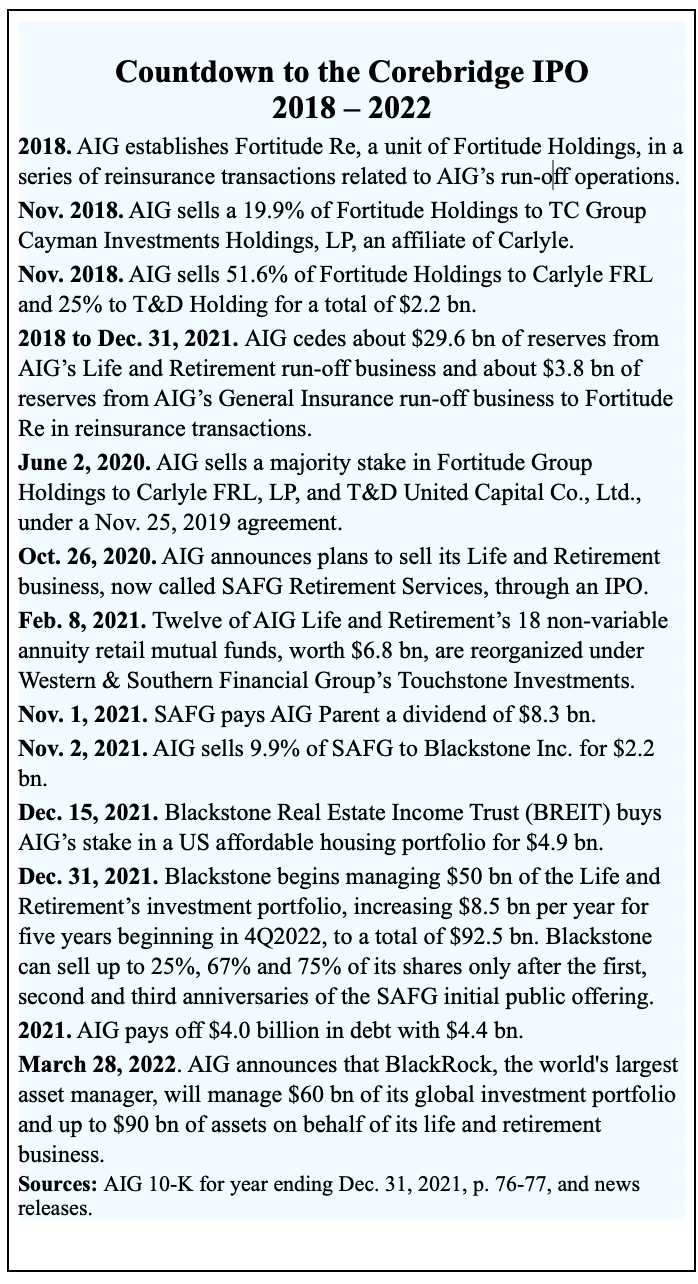

With the collaboration of private equity firms and a Bermuda-based reinsurer, American International Group (AIG) will soon spin off its $410 billion Life & Retirement division into Corebridge Financial, a new entity to be financed in an initial public offering. AIG expects an IPO this quarter, pending approvals.

It’s a launch that exemplifies what RIJ defines as the “Bermuda Triangle strategy,” in which private equity firms become involved in the US annuity business as strategic partners or owners of life/annuity and reinsurance companies in order to manage their annuity assets—which represent the retirement savings of millions of Americans.

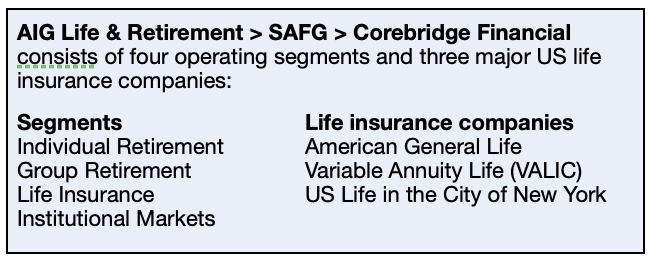

In this case, the entities collaborating to give birth to Corebridge Financial bring expertise in one or more corners of the triangle. The primary life insurers inside Corebridge are AIG’s American General and VALIC; The asset managers are Blackstone and BlackRock. The Bermuda-based reinsurer is Fortitude Re. These strategic partners have interlocking parts.

In this case, the entities collaborating to give birth to Corebridge Financial bring expertise in one or more corners of the triangle. The primary life insurers inside Corebridge are AIG’s American General and VALIC; The asset managers are Blackstone and BlackRock. The Bermuda-based reinsurer is Fortitude Re. These strategic partners have interlocking parts.

