Although American International Group’s (AIG) property-casualty division withstood a big financial hit from natural disasters over the past year, the individual annuity segment of the global insurance company’s life and retirement business has continued to post strong sales. AIG has been pursuing a balanced product strategy, with competitive entries in the variable, fixed and index annuity categories.

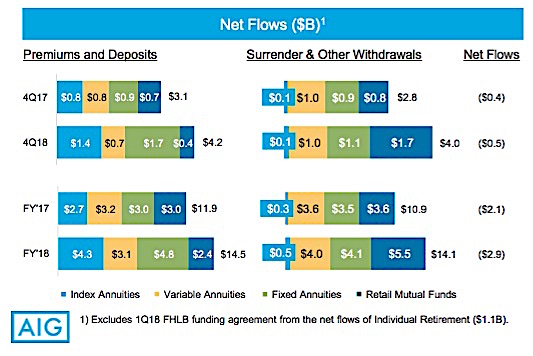

For the fourth quarter of 2018, AIG’s Individual Retirement business reported $3.8 billion in total individual annuity sales (variable sales of $700 million, fixed sales of $1.7 billion and index sales of $1.4 billion). For all of 2018, the division reported $3.1 billion, $4.8 billion and $4.3 billion in those categories, respectively, for a total of $12.2 billion (See chart below right).

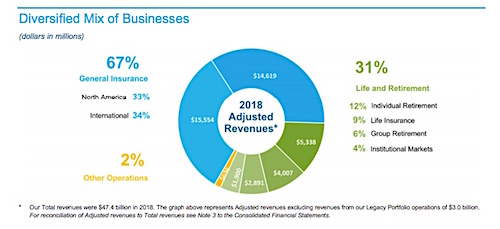

AIG’s entire Life and Retirement group, including Individual Retirement, Group Retirement, Life Insurance, and Institutional Markets, posted industry-leading combined sales of $18.4 billion, according to data released last week by the National Association of Insurance Commissioners (See chart at far right).

[AIG Life and Retirement encompasses American General Life; The Variable Annuity Life Insurance Company (VALIC); The United States Life Insurance Company in the City of New York (U.S. Life); Laya Healthcare Limited and AIG Life Limited.]

Even for AIG’s Life and Retirement business, last year wasn’t easy. It was buffeted by the slump in equity values last fall, industry-wide declines in variable annuity sales, lower reinvestment yields, and a high rate of surrenders and withdrawals, especially in its retail mutual fund business, according to AIG’s 10-K form for 2018. These factors led to a 17% decline in adjusted pre-tax income from Life and Retirement businesses in 2018, to $3.19 billion, compared to $3.83 billion in 2017.

For a closer look at AIG’s annuity business, RIJ spoke with Todd Solash, president of Individual Retirement at AIG. Solash joined AIG in February 2017 after serving as head of Individual Annuities at AXA for six and a half years—a period prior to AXA’s 2017 reorganization as AXA Equitable Holdings, when the firm pioneered the successful index-linked or “buffer” category of deferred variable annuities.

RIJ: What did you come over to AIG to do?

Solash: I came to AIG because of their extraordinary business and the exceptional people. I’ve known Jana Greer [president and CEO, Retirement at AIG] and Rob Scheinerman [president, Group Retirement at AIG] for a long time. I already had a sense of the team and the environment. But what was—and is— most exciting for me is that AIG has such a huge breadth of products and footprint. Being able to spread across all of those businesses is a powerful advantage. My mission is to drive AIG’s Individual Retirement business forward with a focus on serving customers, expanding market leadership and building for more profitable growth.

RIJ: Yes, it’s noteworthy that AIG is a market leader in annuity sales with strong positions across all three product lines. Lincoln Financial is also broad-based. Jackson National, Prudential, and Allianz Life tend to specialize a bit more.

Todd Solash

Solash: Our strategy is to work closely with our partners, listen to our customers and stay flexible with the products we offer. We think having that breadth of products is essential. We’re not beholden to any single product category. If ‘x’ category drops, we still have categories ‘y’ and ‘z’. For our distribution partners, it’s a form of differentiation. We’re a one-stop shop. That’s a service that we provide. It also requires a real commitment. We need to have staff development across all three categories—variable, index and fixed—and that has a higher degree of complexity than being a monoline company. We have to be great in all three areas. We make decisions around where to prioritize, how to sequence product choices, how to staff.

