Bob is 65 and wife Doreen is 66. They have $3 million in mutual funds and a home worth about $1.7 million. They’ll need an income of $140,000 a year or so in retirement. Social Security will provide about $28,000 of that. Where will the other $110,000 come from?

Their financial adviser, Sarah, suggests moving $1 million into a “Longevity Pension Fund.” It’s a kind of mutual fund that will pay Bob and Doreen $61,500 a year. If they squeeze $50,000 a year (2.5%) from their other $2 million in investments, they’ll have the desired $140,000.

One more thing about Bob, Doreen and Sarah, besides the fact that they’re fictional: They live in Canada, where regulators have approved the Longevity Pension Fund. The fund was brought to market by Purpose Investments, a nine-year-old Toronto-based fintech that dabbles in several financial services.

Sales of this tontine-like fund are still embryonic, and limited to Canada. But Purpose Investments has eyes on the US market. It has engaged an unnamed Chicago law firm to help hurdle regulatory barriers in the US.

The product is designed to work like a mutual fund and a pension fund and an individual annuity.

Fraser Stark

“We manage it like a defined benefit plan rather than an annuity,” Purpose Investments’ Fraser Stark told RIJ. He’s president of the firm’s Longevity Retirement Platform. “It’s an investment fund that offers longevity risk protection. Nothing is guaranteed, but there’s an options strategy to reduce risk. Annuities can be brilliant but at today’s interest rates, many investors struggle to justify annuitizing.”

Grandchild of CREF

Pension funds that act like annuities have been available in the US since 1952. That’s when TIAA created CREF, a big centralized equities fund that pays out a rising, sustainable, but not necessarily guaranteed lifetime income stream, mainly to professionals at ivy-clad colleges and universities.

As RIJ reported last week, the basic DNA of the CREF variable income product resurfaced decades ago in the University of British Columbia’s Variable Payment Life Annuity (VPLA), and beats at the heart of Canada’s still-in-progress Dynamic Pension Pools. Purpose Unlimited’s Longevity Pension Fund brings the concept to a wider audience, but still in Canada.

“People have done it,” said Simon Barcelon, vice president to Stark. “It just hasn’t been done within a retail product. We have put the work in to make that happen. We’ve ‘democratized’ the solution to the income problem.”

If you buy and hold shares in this fund through retirement, you get the growth potential of investing in equities and alternative assets. You also get the “survivorship credits” that come from pooling longevity risk.

But what about liquidity? Investors have always balked at tying up big chunks of their money in illiquid income annuities. The variable annuity with guaranteed lifetime withdrawal benefit, so popular between 2005 and 2015, solved that problem, but not elegantly or cheaply.

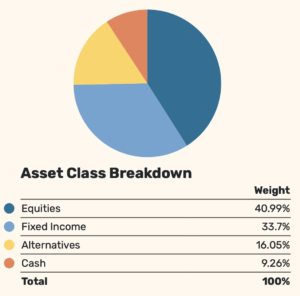

Current allocation of Longevity Pension Fund

The Purpose Unlimited mutual fund offers a compromise. Investors can cash out at any time. If they leave before retirement, they get their principal back, with earnings. If they leave after retirement, they get their principal at 65 minus the income payments they’ve already received, effectively leaving their earnings post 65 in the pool as survivorship credits.

US securities law requires mutual funds to allow investors to cash out at the fund’s current price (the net asset value, or NAV, which is calculated each day after the market closes). That’s a legal obstacle to offering the Longevity Pension Fund as a mutual fund in the US.

“If an investor wants to redeem shares, we can redeem the client at less than market value. That’s how we preserve the risk-pooling structure that’s embedded in the product,” Barcelon said. Another obstacle to US distribution is more operational in nature. It involves capturing the date of birth (DOB) of the investors.

“With annuities, a contract’s price is based on the individual’s life expectancy, and the issuer has to capture the DOB. But with a mutual fund, there’s no specific contract, so you don’t necessarily capture the information,” Barcelon added. “The challenge was to capture the right age. That was something we really needed operationally to provide the [longevity] risk-pooling structure.”

Law of large numbers

As the Bob-and-Doreen example at the top of this story shows, Purpose Unlimited intends the Longevity Pension Fund to produce an initial retirement income of 6.15% in the first year, or $6,150 per $100,000 invested.

The income won’t be fixed and is not guaranteed to hold at that level for their lifetime, because no insurance company is assuming that risk—or charges for it. Instead, the income rate will fluctuate, based on the performance and redemptions (mortality and voluntary) of the fund. Since the initial lifetime income rates are calculated using conservative assumptions for investment returns, mortality and redemptions, the income has a good chance of rising over time.

