Four years ago, the Nobel Prize-winning economist Bill Sharpe started writing a blog to chronicle a pet project. “This is a new blog,” he wrote at the time, “on which I plan to post material on creating and analyzing ranges of scenarios for retirement income using different strategies for investing, spending and annuitizing retirement savings.”

That blog is now an e-book, called “Retirement Income Scenario Matrices” or RISMAT. The 21 free, download-able chapters comprise two books braided into one: a manual for writing retirement income planning software and a more accessible, and often amiable, explanation of the philosophy behind the code.

As you might expect from Sharpe, one of the giants of Modern Portfolio Theory, the co-creator of the Capital Asset Pricing Model and the originator of the eponymous Sharpe ratio, this retirement how-to can rely on market history for its assumptions (or not, according to each user’s preference) and uses Monte Carlo simulations for its probabilistic recommendations.

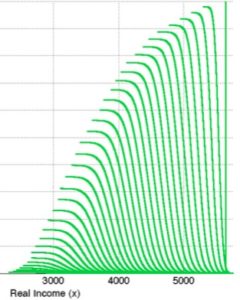

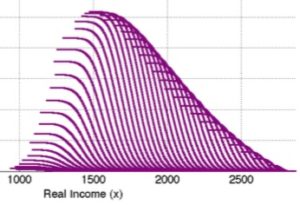

Illustration from RISMAT

But, surprisingly perhaps, this disciple of Harry Markowitz also takes a deep dive into annuities. The big tail risk in retirement, his approach implies, is not market risk but longevity risk. “Annuities are a potent and sensible instrument,” he told RIJ in a recent interview from his home in Carmel, Calif.

Many others have written software for retirement income planning. Sharpe himself has written papers on this topic before. So have the quants at Financial Engines, the 401(k) robo-advice firm he co-founded in 1996. This lengthy e-book, is written in a voice both technical and personal. It sums up the 83-year-old economist’s vision for the future of retirement income planning. Along the way, he brainstorms new ideas for life insurers, financial mathematicians, coders, broker-dealers, advisors and even individual retirees.

Notional “lockboxes”

The algorithms (written in MathWorks’ MatLab software) that Sharpe describes in this book may be rocket science, but anybody familiar with time-segmented income planning, aka “bucketing,” should feel at home with what he calls a lockbox approach, one of several that he prefers to the 4% “safe withdrawal” rule.

In one chapter, Sharpe divides retirement into two periods. During the first period, starting at the retirement date, a retired couple takes withdrawals from an investment portfolio. In one of his examples, the first period lasts 19 years and consumes 64% of savings. In the second period, if the retirees are still living, they buy an income annuity with the remaining 36%.

Each year of the systematic withdrawal period is represented by a “lockbox.” Each lockbox contains a certain portion of Treasury Inflation-Protected Securities and a share in an investment portfolio consisting of ultra-low-cost total market stock and bond index funds.

“The idea is to provide the discipline to say to yourself, ‘I will only cash the number of shares in this year’s lockbox,’ he said in an interview. “Obviously, the lockboxes aren’t really locked. If you have an emergency, you can take money out. You still have the key.”

The asset allocation depends on the client’s risk appetite or capacity. “For implementation, you’d buy a certain number of TIPS, and a certain number of mutual fund shares,” Sharpe told RIJ. “You build a spreadsheet with one column for the initial amount in TIPS and another column for the amount in a risky portfolio. Then you would multiply the number of TIPS and shares for each lockbox by their current values and figure out what they’re worth in each period. Once a year, you would sell off that year’s portions of the two at their current price. It’s an accounting/spreadsheet task.”

In the 20th year of retirement—which in this example roughly corresponds to the average American’s life expectancy—the couple, if living, buys a joint-and-survivor fixed life annuity. For the sake of liquidity, flexibility, and cost-reduction, they might prefer to make the annuity purchase an option, rather than buying an immediate or deferred annuity at retirement.

That’s a layperson’s description of Sharpe’s approach. Underneath the hood, the software relies on programmed assumptions about growth and inflation, incorporates variables about life expectancies and volatility, estimates present values, and uses Monte Carlo simulations to help identify the strategies that are most likely to bring a desired outcome.

[His software includes a valuation model so one can find present values of possible future payments to retirees and their estate. It also can compute costs of taking sequence-of-returns risk.]

Sharpe believes in this technique, but he admits its limitations. “Overall, the results of our exercise are depressing. Even if we were able to obtain a substantial history for the true market portfolio and if its returns had all been drawn from the same probability distribution every year and if future returns will be drawn from the same distribution, we could still make major errors when estimating parameters for the future distribution.

“And the reality is likely to be even worse. Political affairs, technology, communications, financial markets and financial economics have all changed radically over the last several decades. And they will undoubtedly change substantially in the future. When estimating future return distributions, humility is very much in order.”

“And the reality is likely to be even worse. Political affairs, technology, communications, financial markets and financial economics have all changed radically over the last several decades. And they will undoubtedly change substantially in the future. When estimating future return distributions, humility is very much in order.”

A retirement ‘family doctor’

In this book, Sharpe anticipates a future when life insurers, RIAs (registered investment advisors), advisors and retirees might use Sharpe’s software or something like it to create new products and processes and even to overcome some of the behavioral barriers to retirement income planning.

“I would love to see a product called lockbox annuities,” Sharpe told RIJ. “This would be an annuity in which the insurer would hold the lockboxes. The customer would tell the insurer, for example, ‘Here’s what I want in my year 2020 lockbox. Here’s the amount of TIPS I want and here’s the amount of market portfolio.’” The client would bear the market risk and reap mortality credits. “It wouldn’t cost much for the distant lockboxes. You might only pay 10% of what you would need.”

RIAs are already using homemade or licensed retirement planning software, and Sharpe hopes to see more of that. “In a small firm, there could be one or more technology specialists with detailed knowledge of the software’s functions and the ability to adapt or augment them to include additional income sources…

“The person or persons working directly with clients could focus more on communicating possible outcomes, helping the clients understand the options, then implementing some or all of the chosen approaches. Such a ‘family retirement doctor’ could help each client or pair of clients understand relevant graphs, discuss alternatives, then make informed choices.

The book also contains something for individuals. Sharpe recognizes that many retirees avoid talking about annuities or income because it forces them to contemplate their own mortality. “That’s the first hurdle: Talking about death,” he said. He thinks that his software could help retirees “think about what nobody thinks about.”

“I like the idea of sitting down and saying, ‘If I’m alive 20 years from now, and if I’ll need x amount of dollars in order to live reasonably well, what strategy should I have for that year? And if I don’t make it, do I leave my money to a charity or my children? Or do I buy an annuity, have more money and leave nothing? Or some combination of the two” he said.

“The hardest thing to think about is the issue of mortality. The lock box concept helps you think about that and can give you a cost-efficient strategy for each year. Behaviorally, it makes you think seriously about the future.”

© 2017 RIJ Publishing LLC. All rights reserved.