The move is expected to allow the government to save €18bn, or about $27 billion, and combat a growing pensions deficit.

Lincoln Financial to Repay U.S. Treasury Investment

To repurchase almost $1 billion in preferred shares, Lincoln Financial Group is selling $335 million worth of common stock and up to $750 million of senior notes.

With BP Investments, Pensions Win or Lose

BP's falling share price has cost the NY state pension fund more than $30 million, but NJ's public pension fund earned a $5.5 million profit from its investment in...

The Year of Living Less Dangerously

A year or more after the financial crisis, major VA annuity issuers are trying to do more with less—less risk, that is. Here are nine of the latest efforts.

Our First Annual VA Special Editions

This week, we focus on the latest products and sales trends. Next week, we’ll delve into the issues that cloud the variable annuity industry's future.

Loaded VAs Haven’t Lost Their Lustre

Prudential Financial and Jackson National Life rack up sales with variable annuity contracts that ignore the adage, ‘Simplify, simplify, simplify.’

Why Do Educated People Live Longer?

One possible explanation is that the highly educated have better access to medical care and better adherence rates to prescribed regimes.

ING Launches Registered Indexed Annuities

“Offering registered fixed index annuities gives us products that we can make available to many banks and full-service brokerage firms,” said Lynne Ford, CEO of ING Financial Solutions.

Vanguard Now Offers a Dozen TDFs

The 2055 Fund is aimed at investors between ages 18 and 22.

Montana Senator Nixes 401(k) Fee Disclosure

U.S. Rep. George Miller (D-CA) said that the proposed elimination of fee disclosure requirements was “unacceptable.”

Bernanke Cites Fiscal Impact of Aging

"Among the primary forces putting upward pressure on the deficit is the aging of the U.S. population," the Fed chairman said.

A Jolly View of Financial Folly

"Retirementology," a new book by Jackson National Life executive Greg Salsbury, Ph.D., approaches the serious topic of retirement planning in a mordantly funny way.

Thomas M. Marra to Lead Symetra Financial

Symetra Financial is the parent of Symetra Life Insurance Company, a life and annuity company that raised about $365 million in a January IPO and was listed on the...

Lincoln Financial Launches Consumer Website

“MyConfidentFuture.com provides up-to-date information and timely insights to help empower people to face their futures with confidence,” said Heather Dzielak, Chief Marketing Officer, Lincoln Financial Group.

Warning on Excess VA Withdrawals Proposed

New York insurance regulators propose disclosure of the mechanism of the excess withdrawal aspects of the contract before the contract is issued and at the time of the request...

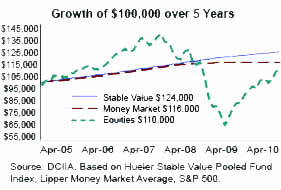

Regulatory ‘Collateral Damage’ Threatens Stable Value Funds

"This legislation may lead to the complete elimination of stable value funds in DC plans, impacting the millions of Americans at or near retirement who rely" on them, a...

Imagining the Future of Longevity Bonds

The bonds would pay coupons that would be higher when the more people outlived expectations and lower when fewer people did.

The Sure Thing vs. The Gamble

There may be a certain futility to creating supposedly win-win products for a market that thrives by generating losers and winners.