Corebridge will be majority-owned by AIG, and run by the same SAFG’s CEO, Kevin Hogan. Blackstone owns 9.9% of Corebridge. Blackstone and BlackRock have agreements (see below) to manage hundreds of billions of dollars for Corebridge. Carlyle is the majority owner of Fortitude Re, having acquired it from AIG in transactions that began in 2018.

To remain a leader in the fixed annuity business, AIG may have had little choice but to follow this path. Corebridge is likely to have enough heft, expertise and scale to compete against the retirement services businesses of Apollo Management’s Athene, KKR’s Global Atlantic annuity business, and other private equity/life insurance combinations with similar structures.

Kevin Hogan, CEO of Corebridge Financial

Recently, MassMutual announced the creation of its own triangle. In the past two years, MassMutual acquired fixed indexed annuity (FIA) issuer Great American and helped start Martello Re in Bermuda. It is partnering with Centerbridge Partners as its alternative asset specialist. Smaller players, like Midwest Holdings, are also in the hunt.

The rivals in the fixed annuity space are all vying for a chunk of the trillions in Boomer savings. As AIG put it in the SAFG S-1 filing for the IPO: “There were about 56 million Americans age 65 and older in 2020, representing 17% of the US population. By 2030, this segment… is expected to increase by 17 million, or 30%, to 73 million Americans representing 21% of the US population.” They’re also competing to sell multi-billion dollar group annuities to corporations that want to cash out of their defined benefit pensions, a business known as “pension risk transfer.”

The Bermuda Triangle strategy, though complex, offers valuable synergies to its practitioners and their investors. Generally speaking, the life insurer sells long-dated annuities, gathering money much as a bank sells certificates of deposit. A substantial portion of this “permanent capital” may be managed by the asset managers, who lend it to relatively high-risk borrowers and bundle the loans, in some cases into collateralized loan obligations (CLOs) for sale to institutional investors.

All or part of the annuity liabilities are passed to one or more reinsurers (typically in favorable regulatory jurisdictions), which send “reserve credits” back to the life insurer, lightening the life insurer’s capital requirements. If all goes perfectly to plan, these measures give life insurers higher yields on their investments, enabling them to post higher profits, pay higher commissions to insurance agents, and offer higher crediting rates to annuity buyers. At the same time, asset managers earn fees on hundreds of billions of dollars of new assets. Direct investors in the life insurer, in the asset managers, and in the insurer all benefit as well.

But, as always in high finance, there are risks. Expressing concern about a complex strategy that brings hundreds of billions of dollars of Boomer savings under the management of a handful of immense asset managers, Sen. Sherrod Brown (D-OH), chairman of the Senate Banking, Housing, and Urban Affairs Committee, last week formally asked the Federal Insurance Office and the National Association of Insurance Commissioners (NAIC) to furnish his committee with answers about the possible effects of this concentration on the overall financial system.

Many publicly traded life/annuity companies that sold high volumes of annuities between about 2005 and 2015 have either withdrawn from the annuity business or retooled their retirement products groups. Hartford, AXA, ING, got out of the individual annuity business. MetLife spun off its life and retirement businesses as Brighthouse Financial in 2017. At the same time, private equity-owned life insurers have entered the annuity business, primarily selling fixed indexed annuities.

