Every farmer or gardener appreciates the value of “succession planting.” That’s a cultivation method where plants are sown in staggered intervals, mature in orderly succession, and supply a continuous harvest. It’s a form of just-in-time food propagation.

Succession planting has a counterpart in the retirement income realm: the time-segmentation or “bucketing” method. Assets are purchased at retirement, assigned to a series of multi-year intervals, and “harvested” for income when each interval begins.

Last week, about 100 advisers, either fans of bucketing or curious about it, gathered in downtown Boston for Wealth2k’s annual IFLM (Income for Life Model) conference, sponsored by Securities America, WisdomTree, UpSellerate and Delaware Life.

Macchia

IFLM is a soup-to-nuts client management platform built around a bucketing tool. Wealth2k CEO David Macchia calls IFLM “a solution that provides everything a financial advisor needs to enter and succeed in the retirement income planning business.”

As an income-generation method, time-segmentation competes with the systematic withdrawal program (the “4%” rule) and the flooring method (using guaranteed income sources to cover all essential expenses) for advisers’ attention. It’s been called gimmicky, but some advisers swear by it, especially as a context for introducing annuities.

Simple and complex

The main attractions of the conference, for RIJ, were two time-segmentation case-studies presented by Zach Parker, first vice president of income distribution and product strategy at Securities America, a registered investment advisor (RIA) and broker-dealer that licenses IFLM under the name NextPhase.

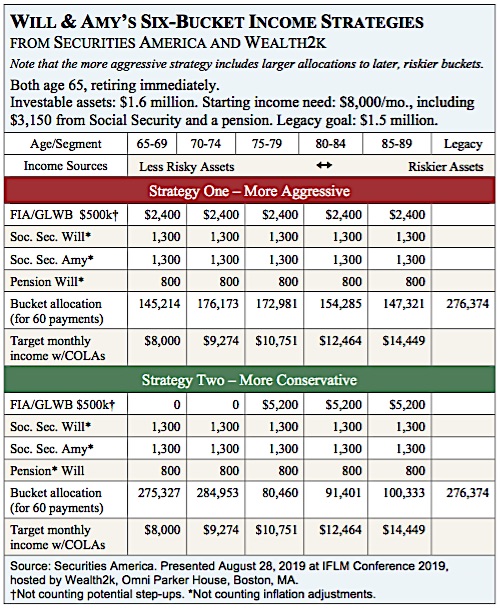

In Parker’s first case study, he prescribed a hybrid of bucketing and flooring to create growth and income for a hypothetical 65-year-old newly-retired couple with $1.6 million in savings, an estate goal of $1.5 million and a first-year income need of $8,000 per month ($4,850 from investments plus $3,150 from Social Security and a small pension).

Following Securities America’s version of IFLM, called NextPhase, Parker advised the clients to put $500,000 into an income-generating annuity and to divvy up their remaining $1.1 million among six five-year segments—with a big chunk in the sixth bucket for bequests or long-term care. (See chart below, where we call this couple “Will and Amy.”)

In this particular plan—before filling the buckets—Securities America calls on these fictional clients to make two important decisions. The couple’s first decision requires picking a lifetime guaranteed income-generation vehicle. It can be a single premium income annuity, a deferred income annuity, a variable annuity with a guaranteed lifetime income benefit (GLWB) or a fixed index annuity with a GLWB.

After that, they need to make an even more important decision: whether to start income from the product immediately or in 10 years. Their choice will affect the amount of liquidity they enjoy in retirement, the fees they’ll pay, and how much money they’ll allocate to each bucket, and what their overall equity allocation will be throughout retirement. It won’t, however, affect their monthly income or their estimated legacy value.

The first two (of many) decisions

Regarding the first decision, Securities America recommends the FIA with GLWB. It generates the most income—either about $2,400 a month for life starting immediately or about $5,200 a month starting in 10 years. For several years now, FIAs have been beating VAs and SPIAs on income production. VA issuers have become risk-averse and offer conservative payouts. SPIAs still suffer from low interest rates and illiquidity. That leaves an FIA with a GLWB, with its generous commission, as the safest, obvious choice.

Regarding the second decision, the clients face a fork in the road. Either fork will lead them to same place, but one route will be more volatile than the other. If they start lifetime income right away, they’ll get $2,400 from the GLWB to go with their $3,150 in Social Security and pension income. Assets in the first two buckets will have to produce only $2,450 a month to boost their guaranteed monthly income to the desired $8,000.

Parker

If the couple delays annuity income until year 11, on the other hand, they’ll have no annuity income at all for the first 10 years. That will force them to draw about $5,000 a month ($60,000 a year) from their investments in each of the first 10 years (See Segments One and Two in the chart).

From an investment standpoint, the couple will end up with a much higher equity allocation over their lifetime if they choose to tap the GLWB at the beginning of retirement. During the first 10 years, in fact, they can allocate about $300,000 more in equities if they take immediate income from the FIA, while generating the same real $8,000 monthly income.

Here’s the computation. To produce a real $2,450 per month during the first 10 years, they’ll only have to put about $145,000 in the first bucket and $176,000 in the second bucket. The rest of money—$474,590—can go into the equity-rich third, fourth and fifth buckets.

To produce a real $5,000 per month during the first 10 years, they’ll need to put about $275,000 in the first bucket and $285,000 in the second bucket. That leaves only $272, 194 for the equity-rich third, fourth and fifth buckets—more than $200,000 less in equities. (Either way, about $276,000 goes into the sixth, most aggressive bucket.)

Funding the segments

What kinds of products are used to fund the segments? Securities America recommends either a five-year period-certain single premium immediate annuity or a ladder of bonds or certificates of deposit (CDs) for the first five-year segment. Of those options, he noted that a SPIA would be least time-intensive for the adviser.

For Segment Two, Parker suggested CDs, a bond ladder, a fixed-rate annuity, an FIA, a structured or “buffer” registered annuity, principal protected structured CDs, or an investment portfolio. Again, packaged annuities were deemed by Securities America to be the least time-intensive for the adviser. Efficiency and commissions become important for advisers working with mass-affluent retirees whose assets generate less fee income.

For Segment Six, which starts at age 90, Parker suggested either a variable annuity with a death benefit for legacy planning purposes, or an investment portfolio. By holding individual stocks in an after-tax account, the couple would minimize their beneficiaries’ capital gains tax exposure via the “step up” in basis at death. The $276,374 in this segment will have 25 years to grow. Over that time, at a 7% average growth rate, the couple’s legacy would reach a value of almost exactly $1,500,000.

Next week: A look at Zach Parker’s presentation of a bucketing plan for someone whose priority is to minimize taxes in retirement and at death.

© 2019 RIJ Publishing LLC. All rights reserved.