Life, the 547-page autobiography of Rolling Stones guitarist Keith Richards, was sitting on my night table when the 533-page report of the Financial Crisis Inquiry Commission was published last week. Since then, I’ve been switching back and forth between them.

Both books tell tales of men behaving badly. As Richards admits, he mainlined heroin and dabbled in a pharmacy of other drugs. His behavior under their influence left a long trail of overturned Bentleys, arrests, dead buddies, broken hearts and (on the bright side) some great rock-and-roll songs.

As some of the bankers admit, they were addicted to collateralized debt obligations and credit default swaps. Their exploits resulted in a long trail of government bailouts, displaced homeowners, unemployed Americans and (on the bright side) many cul-de-sacs of 6,000-sq.ft. Mcmansions with granite-countertop kitchens.

The two books are both limpidly written. Even the FCIC report (unless you’ve already OD-ed on Crisis-related literature) makes for swift, entertaining and persuasive reading. Both books recalled the catch phrase, “You can’t make this stuff up.”

In Richards’ case, and in the case of the mortgage crisis, there’s not much mystery about why the addictions began or lasted as long as they did. In both instances, the drugs of choice had a notable upside: they helped generate vast wealth and other pleasures. (Richards rationalizes that his use of heroin, USP-quality cocaine and quaaludes helped him write immortal riffs and insulated him from the torments of fame. The dude with the skull ring also had a posse of dealers, lawyers, bodyguards, girlfriends, healers, agents, and managers as well as a knife and a Smith & Wesson to help spring him from nasty jams.)

That’s why the users didn’t “just say no.” It doesn’t seem much more complicated than that. In the absence of intervention by a higher authority, the process plays itself out until the bad overwhelms the good. Or until, as former Citigroup chairman Charles Prince put it, “the music stops.”

* * *

Even without producing the proverbial smoking gun, the FCIC report should help dispel the myth that a mass delusion or mania caused the financial crisis. Lots of people saw it coming, warned about it, and tried to take action. (I remember thinking, ‘Uh-oh,’ when Goldman Sachs went public in 1999.) Those conscientious objectors were simply drowned out by the power of $2.7 billion worth of lobbying from 1999 to 2008, by complicit or naive legislators, by complacent or captive regulators, and by the prosperity (real or imagined) that even a debt-fueled boom temporarily brings.

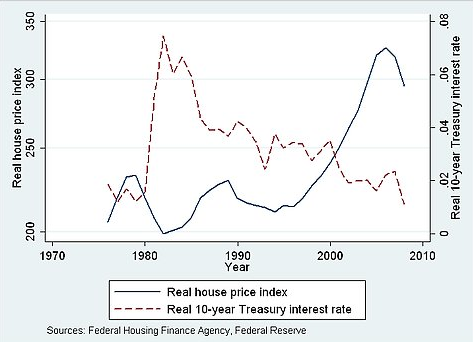

People who actually believed that home prices would continue to rise forever at a steep rate were obviously not aware that, after 20 years of falling interest rates—a key factor in the escalation of home prices—by 2003 interest rates had run out of room to fall.

You didn’t have to be a financial engineer, an economist or even a Fed chairman to see that the 25-year bull market in bonds and homes was nearing an end. Look at the chart below. Some people still deny a causal relationship between the two. But the association is strong enough for me. In any event, it’s nearly impossible to prove absolute causation. Just ask the chicken or the egg.

When Alan Greenspan raised interest rates a quarter-point at a time from mid-2004 to mid-2006 without tipping the stock market, I thought the Nobel Prize committee would soon be waking him with one of its famous 5 a.m. telephone calls. That was wishful thinking. The explosion was merely delayed. And, long before the September 2008 market crash, the smart money was already betting against Greenspan’s boom.

I haven’t finished Life yet, but Keith Richards appears to have survived his heroin binge. He cleaned up his act in the early 80s, married supermodel Patti Hansen and, tan and trim at age 67, now resides in Connecticut and abroad. The U.S. financial system, on the other hand, hasn’t recovered from its debt binge yet. We’re still in cold turkey, and will be for years to come.

© 2011 RIJ Publishing LLC. All rights reserved.