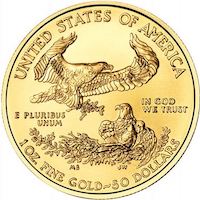

‘Eagle’ gold coins in a self-directed IRA? That bird won’t fly.

Ms. McNulty bought American Eagle gold coins for her IRA but stored them in a safe in her home. That's not legal, the tax court ruled. Attorney Barry Salkin of Wagner Law Group explains.