The SEC could help investors distinguish between bespoke advice and off-the-rack advice that’s merely “suitable.”

A Snapshot of U.S. Household Debt

As a country, the U.S. owes its bondholders almost $13.4 trillion. As individuals, Americans owe about $11.2 trillion. Unlike the national debt, however, household debt recently fell--for the first...

Dutch Pensioners in a Panic

Participants in 14 pension funds in the Netherlands are facing benefit cuts in the wake of the financial crisis.

New SALB Launched By Investors Capital Corp.

The account combines Investors Capital Advisory Services’ series of asset allocation models with a stand-alone living benefit that offers investors a guaranteed 5% lifetime income stream.

John Hancock Offers “To” and “Through” Target Date Funds

The glide path for Retirement Choices portfolios features a lower allocation to equities and slopes down at a faster pace than it does for the Retirement Living portfolios.

In Singapore, as in the U.S., Savings Grow Slowly

In Singapore, HSBC Insurance has unveiled a new annuity contract called SecureIncome to help Singaporeans save for retirement. The product appears to beat putting money under the mattress, but...

Cue the Traveling Music…

... Because the fall conference season is about to begin. It starts after school opens and ends by Thanksgiving.

Making The Case for Fixed Indexed Annuities

Jack Marrion and friends offer hard evidence that FIAs pay off when other investments don't. Their analysis is compelling, but I'm not ready to convert.

How to Reduce the Threat of Fiduciary Liability Lawsuits

A new report designed to help employers reduce their exposure to fiduciary liability lawsuits appears to reflect an increasingly adversarial relationship between plan sponsors and plan participants.

Reliable Sources Disagree on July Fund Flows Data

Morningstar and Strategic Insights both reported mutual fund and ETF flows for July, but the numbers didn't match. If you know why not, please write and tell us.

Transamerica Launches “Bridge” GLWB

The new Income Link rider pays out between 5% and 10% of the income base for a few years, then 4% for life. "It's designed for higher income in...

Indexed Annuity Sales Rebound

"With CD rates at 1% and fixed annuities crediting a mere 3.65% on average, it is no wonder that this was the second-highest quarter in terms of indexed annuity...

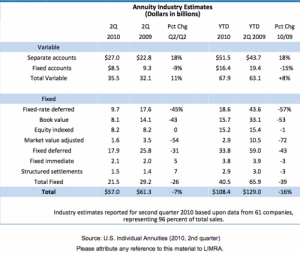

VA Sales Up Sharply in Q2: LIMRA

"VA sales jumped more than $3 billion in the second quarter,” said Joe Montminy, assistant vice president for LIMRA's annuity research.

Broadbridge Acquires NewRiver for $77 Million

The acquisition accelerates Broadridge’s e-strategy while strengthening its industry-leading compliance communication capabilities, the company said in a release.

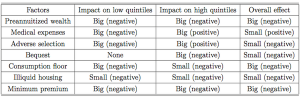

Why the Wealthy Should Buy SPIAs

A recent study by a doctoral candidate at the University of Virginia examines all of the reasons why people don't buy income annuities--and reveals two hidden reasons why they...

Retirement Assets Reach $16.5 Trillion 1st Quarter: ICI

Assets in target date mutual funds grew 9.8 percent in the first quarter. Lifecycle mutual funds managed $281 billion at the end of the first quarter of 2010, up...

New York Life Sets Income Annuity Sales Record

The nation’s largest mutual life insurer announced a record $870 million worth of income annuity sales in the first half of 2010, along with gains in life insurance, long-term...

Long-Term Care ‘Eats’ 3 Sq. Ft. of U.S. Homes Per Day

“Five years ago we started translating long term care costs into square feet of real estate, to highlight the heavy burden of paying for care,” said Denise Gott, chairman...

Boomer Decumulation May Depress Asset Prices

The problem is that the demographic group that is selling homes and investments—the postwar BabyBoom generation—will be larger than the group that will be buying the assets.

Rates Won’t Rise for “Two to Three Years,” Gross Says

PIMCO's $239 billion Total Return Fund, which Gross manages, has returned 13% in the past year, beating 71% of its peers, according to Bloomberg.