The Department of Labor decided not to send an invited panelist the Insured Retirement Institute's Government, Legal and Regulatory Conference on Monday--perhaps because the IRI is party to a...

Where the Fiduciary Puck is Headed

'As a practical matter, the DOL rule killed the business of single product sales, and ushered in an era based on process,' said David Macchia, founder of Wealth2k, in...

Test Your Reverse Mortgage IQ

To benchmark the public’s level of knowledge about HECMs, The American College’s New York Life Center for Retirement Income sponsored a survey that included a 10-question quiz. We invite...

Financial Groups Take DOL to Court—in Texas

RIJ believes that the federal government subsidizes the financial industry through favorable tax treatment, and that the public therefore deserves the assurance that anyone advising them on their retirement...

The American College Is Keen on HECMs. Here’s Why

'We thought it was very much in our wheelhouse to show people how reverse mortgages should be used and how they shouldn’t be used,' said Jamie Hopkins, co-director of...

Expect Sharp Drop in VA Sales: LIMRA

'We are seeing a significant shift in the annuity market,” said Todd Giesing, assistant research director at LIMRA's Secure Retirement Institute. 'We have to go back 20 years—to 1995—to...

Marcia Wagner Explains the DOL Rule

'It will be hard to design a compensation program that eliminates all incentives to provide improper advice,' said Boston-based ERISA attorney Marcia Wagner during a webinar this week on...

Donald Trump Believes What?!

Trump talked about Treasuries bonds as if they were the dispensable top-timbers on a Jenga pile, when they actually comprise the indispensable bottom tier. No, Treasuries aren't in danger...

No Retirement Account Left Behind

"Auto-portability" would consolidate a plan participant's old accounts into his or her current account, automatically. Spencer Williams and Tom Johnson of Charlotte-based Retirement Clearinghouse have spent three years trying...

How The British Save More for Retirement

In Britain, if you contribute £100 to your defined contribution plan and have a 25% tax rate, the government adds £25 to your account. Our system doesn't work that...

Three Advisor-Friendly Reverse Mortgage Strategies

In this installment of our HECM series, we review three strategies that should entice advisors: the HECM-for-purchase, the HECM-LOC for liquidity in down markets, and the HECM-LOC created at...

The Wealthier, The Quicker to Sell in a Downturn?

In a new research paper, a group of Big Ten economists and an IRS analyst say that wealthy people and older people are the most likely to sell in...

The ‘Kosher’ Reverse Mortgage (IV)

A kosher reverse mortgage lender will share what he or she earns when selling the loan by waiving or reducing the borrower's costs, says Wharton emeritus professor Jack Guttentag,...

The Latest from an RIJ Competitor

Catch the Spring 2016 edition of The Journal of Retirement for research on Social Security claiming for widows and widowers by Reichenstein and Meyer, for John Turner's discoveries when...

First Sign of Blood from DOL Fiduciary Rule

'The unexpected change regarding FIAs in the final DOL rule and the related Best Interest Contract Exemption has cast a cloud over our future growth rate,' said John Matovina,...

The Reverse Mortgage Puzzle: Part III

“There’s still a dark cloud over HECMs,” said Michael Banner, a long-time advocate of reverse mortgages who has a CE-accredited business devoted to teaching financial advisors about HECMs.

We’re 10X Too Fearful of a Crash: Shiller

The actual likelihood of an extreme crash occurring in the next six months, Yale economist Robert Shiller and colleagues found, is only about 1.7%.

Surprise: DOL Rule Targets Indexed Annuities

The DOL may have put a crimp in the sales of the hot-selling but controversial annuity product when, without specific warning, it raised the regulatory bar for the sale...

A Conversation with Jackson National’s CEO

'If a guy is getting ready to lose his house, and the VA account is the only liquidity he’s got, he’s not going say, ‘But our guarantee is in...

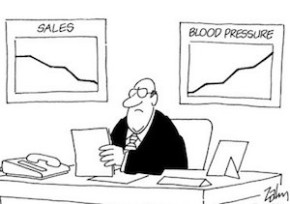

Selling like Coldcakes

This week, RIJ features the first installment of a three-part series on the reverse mortgage industry, and why it's shrinking when it should, on paper at least, be growing....