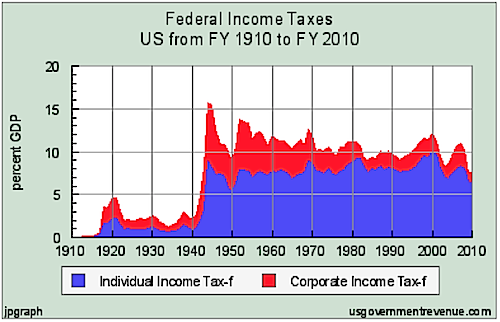

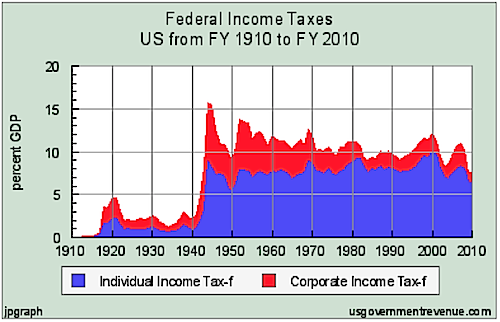

The federal income tax turned 100 this week

"The need to fund our involvement in World War I moved income taxes to the center of federal finances," the U.S. Census Bureau reported this week, in noting the centenary of the birth of the national tax on earned income.