When you shop for a new car, what are your criteria? The manufacturer’s reputation? The model or style of the vehicle? Its main function or purpose in your life? The proximity of the dealer? Or maybe you already have a specific automobile in mind.

Your inquiries wouldn’t stop there. You’ll want to know, for instance, what Consumer Reports or the Kelly Blue Book says; whether a car is likely to perform as expected and hold its value; which dealers provide affordable, get-it-right-the-first-time service.

Annuity shopping isn’t so different from car shopping, except that, as an adviser, you’re shopping for a client, not for yourself. And, as an adviser, if you’re not affiliated with a life insurance carrier, a broker-dealer or an insurance marketing organization (IMO), you might be doing the due diligence on your own.

In this article, we’re talking about finding a life insurer that issues annuities, not about choosing a specific product. At this point in the process, we assume you’re looking for transparency, predictability and great service rather than a specific product’s price, yield, monthly payout or the size of the commission you might receive.

Maybe you’ve never driven down “annuity road” before. With more investors asking safe retirement income or downside protection, and with annuity issuers now offering more fee-based products to Registered Investment Advisors (RIAs), many advisers find themselves grappling with annuities for the first time.

If you’re new to the annuity world, your initial questions might include:

- What does the client need?

- Which life insurers specialize in which annuities?

- What life insurers are safest to invest with?

- What about those ‘platforms’?

- Who offers product comparison tools?

In this primer on choosing an annuity provider and a contract, we’ll briefly answer these questions. The challenge can be both simple and complex, but there are rules of thumb. As annuity guru Sheryl Moore, CEO of Winkintel.com, put it, “First, do your due diligence on the company, on their financials, and on their management. Then, do due diligence on how they treat their in-force clients and business. Only then should you look at their product offerings.”

What does the client need?

Annuity research starts with the client. Since there are at least five or six types of annuities, you’ll first have to figure out what kind of annuity a client needs and what function it will serve in his or her life. (This assumes that you put clients’ interests first and that you don’t represent one carrier or specialize in one type of contract.)

So, before you worry about which carrier is “best,” you’ll need to find out why your client needs an annuity. For instance, does he or she need it for guaranteed retirement income, for tax deferral, for accumulation with protection against loss, for a savings goal within a 10-year time horizon, or as a hedge against long-term care expenses?

“The first order of business is, ‘Does the insurer have the product I’m looking for? If you’re looking for lifetime income, for instance, you’ve already narrowed the field,” said Louis Harvey, president and CEO of DALBAR, which evaluates providers of financial services.

Which life insurers specialize in which annuities?

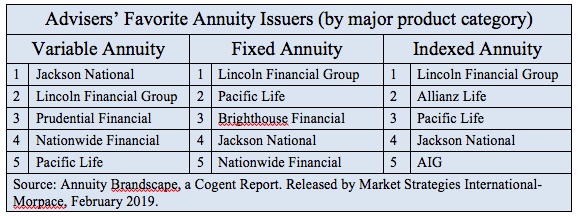

Many of the largest multi-line insurance companies, like Nationwide, Jackson National, AIG, MassMutual, Principal, Pacific Life and Lincoln Financial—offer a range of fixed, variable and indexed annuities. These are among the annuity issuers most popular with advisers. (See chart below from Cogent Research.)

Generally speaking, mutual life insurance companies, which are owned by their policyholders and whose products are more likely to be sold by career agents and advisers, tend to offer simpler, more transparent products than do publicly traded life insurance companies.

For instance, if you’re looking for a fixed deferred annuity or a simple income annuity, New York Life, Northwestern Mutual, Guardian, and MassMutual, all of which are mutual companies, should be in your search. If you’re looking at companies that have specialized in variable annuities, you’ll find Jackson National and Prudential at the top of the sales charts.

Similarly, there are clusters of companies that specialize in fixed indexed annuities (Allianz Life, Athene, Great American, American Equity), in structured or “buffer” annuities (AXA, Brighthouse, CUNA Mutual), in medically underwritten annuities (Mutual of Omaha), or in the newer fee-based, no-commission annuity contracts for RIAs (see “Platforms” below). Once you decide on the kind of contract your client needs, the search for a carrier gets narrower, especially if your search criteria include high sales volume and high strength ratings.

Which life insurers are safest to invest with?

Short answer: All of the “A” rated ones, and maybe even some of the Bs.

To a degree that sometimes mystifies insurance industry veterans, investment-oriented advisers seem to have an exaggerated sense of the financial fragility of large life insurance companies and their risks of becoming insolvent or failing during the life of an annuity contract.