RIJ: AXA revived its annuity business with a registered index-linked annuity (RILA). Did you bring RILA expertise to AIG?

Solash: RILA has become a more competitive space with the arrival of Brighthouse and Allianz Life. The timing right now is interesting. AXA started growing the buffer business about the time when the people here at AIG got into the index business.

RIJ: But with buffered product selling so well, why not get into that game?

Solash: We don’t need to race in and be the sixth or seventh product on that shelf. It’s an interesting space but not having it isn’t a massive hole in our lineup. Many of AIG’s distributors have told us, ‘If you have a buffer product, we’d be really interested in it.’ But they haven’t said they need another product in that space. Besides, with higher rates, the relative value of an index to a buffered product changes. When interest rates are really low and the index caps are really low, the buffer caps look a lot better. But as rates go up, the gap between the two types of products narrows. The conventional index product becomes a more viable competitor.

RIJ: What about variable annuities?

Solash: In our world, there’s been a lot of convergence. Where variable annuity and fixed index annuity businesses used to be separate, the two products are now substitutes for one another in the minds of advisors and clients. The index products tend to be a little more differentiated, a little less comparable to each other. We can ‘pick our spots’ in the index business. The variable annuity space has become much more specific. We were constantly saying, ‘What’s your percentage payout at age 65?’ We went down that road in 2008. You’re really looking at very few variables with which you can differentiate yourself. Still, AIG is very much in the variable business, and we have been very successful.

RIJ: What other product areas is AIG exploring?

Solash: One of the products we are really excited about is a fixed annuity with a living benefit, Assured Edge, and it has done well. The product has the flexibility and the value proposition for guaranteed income that you would historically associate with Index and Variable annuities in a simpler, more streamlined package. This simplicity of the product appeals to the traditional fixed annuity buyer, and allows for a robust income guarantee. We wouldn’t have built the product if we weren’t in all three categories. We wouldn’t have had the expertise or the awareness.

RIJ: AIG has also made some significant organizational changes, hasn’t it?

Solash: After the financial crisis, AIG brought its annuity products together. That has worked really well. AIG has also moved from a set of businesses with a product-driven focus to a set of businesses built around customer needs.

RIJ: Some people have praised your distribution strategy.

Solash: In distribution, we went out and talked to customers. They said they wanted one relationship manager from AIG. They said, ‘You can bring in specialists, but we want one person who can serve as the face of the company.’ Our distribution strategy is built around serving our distribution partners the way they would like to be served. I already mentioned our product breadth, and we have that same flexibility with our sales support model. We have centralized distribution under AIG Financial Distributors, which means no matter what set of products a partner chooses to sell, there is a unified distribution strategy. We’ve also had proprietary bank products where we distribute white label fixed annuities. We have a proprietary fixed index annuity. That’s been really successful. We’re willing to offer a proprietary product under the right circumstances, where and if it makes sense.

RIJ: What about no-commission annuities for registered investment advisors, or RIAs?

Solash: We’re out with a couple of no-commission products on both VA and FIA. We view RIAs as a growth market. But it hasn’t happened in size yet. We don’t know which product will crack the code. The way you deliver it will mean as much as whether you have the dollar-best product. Process matters a lot for RIAs. You can have a good product. But you also have to fit the annuity purchase into their business process. We’re focusing on it and tailoring the product for RIAs. RIAs operate in a different ecosystem, and it is our job to find a way to integrate seamlessly with them, not the other way around. Our goal as a manufacturer is to be on any platform where there is an opportunity for scale. The RIA market checks that box, and we see the opportunity with RIAs as an exciting one in the years ahead.

RIJ: Thank you for speaking with us about AIG’s annuity business. Any final thoughts you’d like to add?

Solash: We’re in a space we really like. We’ve heavily invested in it, and the results have been positive. Our modus operandi is about balance, and about learning how to manage a network of high-quality distribution partners. As the environment becomes more chaotic—with regulatory uncertainty and stock market volatility—and where consumer needs shift, our ability to go across product will be an advantage.

© 2019 RIJ Publishing LLC. All rights reserved.