A coalition of three dozen consumer advocacy groups is urging the Department of Labor to “update and eliminate loopholes in the current definition of ‘fiduciary investment advice’ …and protect retirement savers who are predominantly covered by individual account plans.”

In a press release and letter, the groups asked Acting Assistant Secretary of Labor Ali Khawar—a place holder for Lisa M. Gomez, whose nomination to lead the DOL’s Employee Benefit Security Administration has met opposition in the Senate—to, in effect, reject the more investment industry-friendly “Reg BI” that was developed by the Securities and Exchange Commission during the Trump Administration for use by both insurance and investment product distributors.

The rule has special implications for insurance agents. It will determine whether they are eligible for a “prohibited transaction exemption” (PTE) from a law that would otherwise prevent them from advising prospective clients to “roll over” savings from a 401(k) account to an IRA—to an annuity in an IRA, for instance—when getting paid a commission by a life insurer to sell the annuity. It also involves the life/annuity companies that issue the annuities, and their potential responsibility for representations made by those who sell their products.

Does that commission payment represent a fatal conflict of interest for the agent—a conflict between the client’s welfare and the agent’s financial welfare? Reasonable people have been disagreeing for years.

The advocacy groups’ letter comes as the Biden DOL is still working on a proposal to change the rule back to the Obama administration’s version (PTE 84-24)—more consumer-protective—or leave it in the Trump administration’s version (PTE 2020-02), which was open to interpretation.

Like most pension-related regulations, the regulations under debate here are complex, opaque to outsiders, but fraught with commercial implications for the sale of financial products that involve the exchange of tax-deferred, DOL-regulated savings accounts, like 401(k)s and IRAs.

The following description of the current state of affairs, written by the ERISA law firm of Faegre Drinker for a recent webinar, is plainer than most:

The Department of Labor’s (DOL) expanded interpretation of fiduciary status for recommending Plan-to-IRA rollovers and IRA-to-IRA transfers means that many more insurance agents will be fiduciaries for making those recommendations — and, as such, will need the protections of a prohibited transaction exemption (PTE) due to their compensation, both cash and non-cash. PTE 2020-02 provides the most flexibility, but requires that insurance companies be “co-fiduciaries.” PTE 84-24 is more limited, but imposes less of a burden on insurance companies.

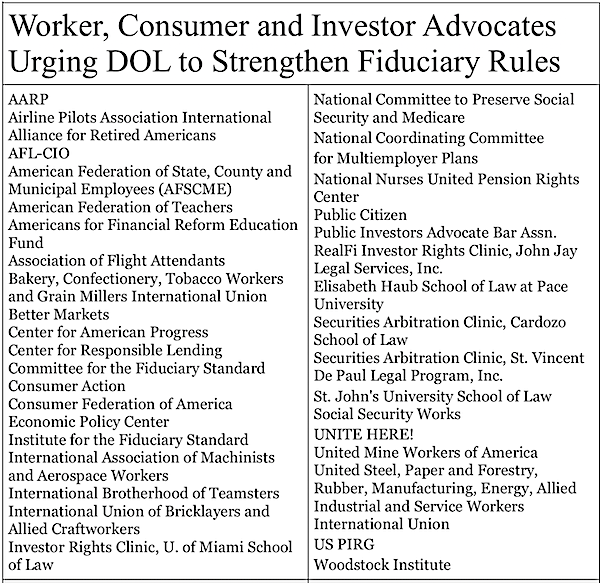

Countless billions of dollars are at stake, because 401(k) participants collectively hold trillions of dollars of assets in their accounts. The rules under question here have been in play—in the DOL bureaucracy and in the federal courts—for at least six years. Issuers of fixed indexed annuities (FIAs) and variable annuities (VAs) are among the most interested parties. Insurance agents compete with financial advisers for rollovers, and don’t want to face special restrictions merely because they take commissions from annuity issuers. In the race for rollover dollars, the advisers and their brokerages have been winning. (Organizations signing the letter are listed below.)

A long and winding paper trail

In 2016, the Obama DOL, after years of study, passed a “best interest” rule that narrowed the ability of insurance agents to recommend rollover annuities to participants and get paid commissions by annuity companies for doing so.

In the competition for rollover dollars, this would have put agents at a disadvantage relative to financial advisers, such as Registered Investment Advisors, who do not take commissions from product manufacturers.

The debate over this hung on a long-standing “five-part test” that determines whether a financial intermediary can conduct him- or herself like a mere broker toward the client (and clearly a sales representative with only a passing relationship to the client) or must meet the high ethical standards of trusted “fiduciaries” who must acts “solely” in the “best interest” of their clients.

After the Trump administration froze the Obama rule, a bevy of financial services industry lobbying groups filed a lawsuit to have the rule vacated and a Texas federal appeals court judge ruled in their favor. (The lead plaintiffs’ attorney, Eugene Scalia, was appointed Secretary of Labor in 2019.) Subsequently, the Securities and Exchange Commission, established a vague compromise rule, called “Reg BI.” It established that advisers or agents are equally free to pitch rollovers to participants as long as they don’t put their own pocket-book interests ahead of the participant’s financial well-being.

Investment and insurance companies can live with this compromise; it gives them flexibility in marketing rollovers to participants. Consumer advocates believe that it allows agents to make sales recommendations in the guise of unbiased investment advice.

As their new letter to Acting Assistant DOL Secretary Khawar noted, the current rule:

frames the retirement advice provider’s basic obligation in comparatively weak terms. It provides that advice is in the retirement investor’s “best interest” as long as it does not place the retirement advice provider’s financial or other interests “ahead” of the retirement investor’s interests, or “subordinate” the retirement investor’s interests to those of the advice provider.

This formulation of ‘best interest,’ which establishes a kind of parity between the interests of the two parties, because neither interest is placed ahead of the other, is contrary to the statutory mandate that fiduciaries must discharge their duties “solely in the interest of the participants and beneficiaries and for the exclusive purpose of providing benefits to participants and their beneficiaries.”

There are lots of side issues that add nuance to this controversy. The Obama-era Employee Benefit Security Administration, led by Phyllis Borzi, preferred, all things being equal, that more retirees would leave their money in 401(k)s, where they enjoy the low fees and consumer protections encoded in the federal Employee Retirement Income Security Act of 1974 (ERISA), which governs retirement plans and pensions.

But they were fighting the tide of history. Defined contribution 401(k) plans were never designed to hold employee savings after the employees retire; they were created as profit-sharing plans, not as pensions. So participants often have no incentive to keep their money there—especially if their particular plan offers few investment options and/or has high costs. Only recently have employers expressed a desire to keep retiree money in their plans, mainly to preserve the economies of scale that keep costs down.

In addition, consumer groups have an abiding suspicion of deferred annuities and the commissioned agents who sell them. Twice in the past 20 years, they’ve urged the federal government to regulate annuities more closely. Both times, they failed. In 2007, the SEC tried to reclassify FIAs as securities, and therefore subject to federal regulation (instead of as state-regulated insurance products).

In 2016, the Obama DOL’s rule which would have required agents selling FIAs and VAs to pledge that they were acting solely in their prospective clients’ best interests when recommending those products to retired plan participants. It made agents subject to class-action federal lawsuits if they violated the pledge.

As noted above, the annuity industry sued to overturn this rule, and a Fifth District Circuit Court of Appeals judge vacated it, ruling against the DOL. The Trump DOL—then led by Secretary Scalia—chose not to contest the ruling.

© 2022 RIJ Publishing LLC. All rights reserved.