Managed payout funds haven't gotten much traction in the last decade. But T. Rowe Price hopes that its target-date fund/payout fund hybrid, the Retirement Income 2020 Fund, will help...

Affluent People on Medicaid? It Can Happen

Only six percent of Medicaid recipients use nursing homes, but their bills account for 42% of Medicaid spending. Many of those who receive Medicaid for long-term care expenses are...

Cloudy with a Chance of Lawsuits

If the fiduciary rule and its Best Interest Contract Exemption are here to stay, will they trigger a wave of lawsuits against advisory firms? No one seems to know...

The Tell-Tale Brokerage Statement

Judging by what I saw (and didn't see) in a friend's brokerage IRA statement, class action lawsuits for breach of the DOL Best Interest Contract might be a lot...

This Couple Needs Your Advice

These two people, ages 64 and 63, have a combined net worth of about $2.5 million. They're looking for ways to generate income in retirement. Here are some specifics...

Three Lessons Learned

By my late 20s, life had taught me a few homely but memorable lessons about leadership, entrepreneurship, and cross-cultural relations.

Morningstar Enters the Indexed Age

Just in time for the activation of the DOL fiduciary rule, Morningstar has expanded its Annuity Intelligence resources to include indexed and fixed annuities.

‘Don’t Expect Action By the SEC’

The retirement industry and its legal teams are receiving about as much useful new information from the SEC about the fiduciary rule as Dorothy Gale got from the Scarecrow...

Complex Annuities for a Complex Era

Indexed variable annuities (IVAs) offer a potential solution for paralyzed clients—perhaps for those who feel baffled by a market where both bond and stock prices are at all-time highs....

A New Book from PIMCO’s Stacy Schaus

If you don’t know Ms. Schaus, you must be new around here. She’s an EVP at PIMCO, the head of its defined contribution practice and the voice of its...

Vermont offers state-wide voluntary MEP

The voluntary multi-employer plan, or MEP, 'will be open to any employer with fewer than 50 employees that does not currently provide a retirement plan to its employees.' Some...

Fiduciary Rule Hurts First Quarter Annuity Sales

Sales of certain fixed annuities were lifted by the recent uptick in the Fed's benchmark interest rate, but sales of variable and indexed annuities were depressed in the first...

Do Rollover IRAs Contain Pension Money?

The Labor Secretary did little this week to dispel the annuity industry's uncertainty about the future of the fiduciary rule. Neither did he demonstrate that he understands what the...

What to Do About Low Returns

The anticipated low return environment doesn't have to ruin your retirement plans, according to industry and academic speakers at the Pension Research Council's annual symposium, held May 4-5 at...

Overcoming Hurdles in the Variable Annuity Race

Prudential and AXA have remained among the perennial leaders of the variable annuity space by patiently tweaking existing products and exploiting niche opportunities.

Talking Annuities with Voya’s Carolyn Johnson

"Taking away the variability on the compensation—that’s generally a good thing,' said Johnson, CEO of the combined annuity and individual life insurance businesses at Voya Financial. "Voya hasn’t played...

Real and Fake News on State Auto-IRAs

Opponents of state-mandated auto-IRAs say the plans will unintentionally rob small business employees of the opportunity eventually to participate in 401(k)s. But that's really a phantom opportunity for many....

Mortality Credits: Sweet and Sour

'The only way to get closer to meeting your spending goals is through some sort of partial annuitization strategy,' said Michael Finke, dean of The American College of Financial...

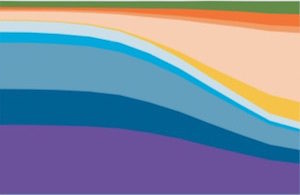

In Target-Date Space, It’s Vanguard, Et Alia

Vanguard’s domination of TDF flows in recent years has paralleled its domination of overall mutual funds flows. Competitors search for ways to be different, but not too different.

Today at the Retirement Industry Conference

The consensus here at the LIMRA Secure Retirement Institute/SOA Retirement Industry Conference is that the fiduciary rule is here to stay. But industry executives hope that it will be...