The exodus of advisors from wirehouses is real, but it’s not of Biblical proportions, according to Boston-based Cerulli Associates, which has just released its annual sizing of the advisor marketplace, with data on assets under management and advisor headcounts by channel for retail advisors.

“There’s this impression of lemmings leaving Merrill Lynch [for example] to go independent,” said Cerulli’s Bing Waldert. “While the trend is real, it’s happening slowly. If anything, it has decelerated slightly.”

The stronger trend, at least since the financial crisis gained momentum last year, has been for wirehouse advisors either to switch houses or accept incentives to stay put. Billions in controversial bonuses—often at companies receiving federal bailout money—have been paid mainly to retain top producers.

The stronger trend, at least since the financial crisis gained momentum last year, has been for wirehouse advisors either to switch houses or accept incentives to stay put. Billions in controversial bonuses—often at companies receiving federal bailout money—have been paid mainly to retain top producers.

“Advisors are getting heavy compensation to stay in their current channel,” Waldert said. A third factor is that the “number of advisors has stayed flat or shrunk slightly in the last five years, so broker-dealers have stepped up recruiting packages. It’s a market share game right now.”

“Despite the discussion about the move toward the ‘indies,’ the wirehouses still have over 45% of the assets,” he added, or $3.95 trillion. “That’s eroding slowly, but Morgan Stanley Smith Barney alone, with $1.4 trillion under management, has more assets than either the entire RIA (registered investment advisor) or IBD (independent broker-dealer) channel.”

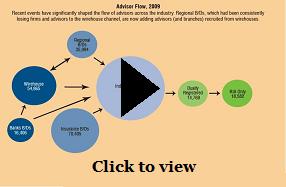

The 54,000 wirehouse advisors represent 18% of retail advisors. The largest group—the 98,000 advisors in the independent broker-dealer channel—represents about 31%, and manages about $1.35 trillion (16%), if dually-registered advisors are included. Dually-registered advisors have an independent RIA, but still maintain a broker-dealer affiliation for commission business.

The 54,000 wirehouse advisors represent 18% of retail advisors. The largest group—the 98,000 advisors in the independent broker-dealer channel—represents about 31%, and manages about $1.35 trillion (16%), if dually-registered advisors are included. Dually-registered advisors have an independent RIA, but still maintain a broker-dealer affiliation for commission business.

The insurance broker-dealer channel has about 70,000 advisors, or 22% of the total headcount, but manages a disproportionately small share of the assets: only 3.4%, or about $238 billion, Cerulli reported. The bank broker-dealer channel has only five percent of the advisors and manages just 2.2% of the assets.

Last fall’s market crash dropped a bomb on advisors whose earnings are based on assets under management. Cerulli’s annual report shows that assets in all retail advisory channels fell from more than 26% in 2008, to $8.3 trillion from $11.2 trillion in 2007.

| Assets by Channel, 2007-2008 ($ billions) | |||

|---|---|---|---|

| Channel | 2007 | 2008 | 1-Year CAGR |

| Wirehouse | $5,458.6 | $3,947.3 | -27.7% |

| RIA | $1,106.7 | $911.3 | -17.6% |

| Including dually registered | $1,740.4 | $1,360.4 | -21.8% |

| IBD | $1,605.4 | $1,182.8 | -26.3% |

| Including dually registered | $1,809.0 | $1,352.4 | -25.2% |

| Regional B/D | $1,589.4 | $1,149.2 | -27.7% |

| Dually registered advisors | $837.4 | $618.6 | -26.1% |

| Insurance B/D | $417.4 | $282.9 | -32.2% |

| Bank B/D | $228.8 | $181.9 | -20.5% |

| Total | $11,243.5 | $8,274.1 | -26.4% |

| Sources: Cerulli Associates, Investment Company Institute, NAVA, VARDS, Strategic Insight/SIMFUND, Securities Industry and Financial Markets Association, Investment News, Financial Planning, Bank Insurance Market Research Group, National Regulatory Services, Standard and Poor’s Money Market Directories, The Institute of Management and Administration, Judy Diamond, Department of Labor, CFO, Pensions & Investments, Cerulli Associates, in partnership with the College for Financial Planning, Financial Planning Association, Financial Services Institute, Investment Management Consultants Association, and Morningstar. | |||

© 2009 RIJ Publishing. All rights reserved.