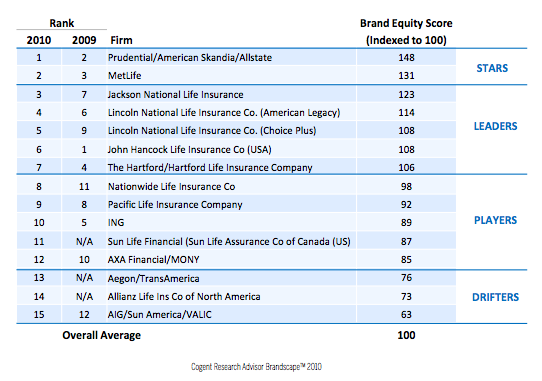

The names “Prudential” and “MetLife,” in that order, come most quickly to the minds of investment advisers and registered reps when they’re asked to name a variable annuity provider, according to the 2010 Advisor Brandscape survey from Cogent Research.

That’s not surprising. Prudential and MetLife were the top two sellers of variable annuities in the U.S. in the first quarter, according to Morningstar, with over $4 billion in sales each and a combined market share of 28.5%.

In Prudential’s case, a relentless advertising push, a well-differentiated product with rich living benefits, and an enhanced wholesale force helped make it the most recognizable name in variable annuities. The company scored well in the two biggest drivers of adviser loyalty: range of products and long-term sub-account performance.

Newark, NJ-based Prudential spent $85 million on measured media in 2009 and $18 million in the first quarter of 2010, according to Kantar Media. MetLife, the second most recognizable annuity brand, spent $56 million on consumer and business-to-business advertising in 2009, according to Nielsen.

“Prudential does have very high ad awareness,” said Meredith Lloyd Rice, senior project director for the 2010 Advisor Brandscape report, which was based on a survey of 1,560 registered advisors—independents, brokers and RIAs—last spring. Non-subscribers to the report can purchase a copy from Cogent Research. In the past, VA issuers have used the Brandscape study to find out if their scores reflect their advertising, marketing and wholesaling efforts.

“The campaign for its HD6 [variable annuity living benefit] seemed to resonate with advisors. In a regression analysis of ‘loyalty drivers,’ we found that ‘range of variable annuity product features’ was the most important loyalty driver for Prudential,” she said.

In mid-June, Prudential signed a deal for two new image-building TV ads for telecast during morning shows, network news shows, and prime time syndicated shows, along with billboard ads in 15 major markets. The company also bought home-plate signage during television broadcasts for eight Major League Baseball teams.

Cogent’s study, which also gathered advisors’ opinions about mutual funds, exchange-traded funds (ETFs), and employer-sponsored retirement plans, added to evidence that some annuity providers have thrived in the “flight to strength” since the financial crisis while others have lost momentum. Companies that maintained rich living benefits, despite the high fees involved, have fared better. Companies that bet the crisis would spark demand for simpler, less expensive riders haven’t done as well.

After Prudential and MetLife, Jackson National, Lincoln Financial, Nationwide, Pacific Life, and Sun Life received the highest combined ratings for awareness and “favorable impressions” from advisors. John Hancock and the Hartford also received high brand ratings, but both have lost ground because of unpopular product design (John Hancock) or questions about financial strength (Hartford).

Last January, Sun Life purchased naming rights to the Miami Dolphins stadium, in a five-year deal worth $7.5 million. That and other promotional moves appear to be paying off. “An impressive story is building for Sun Life Financial, which holds a position a bit further back in the pack. The firm enjoys stronger consideration and favorability, but has yet to translate this momentum into a deeper sense of advisor loyalty, despite best-in-class performance on several key client experience attributes,” the Cogent report said.

Overall, however, allocation of assets to variable annuities by advisors dropped 20% in 2010, compared to the previous year, as average allocations declined to 8% from 10%. Among registered investment advisors (RIAs), allocations declined to only 2% in 2010 from 6% in 2009. Among those advisors who use variable annuities, the average allocation is 12% of assets.

“A two-year uptick in the use of and allocations to variable annuities has ended and some of the products recent ‘foul weather’ friends, particularly RIAs, appear to have already returned to their previous ambivalence toward these products,” Cogent Research said. Among RIAs the average assets under management (AUM) devoted to variable annuities fell by more than half, from $28.9 million in 2009 to $13.7 million today. When RIAs do buy variable annuities, some apparently do so only to exchange a client’s high-cost contract to an ultra-low-cost contract, like Jefferson National’s.

Variable annuities tend to be most popular in the independent channel, where 52% of advisors use them and allocate an average of 16% of client assets to the product. Advisors who manage less than $25 million in client assets are most likely to use them in their practice. Independent advisors represent 23% of all advisor-managed assets but 44% of advisor-managed variable annuity assets.

“What emerges across all these categories is a picture of an experienced Independent planner with a smaller book of business who is comfortable with the VA story and has found a niche for them within his or her practice,” Cogent said.

Advisors are not as nervous about the financial stability of issuers as during the depth of the crisis in 2009, nor are they talking as much about “splitting tickets” among providers to diversify risk. Instead, they are “once again seeking out those providers with a performance story to tell,” while also looking for guarantees that offer security “in the post-meltdown investment environment,” the Cogent researchers said.

Advisor Brandscape showed that, for the first time, more than half (54%) of all advisors describe their compensation as “fee-based.” Because of that, Cogent said “VA providers should build solutions that are simple, low-cost, and priced to “fit” into the growing advisor asset-based platforms.” The average advisor client is 57.7 years old has about $690,000 in investable assets.

© 2010 RIJ Publishing LLC. All rights reserved.