Luckily, the financial strength rating of a life insurance company is easy to find. Just go to their website and click to the Ratings or Investors section. There you should find the strength ratings assigned by the four major rating agencies, which include A. M. Best (the insurance specialist), Standard & Poor’s, Moody’s, and Fitch Ratings.

You won’t usually find Weiss Ratings cited there, but it’s worth checking out. Founder Martin Weiss suspects that the major ratings agencies have indulged in some grade inflation, and he reserves his A+, A and A- ratings mainly for big mutual life insurers and mutual-like companies.

According to the Weiss website (by subscription fee), these include TIAA, MassMutual, State Farm, New York Life, Pacific Life and Guardian. Since they don’t have to impress Wall Street analysts with quarterly performance data, mutual companies can afford to hold higher levels of reserves than publicly traded companies. Weiss rates not only by letter but also by color, and it recommends carriers at the A+ through B- levels.

To learn more about a life insurer, you might call David Paul or Dan Hausmann at ALIRT. This insurance research firm digs down into the financials of the insurance holding companies, looking at not just the parent companies but also each subsidiary life insurer. If you buy a contract from a subsidiary, the ratings of the parent might not completely apply.

“We have a scoring system that shows trends over time,” Paul told RIJ in an interview. “We’re in a period when these subsidiaries are changing ownership like crazy. And their ratings can drop when the umbrella of a holding company isn’t there anymore. We look well below the level of the parent.”

When comparing the yields of fixed annuities, advisers will notice that the B rated companies typically offer higher yields than A rated companies. According to Paul, an adviser shouldn’t necessarily rule out investing in a B life insurer, especially for a contract that will be held for only three to seven years.

“A lot of people dismiss them out of hand, but some are well-run and quite solvent. If you looked at an ALIRT analysis, you might see that they have strong risk-adjusted capital levels. They might be a small or regional company that doesn’t necessarily want to qualify for higher ratings,” he said. “Keep in mind that, if you’re talking about a five-year MYGA (multi-year guaranteed-rate annuity), the risk of a company getting into trouble during that time is pretty low.”

Strength ratings won’t tell you much about a life insurer’s annuity service quality, however. “When we work with reps on selecting an index annuity carrier, the newcomers usually ask, ‘Is this B or B+ rated carrier safe?” said Jon Legan, vice president of AnnuityRateWatch.com, in an interview. “The more seasoned folks look at the processes: Is it easy to do business with this carrier? The tough part is that you don’t really know until you work with a carrier how easy or hard it will be to work with them.”

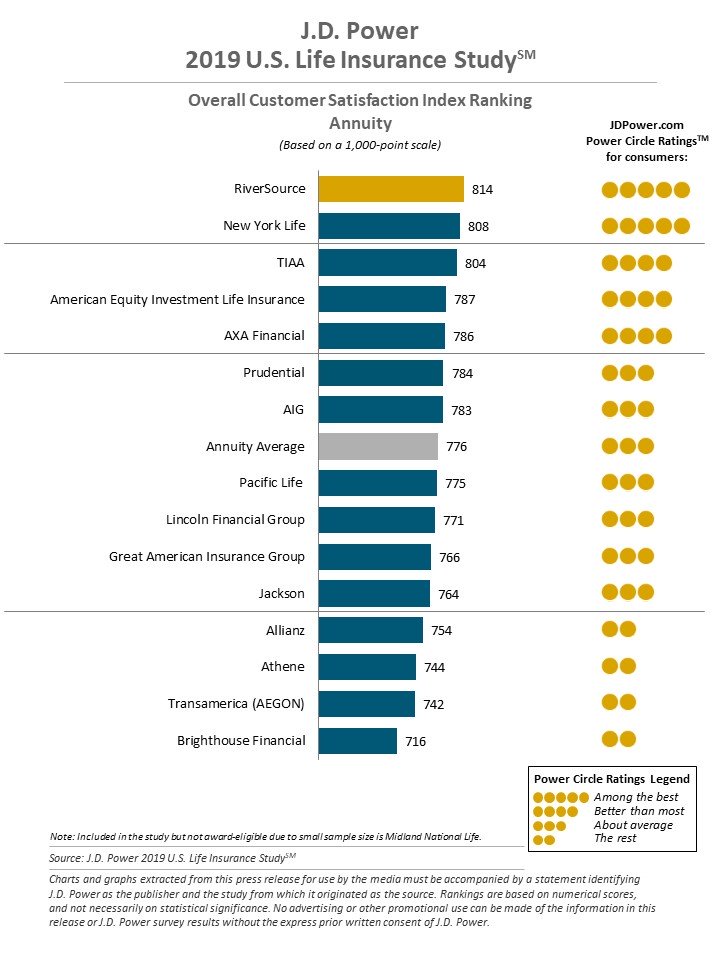

J.D. Power’s 2019 U.S. Life Insurance Study includes an “Overall Customer Satisfaction” ranking for annuities. (See below.) Interestingly, each of the top five companies concentrates on a different segment of the annuity market. Generally, RiverSource is associated with individual variable annuities, New York Life with fixed and income annuities, TIAA with group variable annuities, American Equity with indexed annuities, and AXA with structured or “buffered” annuities.

