The scene of the Occupy Wall Street demonstration at Zuccotti Park in lower Manhattan on October 10 was a flash from the past to anybody who participated in similar events during the late 1960s and early 1970s.

The denim-wearing crowd, the scent of incense, the hand-lettered signs, the anomaly of bare breasts in broad daylight and the incredible lightness of civil disobedience—all recalled the rock concerts, sit-ins and nude beaches of 40 years ago.

But, if they really wanted to up-the-establishment, these avatars of protests-past might have picked a different place to camp out. As I learned the following day at The Big Picture Conference in midtown Manhattan, most of the trading that once occurred at the Stock Exchange now happens on high-speed servers in Mahwah, NJ, 35 miles north of Wall St.

At the conference, the speakers were even more pointed in their complaints about the financial system than the protesters, and their comments were more sobering than a dozen AA meetings. Sponsored by Barry Ritholz, a money manager who publishes The Big Picture financial website, the conference showcased the a series of experts—a gold bug, a technical analyst, consultants to institutional traders—who led the audience of 300 or so through a litany of numbing factoids and predictions.

The gold bug

For instance, Paul Brodsky of New York-based QB Asset Management predicted that the price of gold was currently selling at about an 80% discount and that it would eventually top out at about $10,000 an ounce.

This figure, which Brodsky called the “shadow price” of gold, comes from dividing the current outstanding amount of public and private debt dollar-denominated ($52 trillion) by the current level of gold in the world. (He did not say why such a relation between the dollar and the price of gold should exist or be expected, however.)

“That’s the realistic value of gold—if there is no more money printing,” Brodsky said. “In 1980, the shadow price was under the market price. Today it’s much higher than the market price.”

Brodsky, a self-professed gold bug, believes that the only politically acceptable way to solve our debt crisis will be through inflation, and he thinks the country will move back to a quasi-gold standard where the government will redeem gold at $10,000 an ounce.

He sees the end of the dollar’s reserve currency status in the near future. “There’s a rotating debasement of currencies that presages the end of a currency regime,” Brodsky said. “It happened in 1945 and in 1971 and it may be happening now. Baseless currencies have all gone away and so shall this one. We’re on the cusp of a change in the global monetary system.”

The Fed’s rescue of the private financial system bought time but solved nothing. “The economy can’t be deleveraged by shifting private debt to government balance sheets,” Brodsky said.

The HFT watchers

If Brodsky’s numbers were scary, Sal Arnuk and Joe Saluzzi of Themis Trading offered even more worrisome descriptions of the damage that high-frequency traders (HFT) are doing to the financial system today.

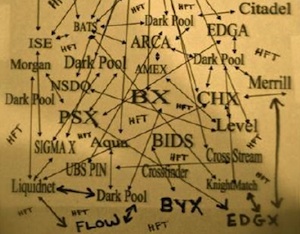

The two men, who are consultants to institutional investors, explained that HFTs are using phenomenal computing speeds and program trading to take advantage of arbitrage  opportunities in what has become a highly fragmented trading world. (The illustration at right is their informal map of the many platforms on which equities are traded throughout the U.S. today.)

opportunities in what has become a highly fragmented trading world. (The illustration at right is their informal map of the many platforms on which equities are traded throughout the U.S. today.)

The exchanges, including the New York Stock Exchange, now make money selling “enriched data feeds” and renting server space to HFTs who trade micro-seconds ahead of other market participants. “They can re-engineer the national best bid/offer. They see the future. That’s risk-free arbitrage,” Arnuk said.

“Some of the more nefarious players flood the an exchange to slow it down and arbitrage [the difference] away. It scares us,” said Arnuk. “Our market has been hijacked by conflicted interests,” added Saluzzi.

Advising members of the audience never to place a market order, the two men warned that, thanks to program trading by HFTs, an even bigger “flash crash” than the one that occurred last May is likely. “HFTs will supply liquidity in a monsoon and take it away in a drought,” Saluzzi said.

Two percent of the trading firms now account for 80% of the volume on the exchanges today, they said. They called for a series of reforms: speed limits on trading velocity, limits on leverage, limits on data distribution, fees for order cancellation, fees for high usage of the exchanges, and perhaps “separate highways” for HFTs and regular investors.

The technical analyst

A third presenter, James Bianco of Bianco Research, estimated the chance for a new recession at “better than 50%,” based on the fact that, three years after the financial crisis, the system is more leveraged than it has ever been.

The Fed’s policy of converting private sector debt into public sector debt had the immediate effect of stemming panics and preventing defaults, but it hasn’t helped extinguish any debt or put the economy on a sound footing.

“What deleveraging has occurred? Total debt is again very close to a new nominal high. There has been no deleveraging. Total debt is higher than it was at the end of the ‘Great Recession’,” he said. “You cannot cure a debt problem with more debt. You can make it better for awhile. We did that. Now we are back to having too much debt in the form of government debt, which is why the U.S. is getting downgraded and Europe’s yields are soaring.”

“If the economy goes into recession, earnings forecasts are not 10% to 12% too high. Instead they might be 20% to 40% too high. In other words, if the economy goes into recession, the earnings forecasts are horribly wrong. They might be so wrong that one can make the case that the market might be overvalued,” Bianco added. “We believe this is in part what is bothering the markets, the epiphany that the economy is much weaker than expected and a recession will blow a hole in earnings forecasts to the point that the market might not be cheap anymore.”

Meanwhile, back at Zuccotti Park

Although they were far more informed and articulate than the motley demonstrators at Occupy Wall Street, the speakers at The Big Picture Conference were, in their own way, just as angry and just as alarmed about the current state of the economy.

The Occupy Wall Street phenomenon has probably not turned violent so far—in the U.S. at least—because it has found so little opposition. The demonstrators appear to be voicing emotions and opinions that a majority of Americans share. (It’s significant that the recent eviction or “clean-up” effort was called off after confrontations became more physical.)

On the day I visited Zuccotti Park, a youthful-looking man in a well-tailored charcoal-grey suit who said he was 60 years old was standing by the steps to the Trinity Building, about a block and a half or so south of the park. When asked what he thought of the sit-in, he said, “I think it’s great. It’s about time we’re seeing something like this.”

© 2011 RIJ Publishing LLC. All rights reserved.