True story: Around midnight, a sleepless retiree speed-dials her adviser. Their last meeting had ended on what the adviser thought was a positive note: a Monte Carlo simulation showed that the client’s portfolio had a 94% likelihood of success through age 90.

But now the client was bedeviled by bankruptcy goblins. “Was 94% safe enough?’ she wanted to know. ‘Shouldn’t they reach for 96% or 97%?”

Anxiety attacks like those are what Johnny Poulsen and Justin Fitzpatrick, two former Jackson National Life executives turned entrepreneurs, see their software curing. Their product, beta-launched a year ago and now available to advisers, is called Income Lab. The name sounds scientific—like the AgeLab at MIT.

Denver-based Income Lab is designed to help quell the fearful client question: Will I run out of money? and emphasize the more common question, How much can I spend in retirement? The goal is to maximize annual income during retirement rather than maximize gains or final wealth.

“Most people begin retirement with a lot of upside, relatively speaking,” said Fitzpatrick, who earned a Ph.D. in linguistics at MIT. “There’s more upside to their situations than downside. But other software doesn’t capture that at all. There’s no way to tell the hopeful story. We have a system that shows people the upside, and encourages them to ‘live a little.’”

With a financial planning software market that’s both crowded and concentrated in just a couple of firms, one has to wonder if there’s room for one more. Poulsen and Fitzpatrick believe that none of the existing tools do a very good job with income planning. “We worked with 20 different finance professors when we were developing this, and nobody disagreed that there’s a need for a massive upgrade,” Poulsen told RIJ.

Grabby screenshot

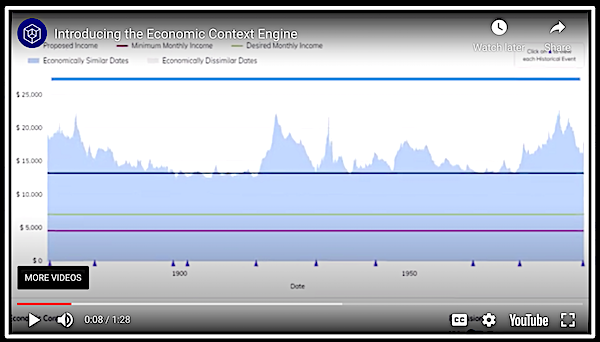

The grabbiest screenshot in Income Lab, of what I saw, is a chart that resembles a scenery artist’s grey and blue silhouette of a distant urban skyline. This is Income Lab’s “Economic Context” tool. (For a video, click here.) Each of the tightly packed vertical bars on the chart represents a month in market performance history, and the height of each bar indicates the maximum amount a particular client could have safely spent from his or her portfolio in such a month.

Three colored lines run horizontally across the width of the chart. A purple line represents the retiree’s minimum spending need; a higher green line represents the retiree’s desired spending, and an even higher blue line represents the advisers proposed spending level. The blue line shows a spending level that’s in-the-money—affordable, that is—for almost every month in history, going back to the 19th century. (See below.)

Exactly how Income Lab generates those numbers, I don’t know. But I suspected that a client would find this chart soothing to look at before and during retirement. In practice, an adviser would get an automatic ping from Income Lab’s software every year, recommending that clients should tweak their incomes up or down a notch.

“We call it ‘guardrail-based retirement income planning,’” Fitzpatrick told RIJ. “Any time you have dynamic income planning, you need triggers. That’s the framework that a lot of advisers would like to use but, given the software that they’re using, it’s a square peg in a round hole.”

Under-applied research

Poulsen emigrated to the US from Denmark in the late 1990s. He joined Jackson National at its Denver office, eventually becoming senior vice president for distribution. Fitzpatrick had been a linguistics professor before arriving at Jackson. When he met Poulsen, Fitzpatrick was leading a team of CFPs and CPAs who were studying research on advanced financial planning.

“That got me thinking about the state of the art of financial planning,” Fitzpatrick told RIJ recently. “Retirement planning is such a difficult problem. It’s attracted the heavy hitters in the financial world, like Robert Merton and Bill Sharpe. So there’s been a lot of great research.” But advisers and clients weren’t applying much of it, he thought.

Fitzpatrick (l) and Poulsen of Income Lab

By 2018, a time when Jackson National was starting to change course—it vacated its Denver office for Nashville and began separating from its long-time owner, Asia-focused Prudential plc, in 2020—the two men and a distribution colleague, Gregg Mahalich, decided to put what they’d learned (and their own savings) to work by starting Income Lab.

“Johnny and I were part of a team looking at technology,” said Mahalich, who is chief revenue officer at Income Lab. “Justin was researching retirement planning. We found a lot of high quality research that we thought could greatly improve the process of retirement planning.”

They had three implicit goals: To make the software dynamic, so that a retiree’s income would adapt to market conditions; to help retirees avoid unnecessary worry (an affliction common even among the well-off); and to help retirees avoid under-spending.

“I have a 59-year-old neighbor who invests with a national broker-dealer. He got a plan from his adviser with a 90% success probability,” Fitzpatrick said. “His wife is 49. She’ll probably outlive him by at least 10 years. He assumed she’ll face a 10% risk of portfolio failure. We showed him that their worst-case scenario would involve an 8% decrease in spending. Would that be inconvenient for them? Maybe. Would it mean ‘failure’? No.”

Top-heavy field

Fitzpatrick, Poulsen and company are now taking their product to market. They have added a tax module to the original software, so that advisers can help clients spend tax-efficiently from their various taxable, tax-deferred and Roth IRA accounts. So far they’ve been working with a few firms in the XY Planning Network, the group of independent planners created in part by advisory guru Michael Kitces.

Gregg Mahalich

“We launched a beta version in April 2020, and we stayed under the radar for a while to get product feedback. We started in earnest in the fourth quarter of last year, and launched the tax module this year. We see ourselves at the intersection of academics, technology, and practice,” Fitzpatrick said.

Pricing is volume based. A single adviser would pay $159 a month to use the software, with a 10% discount for annual payment. Teams up to nine people would pay $149 per month and teams of ten or more would pay $139 per month. Again, the 10% discount for annual payment is available.

They’re trying to penetrate a market dominated by a handful of big players. According to Bob Veres and Joel Bruckenstein’s 2020 survey of advisers on their choices of financial planning software, two providers accounted for 50% of the market. MoneyGuidePro, which Envestnet owns, had a 28% share. Fidelity’s eMoney Advisor had a 21.5% share. Right Capital was a distant third at 5.5%. MoneyTree and Advicent/Naviplan filled out the top five.

Of course, it seems as if all planning software makers claim to provide dynamic modeling, retirement income projections, side-by-side plan comparisons, risk assessment, a holistic, all-encompassing approach and the ability to integrate annuities into the plan.

But they arguably tend to emphasize investment management and optimal accumulation. That may reflect the fact that most advisers have those priorities. It may also signify that many affluent people over age 65 don’t think of themselves as retirees but as full-time investors.

Fitzpatrick sees it differently. “People ask us, ‘Why has no else one done this before?’” he said. “Because it’s really hard. It’s much easier to run a static plan. The plans that people create on Income Lab are fully dynamic. Many other planning platforms will tell you that they’re dynamic. But while they may be able to update account balances through integration, their plans are static. We recognize that things change. People adjust their spending as their circumstances change.”

© 2021 RIJ Publishing LLC. All rights reserved.