What about those ‘platforms’?

“Curated” is a popular word today. It means “selected, organized and presented using professional or expert knowledge.” There are now several online platforms where a fee-based advisers can go to find lists of pre-screened annuities for direct purchase.

At the Fidelity Investments website, visitors can view and compare life insurers and annuity contracts that Fidelity considers best-in-class. Interestingly, Fidelity lists only one of its own products, a low-cost deferred variable annuity called the Fidelity Personal Retirement Annuity.

The site also offers a New York Life variable annuity with a guaranteed minimum accumulation benefit, the New York Life Clear Income Annuity (a fixed deferred annuity with a lifetime withdrawal benefit), and income annuities from Guardian, MassMutual, Principal, New York Life, and Western & Southern.

Several other platforms specialize in selling annuities and life insurance to fee-based advisers, including those not insurance-licensed. One of these is RetireOne, which offers annuities from Allianz Life, Ameritas, Great American, Great-West, Jackson National, Symetra, TIAA, and Transamerica.

Another new platform for indexed annuities, also aimed at fee-based advisers, is DPL Financial Partners, which offers products from Allianz Life, Ameritas, AXA, Great American, Great-West, Integrity, Jackson National, Lighthouse Life, Lombard International, and Security Benefit. Other platforms that aim to make it easy for RIAs to integrate annuities into their overall financial plans include Envestnet and Orion Advisory Services.

For individuals and advisers who would like select life insurers to bid for their annuity business, there’s Income Solutions, a web platform run by the Hueler Companies in suburban Minneapolis. Founder Kelli Hueler wanted to give investors an information advantage by making annuity issuers compete against each other to offer the most competitive payout rate. Companies currently offering immediate and deferred annuities on the platform include the Integrity Companies, Lincoln Financial, Mutual of Omaha, Nationwide, and Symetra.

Who offers product comparison tools?

Once you know the product type you’re looking for and selected the suitable life insurers, you still face the chore of comparing, contrasting and choosing specific contracts. Given the many types of riders and levels of fees, even on the same type of annuity from the same company, you may find it difficult to make apples-to-apples comparison.

Cannex, Beacon Research, and Wink are leading sources of annuity sales and/or contract data. Cannex offers its subscribers a tool for comparing variable annuity contracts with each other or index annuities to each other. Its Income Annuity Exchange supplies comparative quotes and illustrations to distributors and services providers for deferred or immediate income annuities.

On Wink’s website, you can find an alphabetized list of dozens of annuity companies, with a link to each. Wink’s AnnuitySpecs service provides product-level data on virtually all annuity products, including riders, along with tools for comparing and evaluating them.

Another company in that space, Beacon Research/AnnuityNexus.com, provides comparative data on fixed rate, indexed and variable annuities to annuity issuers and distributors. As mentioned above, there’s also AnnuityRateWatch.com, which provides advisers, brokers, banks, insurance marketing organizations and carriers with data on fixed and indexed annuities and their riders.

Immediateannuities.com is a logical (and free) first stop for retail income annuity shoppers who are looking for instant rough payout rates as well as lists of issuer-by-issuer quotes or who want to be referred to an insurance-licensed agent to execute an annuity purchase. Its data comes from Cannex.

Here are two more examples of companies in the annuity comparison business: Ebix, which offers a VitalAnnuity tool, and Capital Rock, which offers a proprietary comparison tool called RightBRIDGE Annuity Wizard.

VitalAnnuity is software that compares fixed annuity quotes and information to find the best or most appropriate rates and options for a given client. It gets its data from Beacon Research, which verifies product data provided by the carriers.

Through VitalSigns, an Ebix service, you can get the Comdex scores of life insurance companies. The Comdex score takes a company’s letter ratings from A.M. Best, Moody’s, Standard & Poor’s, and Fitch Ratings and averages them to a single number. The Comdex number makes comparisons between companies more accurate.

RightBRIDGE is a “systematic process to help advisors select and/or validate the best product types and products for each individual client’s needs and preferences,” according to the CapitalRock website. It uses a scoring engine and proprietary analytics to “explain why a profit fits a client’s needs.”

(See related story on today’s homepage, “Five Questions to Ask about an Annuity Issuer.”)

© 2019 RIJ Publishing LLC. All rights reserved.