What you get from the Longevity Pension Fund that you couldn’t have gotten from, say, one of the payout mutual funds that Vanguard and Fidelity offered in the first decade of this century, is “survivorship credits.” That’s the dividend that accrues to the surviving members of each of the fund’s age-cohorts when one of the members dies or redeems voluntarily. In old-fashioned tontines, the inevitable acceleration mortality rates at older ages meant that the payments usually grew huge toward the end. In this product, as in a fixed income annuity, the survivorship credits are anticipated; they’re spread more or less over the entire payout period.

Simon Barcelon

Here’s how Barcelon put it:

In addition, similar to how a pension plan is managed, Purpose takes a funding-level approach that compares the Fund’s assets with the present value of all expected future liabilities. The long-term funding-level target is 100%; however, this may be higher in the earlier years of a cohort to provide additional stability in distribution levels. The distribution levels are adjusted annually to bring the funding level to its target, which ensures the cohorts are adequately funded to provide income for life.

Longevity risk pooling requires help from the law-of-large-numbers—but the numbers don’t have to be huge. “You need a group of people to do this, but what’s surprising is how low the number can go before there’s any negative effect on pooling,” said Barcelon. “We’ve modeled this extensively, and you can go down to as few as 100 to 300 people, which can be built over time. In building out a cohort, we take people within three years of a given age. The difference in life expectancies is small enough for the product design to work as intended. We accept new investment until the 80th birthday.” There’s no joint-and-survivor version of the fund, so couples planning retirement will want to split their investment in both their names.

Purpose Investments, a subsidiary of Purpose Unlimited, is the asset manager of the fund. There’s an annual management fee of 60 basis points, plus whatever advice fee an adviser charges his or client. In Canada, there’s also an Adviser series with an annual management fee of 1.10% to the investor; that includes the investment fee and a trailing commission of 50 basis points paid by the fund to the adviser’s broker-dealer.

“The fund can be sold through a bank, independent wealth adviser, or online account. Or we can put it on the platforms of companies that manage DC plans, as an option for employees. It can’t be sold as an ETF given the unique elements of the redemption structure,” Stark told RIJ.

Three pots of money

Purpose Unlimited appears to have the resources necessary to make this work. Last year, Allianz X, the venture capital arm of Allianz SA of Germany (parent of Allianz Life of North America), invested the equivalent of $38.37 million in the Toronto fintech, which has about 300 employees and manages about C$14 billion ($11 billion). Toronto-based CIBC Mellon Global Securities Services Company is the registrar and transfer agent for the units of the fund.

Som Seif

The founder and CEO of Purpose Unlimited, Purpose Investments’ parent, is Som Seif, 46. An engineer by training who started his financial career at the Royal Bank of Canada, Seif made his first fortune founding Claymore Investments, building it to $7.5 billion in assets and selling it to BlackRock.

The company has been endorsed by the Canadian Association of Retired Persons (C.A.R.P.), which offers investors a 15% fee discount. It currently distributes the Longevity Pension Fund through the Bank of Montreal and National Bank, but not yet through Canada’s four other major banks.

Advisers to Purpose Investments include Keith Ambachtsheer, emeritus director of Canada’s International Centre for Pension Management, Bonnie-Jeanne MacDonald, Director of Financial Security Research at Ryerson University’s National Institute on Aging, Fred Vettese, Former Chief Actuary of Morneau Shepell and personal finance author, and Jim Leech, Former President & CEO of Ontario Teachers’ Pension Plan and Chancellor of Queen’s University.

“When we showed the Canadian regulators, they helped champion the concept. In Canada, the regulatory changes were in the retail investment product space, but also made the fund available to defined contribution (DC) plans. In the US we’re also hoping to put this product on the shelf inside DC plans. It will let DC plan sponsors offer their employees an income for life option,” Stark said.

Last week, Purpose Investments announced that the Toronto-based global human resource consultant LifeWorks (formerly Morneau Shepell) validated Purpose’s assertion that the Longevity Pension Fund “could achieve initial lifetime income rates starting at 6.15% for 65-year-old investors, and that Longevity’s distribution levels should increase over time in the majority of cases as a result of the Fund’s risk pooling structure and the conservative assumptions used to set the initial rates.”

So far, Longevity Pension Fund has fewer than 100 investors and assets in the “low millions,” Stark said. But Purpose Investments thinks the concept—already proven by TIAA in the 403(b) plan space—is an idea whose time has come.

“If the average investor thinks of three categories, balanced portfolio of traditional investments, annuities, and longevity risk pooling…this is money you’re not going to leave to your estate,” Stark said. “No one should totally move away from traditional investments. But many investors will believe that some money should go into the longevity risk pooling sleeve.”

© 2022 RIJ Publishing LLC. All rights reserved.