When a spouse dies during retirement, the loss deprives the widow or widower of love, support and companionship. It also deprives the the survivor of a second Social Security payment and sometimes part of a pension, shrinking the survivor’s income.

Advisers who work with older couples, especially couples who expect to rely heavily on Social Security and pensions for retirement income, are in a position to help them anticipate this risk and prepare for it.

At Wealth2k’s IFLM 2019 conference in Boston last month, Zach Parker, vice president of wealth management and product strategy at Securities America, the 2,500-adviser brokerage and advisory firm, presented a work-in-progress retirement income plan for just such a couple, using the IFLM (Income for Life Model) “bucketing” software.

Parker

The bucketing or “time-segmentation” method involves dividing a client’s retirement into periods of five to 10 years each. Monthly income during each segment is funded by a designated bucket of assets, which is liquidated and invested in short-term securities when its segment starts.

Academics sometimes describe bucketing as a “mental accounting” gimmick that requires frequent revisions and creates timing problems. That is, as clients age from segment to the next, like canal boats moving up a series of locks, the transitions won’t necessarily align with market conditions. But advisers who use bucketing say that it can make the future seem less uncertain and less daunting, especially for “constrained” retirees who are at risk of running short of income.

Herb and Gigi

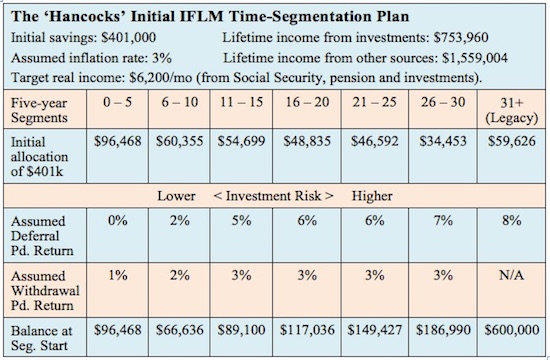

Parker’s case study was based on a real couple, both 60 years old, whom he calls “Herb and Gigi Hancock.” The Hancocks have saved $401,000, of which $340,000 is in qualified or pre-tax accounts. Herb was recently laid off from his job of many years. Gigi expects to work part-time for five more years.

The Hancocks’ guaranteed income sources in retirement include Herb’s pension of $3,102, his Social Security ($2,150 at age 65), Gigi’s Social Security ($1,200 at age 65). Gigi expects her job to net about $1,000 a month.

The Hancocks tell their adviser that they’ll need a gross real income of $6,200 each month to cover their essential expenses in retirement. They also aspire to leave a $600,000 legacy to their 32-year-old daughter.

Gigi and Herb are young enough to work for a few more years and delay claiming Social Security. They could also mobilize the equity in their home. But they ask their adviser for a plan under which Herb could retire right away, allow Gigi to retire in five years, and that wouldn’t dip into their home equity.

At first glance, barring catastrophe, the Hancocks’ vision of a secure retirement looks achievable. Over the first five years of retirement, their income from earnings and pension will be about $4,200, plus income from spending the $96,000 in their first bucket. Starting in the sixth year, they will receive $3,350 from their combined Social Security benefits plus Herb’s pension plus income from the investments in the second bucket. And so forth.

Their adviser uses IFLM software to create a preliminary plan that assigns their savings to six five-year buckets plus a seventh, legacy bucket. The segments look like this:

How does this compare to a 4%, inflation-adjusted withdrawal from a $401,000 total-return balanced mutual fund portfolio. Four percent times $401,000 is about $16,000 or $1,333 per month. If they don’t touch the $60,000 in the legacy fund, they would have an investment base of $340,000, yielding $13,600 per year or $1,133 per month. So the 4% method may not be attractive for this couple, especially if it require austerity measures during market downturns.

Mind the gap

But retirement is predictably unpredictable. The adviser alerts the Hancocks to the possibility that Herb might very well predecease Gigi during retirement. Since the survivor’s benefit of Herb’s pension is 50%, Gigi’s benefit would be only $1,551. Gigi would also lose her Social Security benefit when she stepped up to Herb’s. So her monthly income from guaranteed sources would shrink by about 43%.

How can the Hancocks deal with that possible shortfall? In Parker’s retelling of the case, the adviser at first suggests that the Hancocks buy $500,000 worth of life insurance on Herb. If Herb dies very early in retirement, for instance, Gigi would have $900,000 in savings to generate income in addition to her Social Security widow’s benefit and half of Herb’s pension.

Herb objected to that specific proposal, Parker said. He notes that if he lives to a ripe old age, then life insurance premiums will simply reduce the couple’s disposable income in retirement. The adviser then looks for a compromise between those two choices, and recommends the purchase of $267,000 worth of life insurance coverage.

Since the longer Herb lives, the less Gigi will need to make up her loss of his benefits, the adviser suggests a “staged term insurance/guaranteed universal life strategy.” It would give Gigi a benefit of $275,000 if Herb died during the next 20 years (based on the purchase of $150,000 worth of guaranteed universal life insurance and $125,000 worth of renewable term life on Herb for 20 years), after which the benefit would drop to $150,000. Parker estimated the cost of the insurance at about $400 per month.

Unknown unknowns

Retirement income planners often recommend life insurance for wealthy retirees as an estate-planning and tax-planning tool. But in the Hancocks’ case demonstrates a potential use for life insurance in a mass-affluent retiree’s income plan.

Before completing their plan, the Hancocks will inevitably need to contemplate more tactics and more risks. For example, they may decide to take more investment risk, mobilize their home equity as a first or last resort, reduce their legacy goal, or buy long-term care insurance.

In the income planning process, retirees must prepare for the expected and the unexpected—the “known knowns, the known unknowns, and the unknown unknowns,” as a former U.S. defense official famously said. Whatever a retiree’s initial plan might be, advisers know that it will need to be adjusted, perhaps many times. That’s what makes retirement income planning complex, challenging, and essential.

You can find previous case studies in this series here and here.

© 2019 RIJ Publishing LLC. All rights reserved.