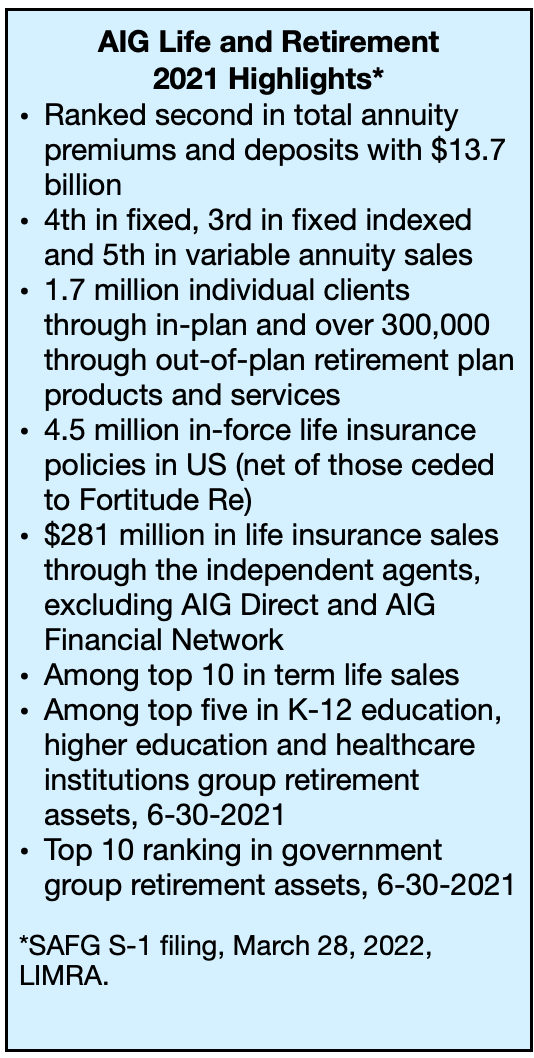

AIG Life & Retirement collected $13.7 billion in individual annuity premium in 2021 and $19.2 billion in total annuity considerations, according to the NAIC and AIG. That was second only to Apollo Global Management’s Athene Life, with $23.1 billion in individual and group annuity premiums, and Jackson National Life, with $19.6 billion in premiums, last year. (In mid-2020, Jackson National sold $27.6 billion in fixed and fixed indexed annuity business to Athene Holding.)

AIG Life & Retirement collected $13.7 billion in individual annuity premium in 2021 and $19.2 billion in total annuity considerations, according to the NAIC and AIG. That was second only to Apollo Global Management’s Athene Life, with $23.1 billion in individual and group annuity premiums, and Jackson National Life, with $19.6 billion in premiums, last year. (In mid-2020, Jackson National sold $27.6 billion in fixed and fixed indexed annuity business to Athene Holding.)

Last Monday, AIG announced that BlackRock, Inc., the world’s largest asset manager, would manage as much as $150 billion of the insurer’s assets. Under a separate, prior agreement, Blackstone entered into a “long-term strategic asset management relationship” to manage an initial $50 billion of AIG Life and Retirement portfolio, and as much as $92.5 billion within six years.

AIG’s restructuring has been in the works for about four years. Last October, the global multi-line insurer announced its intention to sell AIG Life & Retirement, which has about $410 billion in assets under management, through an IPO. This week, Corebridge Financial was revealed as the new entity’s brand name.

The size and price of the Corebridge share sale are yet to be determined, according to AIG’s SEC S-1 filing about the IPO, which indicated the business had total equity of $28.9 billion as of the end of 2021. An estimate of the IPO value, based on Blackstone’s $2.2 billion payment for 9.9%, is over $20 billion, according to press reports.

Six directors will be senior executives of AIG, according to a release this week. The CEO of Corebridge Financial will be Kevin Hogan, the current CEO of AIG Life & Retirement. According to SAFG’s March 28 S-1 filing:

“Following this offering, AIG will continue to hold a majority of our outstanding common stock, and as a result AIG will continue to have control of our business… In addition, Blackstone will have corporate governance, consent and information rights with respect to us under the Blackstone Stockholders’ Agreement.”

AIG Life and Retirement includes American General Life ($221 billion in assets), Variable Annuity Life Insurance Company (VALIC; $96 billion), US Life Insurance of the City of New York, and SunAmerica Asset Management (SAAM). American General alone reported individual annuity sales of more than $12 billion in 2021, making it one of the largest custodians of Americans’ retirement savings.

This week, AIG announced that Corebridge intends to offer senior unsecured notes. “The Notes will be offered in a private offering,” AIG said in a release, “exempt from the registration requirements of the US Securities Act of 1933, as amended.”

Peter Zaffino, AIG’s chairman and CEO, will serve as chairman of Corebridge Financial, and the board will include the following independent directors:

- Alan Colberg, retired CEO, Assurant, Inc.

- Christopher Lynch, former National Partner in Charge of KPMG LLP’s Financial Services Line of Business

- Amy Schioldager, former Senior Managing Director and Global Head of Beta Strategies at BlackRock, Inc.

- Trish Walsh, Chief Legal Officer, Stripe, Inc.

Jonathan Gray, President & Chief Operating Officer, Blackstone, Inc., joined the board in November 2021 following Blackstone’s 9.9% July 2021 equity investment in AIG Life & Retirement. Kevin Hogan, as CEO of Corebridge Financial, is also a member of the Board.

Corebridge plans to list its shares on the New York Stock Exchange under the symbol CRBG. JPMorgan Chase & Co., Morgan Stanley and Piper Sandler are leading the share sale.

© 2022 RIJ Publishing LLC. All rights reserved.