income riders when the contracts are “in the money” and the contracts no longer benefit from further deferral bonuses. (In this case, a contract is “in the money” when the value of the guaranteed benefit base, which determines monthly income amounts, exceeds the contract’s cash value. This is most likely to happen during an equity market crash.)

“If I were 60-something and I’d been paying rider fees for 10 years and had deliberately delayed taking income in order to get the full bonus, I would think about doing it now,” Paris told RIJ. You’d think that this was fundamental to the offering. Presumably, advisers are telling clients to that.”

Enough time has passed since the peak in sales of deferred variable annuities (VAs) with GLWBs and GMIBs for Ruark to see such a pattern appear. “In the last few years the data has started to go out beyond the 10-year mark,” he said. “We’re now in the 11th and 12th policy years. A lot of contracts have riders that incentivize the owner to defer income for 10 years.

“What we find is that after year 10, once the incentives kick in, that people are five to six times more likely to commence income. Commencement is highly sensitive to the end of the deferral period. I would not be at all surprised that when the market is down 30%, folks will recognize that the product was fundamentally built for this purpose, and say, ‘I’ll take the income now.’”

I asked Paris if VA issuers were likely to suffer as much as they did during the 2010s. “I wouldn’t be too surprised if we had a similar experience this time,” he told me. “It won’t be exactly the same, because carriers are more educated now than they were last time. After the shock of the last crisis, issuers found out how expensive the riders were. That led companies to think along different lines.”

If the Fed keeps interest rates close to zero, however, he added, it will be difficult for carriers to issue attractive products. “With zero rates, I get a ‘shrinking iceberg’ feeling,” he said.

“It will be hard to offer a lifetime income guarantee. There are more levers the carriers could tinker with. The guaranteed floors could go lower, the income payout rates could go down. But you can’t escape the reality that these are the rates and these are the costs and you’re forced to bake them into the product. As a result, the products will won’t look as good.”

At CANNEX, Toland is seeing distributors pulling annuity products off their shelves. New products are not attractive at the prices that life insurers are able to offer right now, and today’s products will look even worse if rates rise and better products eclipse them.

“We’re seeing suspensions of sales of annuities across all product categories, including immediate and deferred income annuities,” Toland told RIJ. “We anticipate more of the same.”

On the other hand, she added, “There’s still an argument to buy an annuity. If someone has to retire now, and needs a guaranteed income, and is worried about sequence of returns risk, there’s still an argument to buy. So there’s going to be a demand regardless of what happens to rates.”

Mettler, an insurance agent who recommends income annuities to his clients, believes that life insurers may be able to bring annuities to market, but they may not be products that agents will want to sell.

“There will still be an annuity market, but the carriers that remain will be overwhelmed by demand,” he said. “They might say that their budget for annuities will be only so much in a given year. And they might hit that mark in the first three months of the year.

“Some might partially withdraw from the market, or they’ll stay in the market with pricing that’s even more terrible than it is now. They might stop issuing contracts to people under 50. There might be no ‘period certains’ longer than 10 years, or no cash refunds. The carriers will find a way to survive. But who will be available to sell the products?”

© 2020 RIJ Publishing LLC. All rights reserved.