Conventional wisdom tells us that last winter’s collapse in equity and housing prices devastated the finances of millions of Baby Boomers and left their dreams of a secure retirement, let alone an early or ideal retirement, in tatters.

But several research studies published by authoritative sources in recent months show that the situation isn’t necessarily as dire as the mass media or the latest end-of-civilization movies like “2012” and “The Road” would have us believe.

These new studies suggest that, contrary to myth, most Boomers didn’t blow their home equity on plasma TVs, most Boomers didn’t lose most of their wealth in the equity and real estate crashes, and most Boomers will be able to retire on time or close to it.

To be sure, suffering exists. People in their 50s who lost their jobs and people who lost their homes to foreclosure face difficult futures. And if the stagflation of the 1970s returns, many of us may find ourselves clipping coupons and looking for senior discounts at theaters and restaurants in retirement.

But the data shows that most of the people that financial advisors and investment companies focus on—over 50, college-educated, and in the upper wealth tiers—came through the crash with a great deal of their wealth intact. If you count the present value of pensions and Social Security as part of household wealth, a surprisingly small percentage of anyone’s wealth is tied up in equities.

Hold the apocalypse

In their study, “The Wealth of Older Americans and the Sub-Prime Debacle,” Barry Bosworth and Rosanna Smart of the Brookings Institute start out on a somber note, saying that “no demographic group was left unscathed” by the 2008-2009 financial crisis.

But the data itself offers a less apocalyptic view. For one thing, there’s no evidence that Boomers “used their homes like ATMs.” Of the 44.9 million homeowners over age 50 in the years 2004 to 2007, 24% extracted money from their home equity.

But of the $12 trillion that their homes were worth, they extracted only $479 billion, or four percent. Almost half (45%) used the money for home improvements. Only 10% financed “consumption”—those proverbial plasma TVs—with home equity.

At the market bottom last March, Smart and Bosworth show, Americans households had lost about a quarter of their wealth. But, even before the upturn, the households that advisors and financial services companies focus on—college-educated people over age 50 and in the upper-third of wealth ownership—still had significant wealth.

If housing wealth and the present value of Social Security and pensions are included, older, wealthier households had average wealth of $1.33 million at the market bottom. That’s down from $1.77 million in 2007, when real estate and stock market values were inflated, but it’s far from total ruin. In real terms (2000 dollars), this segment had almost twice as much wealth in 2009 as in 1983.

If housing wealth and the present value of Social Security and pensions are included, older, wealthier households had average wealth of $1.33 million at the market bottom. That’s down from $1.77 million in 2007, when real estate and stock market values were inflated, but it’s far from total ruin. In real terms (2000 dollars), this segment had almost twice as much wealth in 2009 as in 1983.

By contrast, younger, middle-market people fared worse. That happened not because they lost money in the stock market; they don’t own many stocks. It happened because they were more likely to have purchased homes more recently and had less home equity.

Households headed by someone under age 50 in the middle-wealth tercile, for instance, lost 41% of their wealth in the crash. The average wealth of that group—including housing and the present value of public and private pensions—fell to $45,000 in 2009 from $76,000 in 2007 (in 2000 dollars).

“The percentage losses are larger for younger than for older households,” commented Bosworth and Smart. “The larger loss among younger families is concentrated in housing wealth, which reflects their lower ratio of home equity to value. Thus, a 20% loss in home value became a 45% loss in home equity. Older households have a larger equity position and that translates into a smaller 30% loss of housing wealth.

“[We found] that the losses have been larger for younger households and that less-educated and lower-income households below age 50 have suffered particularly large declines in wealth,” they added. “Younger middle-income households show the largest losses, 40%, because their wealth holdings are dominated by housing with a low equity share, and reliance on defined-contribution retirement accounts, which also were hard hit by the fall in equity prices.”

Averages can mislead

In a similar analysis of the impact of the Great Crash, economists at Dartmouth College and Texas Tech University delve below the statistics on average market losses and show that, although stock ownership in U.S. is highly concentrated among the wealthiest Americans, even they don’t have very much of their household wealth tied up in equities. As a result, the crash by itself shouldn’t ruin their ability to retire as planned.

