The good news this past week is that Treasury Secretary Mnuchin announced that the imposition of tariffs on many Chinese goods imported into the United States is “on hold” in exchange for a pledge that the Chinese would increase significantly their purchases of U.S. goods, primarily agricultural and energy products.

Any agreement that significantly expands the market for U.S. goods overseas is encouraging. However, the agreement does not address the primary issue: The Chinese lack of respect for intellectual property rights and their blatant stealing of U.S. technology. That is what manufacturers we talk to are concerned about.

We are unrepentant believers in “free trade”. The world has been steadily moving in that direction since World War II, and it is generally accepted that all countries have benefited from it. In each country there is a wider array of goods and services available at lower prices than if that country chose to go it alone.

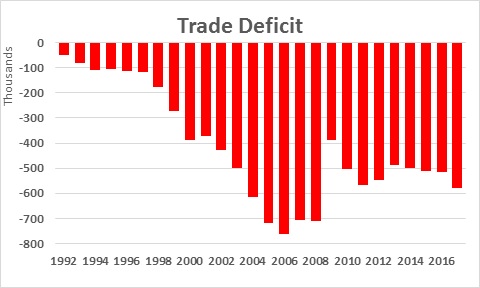

Last year the U.S. had a trade deficit of $568 billion. But so what? All that means is that the U.S. imported more goods from overseas than we purchased globally. Thus, foreigners accumulated $568 billion of dollars because of trade. The counterpart of a $568 billion U.S. trade deficit is $568 billion of foreign capital inflows into the United States. That money will be invested here. Foreigners will start businesses in the U.S., they will create jobs, and/or they will invest it in the stock market. Those are all good things. Thus, in our mind, a laser-like focus on the magnitude of the trade deficit is misplaced. Keep in mind, too, that the U.S. has had a trade deficit of roughly its current size (or larger) since the early 2000’s and nothing bad has happened.

While we are staunch believers in “free” trade, we are equally adamant about our belief in “fair trade.” Therein lies the problem. Free trade works well if all players operate using the same playbook. That is not the case today. Some countries blatantly cheat, the most widely recognized cheater is China. It shows absolutely no regard for intellectual property rights. It routinely ignores patents and copyrights. It steals our technology. These fairness issues are what we hear about most often in our discussions with manufacturers. The recently announced agreement between the U.S. and China does not address these issues which are critical. Hopefully, they will be addressed in subsequent negotiations.

Having said all that, we do not want to completely dismiss the importance of what transpired this week. Please note that the overall trade deficit of $568 billion consists of an $811 billion trade deficit for goods, and a $243 billion trade surplus for services. Of that $800 billion trade deficit in goods, almost half is with one country—China. We do not have trade issues with our neighbors, Canada and Mexico. Nor do we have a problem with Europe or even OPEC. We have a problem with China and a handful of other Asian nations.

Several months ago, President Trump proposed steep tariffs on aluminum and steel products across the board. The Chinese quickly retaliated with tariffs on a variety of U.S. goods and the U.S. was on the cusp of a trade war not only with China but with other countries as well. That was obviously not the desired solution. Nobody wins a trade war. All countries lose. And to impose penalties on our neighbors and allies with whom we do not have a trade issue made no sense. Given the concentrated nature of the trade deficit with just a handful of countries, the focus should have been on those countries with whom we have a problem. Target the measures you intend to take on them. Do not apply restrictions across the board.

What happened this week is vastly different. The agreement is for the Chinese to shrink the bilateral trade deficit by boosting their purchases of U.S. made goods— principally agricultural products and energy. This is not shrinking global trade, it is expanding it. While the Chinese would not agree to a specific target for the reduction in the size of the trade deficit the U.S. was seeking improvement of about $200 billion. Explicitly or implicitly, a $200 billion reduction in an $800 trade deficit in goods, is significant and will lead to an additional $200 billion of U.S. exports.

Some economists were disappointed that the fairness issues were not a part of the recent agreement and have criticized Treasury Secretary Mnuchin for not addressing them. However, Mnuchin said that the previously announced tariffs on steel and aluminum imports would remain in place. Presumably, he is using the imposition of the tariffs on those metals as a bargaining chip to crack down on the alleged trade abuses by China. We’ll see.

© 2018 Numbernomics.com