After losing $12 trillion in paper wealth during 2008 and 2009, retail investors are feeling more conservative. But that shift will probably be “fleeting.” In the meantime, financial advisors should promote “stepping stone” products like fixed income and low-volatility equity income products.

Those were among the conclusions of Cerulli Quantitative Update, Annuities and Insurance 2009, published recently by Boston-based Cerulli Associates and Phoenix Marketing International.

The report also found that poor investment performance is the number one reason why affluent investors change advisors, and that annuities might appeal to wealthy clients if they are positioned as part of an overall retirement solution rather than as isolated products.

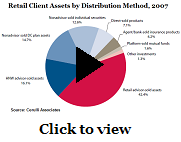

The study quantified the great extent to which financial advisors act as the gatekeepers to end-buyers of financial products. Advisors influence 58% of the sales to retail investors, the survey showed, while products sold without the aid of an advisor account for only 12.9% of retail investors’ holdings.

The study quantified the great extent to which financial advisors act as the gatekeepers to end-buyers of financial products. Advisors influence 58% of the sales to retail investors, the survey showed, while products sold without the aid of an advisor account for only 12.9% of retail investors’ holdings.

From August to December of 2008, the number of households describing themselves as conservative investors jumped to 32% from 25%. Of people with more than $10 million, the conservative segment more than doubled, to 38.3% from 17.1%. That group also had the highest percentages of self-described “aggressive” investors, with 20% in August and 14.6% in December.

Even after investors regain their optimism, Cerulli expected there to be “a revamping of allocation and diversification strategies to better protect investors in down markets.” Interest in guaranteed products, liability-driven investment strategies, and alternative assets with low correlation to market returns is expected to rise.

“Protecting current levels of wealth” and “minimizing taxes” were the two biggest concerns of households with more than $500,000 in investable assets, the survey showed. “Getting household debt under control” and “financial impact of caring for an aging parent” were the two least concerns.

“Protecting current levels of wealth” and “minimizing taxes” were the two biggest concerns of households with more than $500,000 in investable assets, the survey showed. “Getting household debt under control” and “financial impact of caring for an aging parent” were the two least concerns.

Expertise in minimizing taxes is likely to be a competitive advantage for advisors. “Asset managers that bring simplified, easy-to-implement solutions to advisors either through tax-sensitive vehicles or through value-added programs focused on tax strategies stand to gain a leg-up,” the report said.

Investors with $5 million to $10 million were most likely to have an advisor either directing their financial affairs or assisting them (40.4% were “directed” and 29.9% were “assisted”) and were least likely to be “self-directed” (17.8%).

© 2009 RIJ Publishing. All rights reserved.