Looking at the distribution of assets in 2006 of households with at least one member born from 1948 to 1953 (excluding the top one percent, which skews the averages upward), the study showed that on average the households held $115,400 in stocks and that 13.2% of their total wealth (including homes and present value of Social Security and retirement benefits) was invested directly or indirectly in stocks.

But the averages are misleading. The richest nine percent of this group had an average of $561,000 in stocks (8.4% directly and a total of 20.7% if retirement plans are included) while those in next wealthiest decile averaged $237,000 in stocks (5.1% directly and 15.1% overall). No other group had more than 2.6% of their wealth invested directly in stocks.

“We find those nearing retirement had only limited exposure to the stock market decline,” say the authors of “How Do Pension Changes Affect Retirement Preparedness? The Trend to Defined Contribution Plans and the Vulnerability of the Retirement Age Population to the Stock Market Decline of 2008-2009”.

“When direct stock holdings, and stock holdings in IRAs, are added to stock holdings in DC plans, in 2006 total stock holdings of the early boomer cohort averaged 13.2 percent of total wealth. This greatly limits the direct exposure of the early boomer population to the decline in the stock market,” they add. “We also show that as a result, despite speculation to the contrary, those approaching retirement are not likely to substantially delay their retirement in reaction to the stock market decline, probably postponing their retirement by no more than a couple of months.”

Equities and retirement

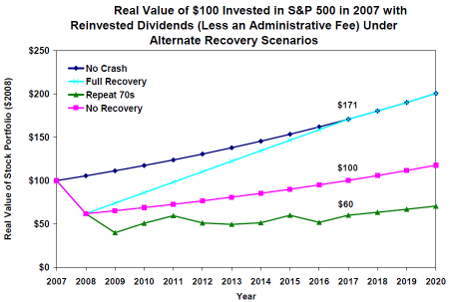

In a new paper, “Retirement Security and the Stock Market Crash: What Are the Possible Outcomes,” three Urban Institute researchers take the analysis a step farther and compare how early, middle and late Boomers might fare under a variety of stock market scenarios over the next decade or so.

The authors, Barbara A. Butrica, Karen E. Smith and Eric J. Toder, compare several alternative futures for the economy, including a “no recovery” scenario where stocks resume their historical growth from a low, post-crash base; a “full recovery” scenario where stocks make up all their 2008 losses by 2017; and (the worst case scenario) a repeat of the 1970s.

Future market behavior, they find, will mainly affect people who own a lot of stocks, which means those with highest incomes and the most education. If there’s no recovery, those in the top wealth quintile who were born between 1951 and 1955 can expect an 11% drop in income by the time they reach age 67. If there’s a repeat of the 1970s, their retirement incomes could fall 20%. That’s about double the impact on any other group.

“Major income losses from the crash are concentrated among high income groups who own the most stocks. Pre-boomers will on average be worse off, regardless of whether or not the market recovers. Middle and late boomers will also be worse off on average if the market fails to rebound to its previous growth path, but may be net winners if the market drop is temporary and they can benefit from the opportunity to buy low and sell high,” the Urban Institute researchers said.

“Another year of work, however, virtually eliminates any big losers among individuals in the bottom three quintiles in the middle and late boomer cohorts,” they added. “Because low-income individuals receive a relatively small share of their retirement income from DC plans assets and other financial wealth, working another year wipes out most of any losses that they might have sustained, even if the market fails to recover or continues to decline as it did after 1974.”

What’s the big lesson of this research? Most Boomers in higher income groups still have enough pension, housing, and stock market wealth to be able to retire with no dramatic reduction in income, barring anything but an extended bear market in stocks. Those who are most exposed to stock market losses are also the most well-equipped to withstand them.

There’s plenty of pain, particularly among people who have lost their jobs and those who lost their homes. But, generally, as long as there are enough jobs and as long as Social Security is funded, most people will retire as planned. By and large, American retirement doesn’t rest on equities.

© 2009 RIJ Publishing. All rights reserved.