Ten Vanguard funds (including seven actively managed funds) are now available as investment options in several Jackson National variable annuities, including the fee-based Perspective Advisory II, issued three weeks...

Don’t Mess Up a Good Thing

Fee-based indexed annuities have generous crediting terms. But unless fee-based advisors can decide how to bill clients for holding such a safe, low-maintenance product, they may not recommend the...

How About ‘Free-Based’ Index Annuities?

If advisors choose not to sell fee-based FIAs because the remuneration is unattractive, then the fiduciary rule will have backfired.

‘Rothification is a Stupid Idea’

During a panel discussion at the IRI conference, former Treasury official Seth Harris, Voya's Sean Cassidy and former Oklahoma congressman J.C. Watts shared strong opinions about tax reform, the...

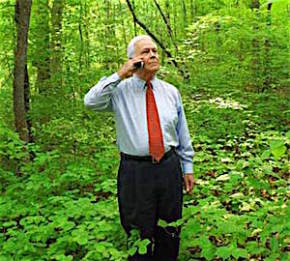

‘Tell Ken Fisher To Stuff It’

That's what variable annuity pioneer Bob Saltzman said at the Insured Retirement Institute's 25th anniversary conference in Florida this week. The fiduciary rule, he added, will lower the cost...

Bob Reynolds’ & the Future of 401k

Reynolds emphatically favors the investment interpretation, as does Brian Graff of the American Retirement Association and other industry advocates.

On the Case: Income from a ‘Certified’ Used Annuity

In this latest income solution for "Andrew and Laura," a real couple near retirement, Bryan Anderson of AnnuityStraightTalk and Nathaniel Pulsifer of DCF Exchange combine a secondary market annuity,...

Tax-Free QLACs? It Makes Sense

There would be no better way to jump-start awareness of longevity risk than by making withdrawals from qualified longevity annuity contracts tax-free. By reducing dependence on public assistance, the...

Bill Sharpe’s ‘Lockbox’ Strategy

The Nobel Prize winner's new e-book describes a retirement income generation method that combines Modern Portfolio Theory and income annuities. Advisors, life insurers, quants and even retirees should find...

The Time to Buy Annuities is Now

With the market so high, more near-retirees should be taking profits and buying lifetime income products. This opportunity won't last forever.

On the Case: A Solution from ‘Retirement NextGen’

Robert Fourman, a colleague of Curtis Cloke at Acuity Financial, uses their Retirement NextGen software to create a retirement income plan for Andrew and Laura, a near-retirement couple with...

Roth 401(k)s Are the People’s Choice

New research suggests that the majority of participants, without doing the math, might actually prefer to get taxes on their savings out of the way today and have the...

On the Case: TIPS Ladder + QLAC + HELOC = Income Security

Mike Lonier, of Lonier Financial Advisory, solved 'Andrew and Laura's' retirement income puzzle with a combination of products. A certified Retirement Management Analyst, he first builds a safe income...

On the Case: Jim Otar Answers Our Income Challenge

'I would not worry too much about complicated strategies,' Otar wrote after reviewing Andrew and Laura’s retirement finances. 'They probably don’t need guaranteed income (annuities), a bucket strategy or...

Dealing with the Contradictions of Financial Advice

'This is not a problem of Truth and Proof,' wrote Francois Gadenne of RIIA in an email and the inconsistencies of advice. “It is a problem of measurement (of...

Curve, Triangle or Rectangle: What Kind of Advisor Are You?

At the Retirement Income Industry Association's 2017 Summer Conference, founder Francois Gadenne asserted that advisors can protect themselves from automation, regulation and commoditization by advising in three dimensions. ...

Symetra Offers Fee-Based Fixed Indexed Annuity

Distribution of the Symetra Advisory Edge and Advisory Income Edge products began in April through Merrill Lynch, Commonwealth and Raymond James.

Has the Fiduciary Rule Lost Its Sting?

'The government is no longer defending the BIC Exemption’s condition restricting class-litigation waivers insofar as it applies to arbitration agreements,” lawyers from the Departments of Labor and Justice wrote...

Vanguard’s New CEO: No Surprises

For at least two decades, it was assumed that Tim Buckley would be Vanguard's CEO someday. And why not? He helped Vanguard grow into the paradoxically transparent yet mysterious...

A High-Tech Challenge for High-Touch Advisors

Wealth management firms know they need next-gen ‘fintech.’ But many of them don’t know exactly which digital tools to buy or where to apply them in their businesses, tech...