‘I’ve been on the bleeding edge as much as I’ve been on the leading edge, and it’s not always a comfortable place to be,’ said Judson Bergman, Chairman and...

A Safe Harbor is in Jeopardy

We shouldn’t deprive workers of 'bread' on the chance that brokers will be able to sell 'cake' to their employers.

How Ticos Turn DC Savings to Income

Retirees can take a monthly income equal to 1/12 of the earnings on their DC savings, or they can take a “scheduled withdrawal” where their accumulation is divided by...

Is (or Isn’t) Time Running Out for the Fiduciary Rule?

Three benefits attorneys told RIJ this week that the DOL's fiduciary rule became effective last June, and that it may be hard to stop the rule--or even delay the...

Federal Judge Upholds Obama Fiduciary Rule

Ignoring a Trump administration request to delay her ruling, Chief Judge Barbara Lynn of the Northern District of Texas, Dallas Division, rejected industry arguments that the Obama Department of...

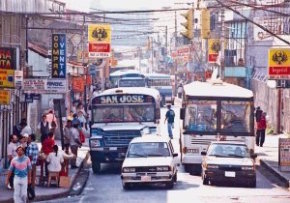

Más o Menos: Ticos Cheerfully Eke By

With 4.8 million people, Costa Rica’s problems are comparable to those of a big U.S. city, like Los Angeles or Chicago. Yet the tensions of a large U.S. city...

President Trump and the DOL Fiduciary Rule

If the DOL rule is removed or neutered, then financial services firms may have more autonomy in choosing how to use the savings that digital automation brings: To raise...

Dream-House Shopping in Costa Rica

The house was for sale. Its mystical vibe seduced them into paying $150,000 in cash. Monkeys, sloths, macaws, butterflies and gekkos would be their neighbors as the couple aged....

Rx for Retirement: A Low Dose of Equities

'For retirement investors attempting to minimize downside risk while sustaining future withdrawals, appropriate equity allocations range between five and 25%,' write Keith C. Brown (inset) and W. V. Harlow...

Skin in the (Costa Rican Retirement) Game

How do Costa Ricans pay for retirement? In San Jose, Alvaro Ramos Chaves (above), the pensions regulator, told RIJ how his nation’s mandatory DB and DC plans work. His...

Who Will Sell Transamerica’s New No-Commission VA?

“The sales outlook for 2017 is too soon to tell, given . We are confident that there is a market need for this structure in...

Anecdotal Evidence: The 10% Solution

The smartest companies contribute 10% of pay to each employee's retirement account--not as a bonus but as a carve-out of compensation. This policy is the most effective way to...

The View from Costa Rica

By visiting Costa Rica and interviewing retirement experts there, I hope to gather a few facts that might help me and RIJ readers understand our domestic retirement financing...

RetirePreneur: Dream Forward

The next wave of automation in retirement plans will be chatbots--intelligent virtual assistants that both teach and learn from participants. Dream Forward, a startup led by Grant Easterbrook, is...

‘Yours Sincerely, Wasting Away’

Ultimately, I'm fatalistic about the high cost of getting old. No matter how expensive health care gets, the elderly and their families will pay no more than they are...

When You’re 64

Six months after reaching age 64, Americans are showered with Medicare supplement pitches. While the path of least resistance leads to a Medicare Advantage plan, a Medigap plan might...

Xmas Cheer: The Debt Is Not Our Biggest Problem

Why do so many pundits and politicians, including the future director of the Office of Management and Budget, beat the debt drum so loudly and so often? It’s one...

Policy Forecast: Gloom with a Chance of Doom

At the Employee Benefit Research Institute's policy forum in D.C. last week, retirement policy experts were not cheerful about the coming inauguration, and some feared that retirement security will...

Calculating After-Tax Social Security Benefits

A handy crib sheet recently published by Vanguard shows the formulae for calculating the portion of an individual's or couple's Social Security benefits that will be subject to ordinary...