A 4% starting withdrawal rate, with annual inflation adjustments to that initial dollar amount thereafter, is often cited as a “safe” withdrawal system for new retirees. Financial planner Bill Bengen first demonstrated in 1994 that such a system had succeeded over most 30-year periods in modern market history, and in the nearly 30-year time period since Bengen’s research, a 4% starting withdrawal rate would have been too modest.

But is such a withdrawal system safe today, given the confluence of low starting bond yields and equity valuations that are high relative to market history?

That’s what I explored with my colleagues John Rekenthaler and Jeffrey Ptak in “The State of Retirement Income: Safe Withdrawal Rates.” Using forward-looking estimates for investment performance and inflation, we estimate that the standard rule of thumb should be lowered to 3.3% from 4.0%, assuming a balanced portfolio, fixed real withdrawals over a 30-year time horizon, and a 90% probability of success (that is, a high likelihood of not running out of funds over the time horizon).

This should not be interpreted as recommending a withdrawal rate of 3.3%, however. That’s because the previously mentioned assumptions that underlie the withdrawal-rate calculations—a long time horizon, a fixed real withdrawal system, and high odds of success—are conservative.

Nevertheless, given current conditions, retirees will likely have to reconsider at least some aspects of how they define their “safe” withdrawal rate to make their assets last. Our research finds that retirees can take a higher starting withdrawal rate and higher lifetime withdrawals by being willing to adjust some of these variables–tolerating a lower success rate or forgoing complete inflation adjustments, for example.

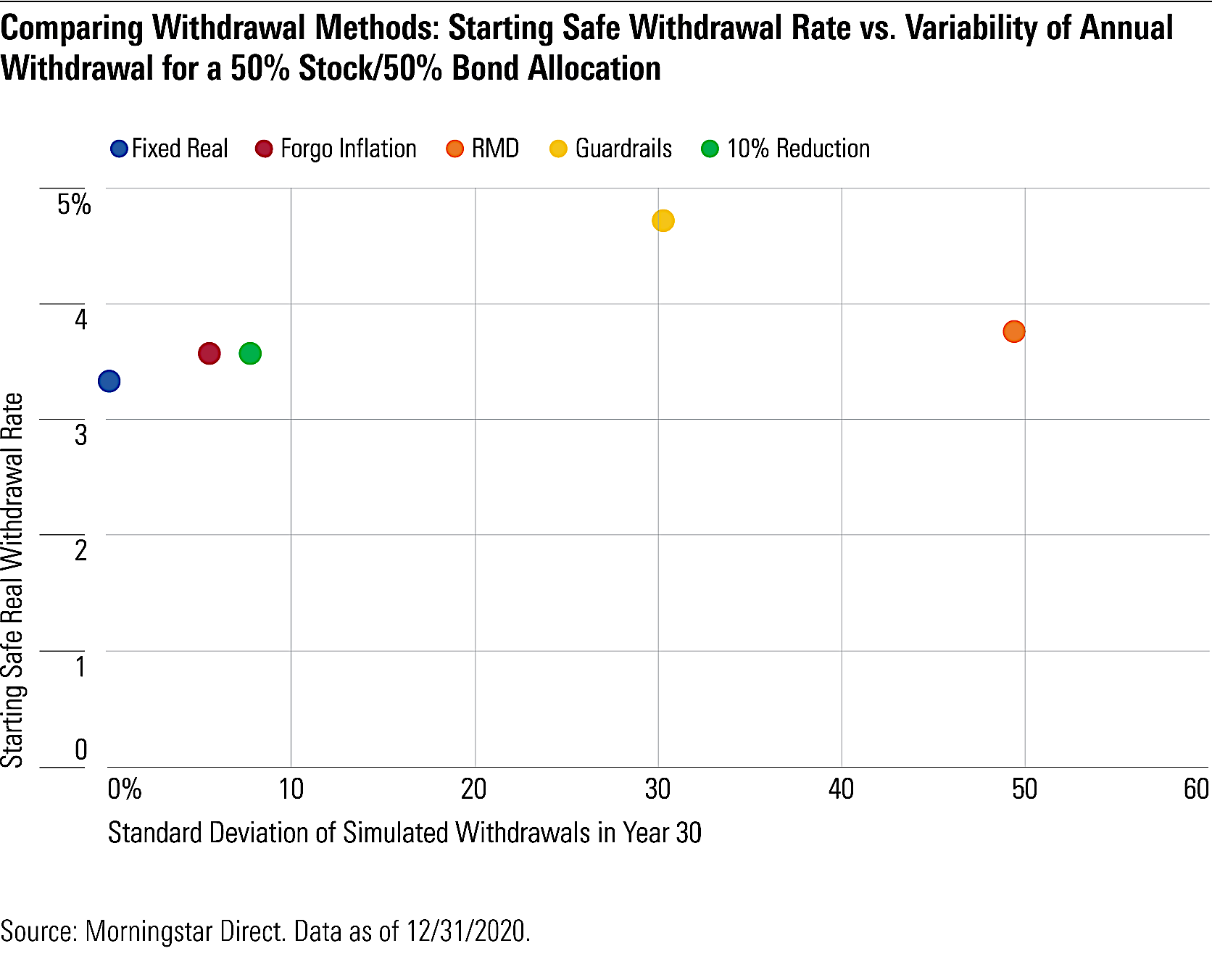

Alternatively, retirees who employ variable withdrawal systems that are based on portfolio performance—taking less in down markets and more in good ones—can significantly enlarge their starting and lifetime withdrawals.

For instance, our research finds that some flexible withdrawal systems would support a nearly 5% starting withdrawal rate. But these variable strategies involve trade-offs—specifically, the year-to-year cash flow can be more volatile. This is evident in the chart below, which compares the starting real withdrawal rate of five different retirement spending methods with the volatility of their cash flows when analyzed across 1,000 simulated retirement spending scenarios. We’ll examine those variable withdrawal methods in more detail later in this piece. (To read on, click here.)

© 2021 Morningstar, Inc.