The latest evidence of the opinions of plan sponsors and plan providers on this topic comes to us via the “2015 Survey of Defined Contribution Viewpoints,” produced by Rocaton...

Tales from the Annuity Frontier

Three pioneers in the creative use of annuities in retirement portfolios--Wade Pfau, Joe Tomlinson, and Steve Vernon--have created an "efficient frontier" for deferred income annuities in two reports published...

‘The Big Short’ Is No Tall Tale

'The Big Short,' in which the actress Margot Roddie (above) provides exposition from her bath, is an excellent docudrama based on Michael Lewis' bestseller. It blames the financial crisis...

RIJ’s 20 Top Events for 2016

Here are 20 events that RIJ would like to attend in 2016. We'll try to reach as many of them as we can.

Damage Assessment: Who’s Hurt by New Fiduciary Rule?

Advisors who sell on commission, I-banks that underwrite securities and sell them through their own broker-dealers, and recordkeepers that capitalize on their access to participants should all beware the...

Bob Pozen Knows Retirement

'My proposal was to link the growth of Social Security benefits of the upper third of earners to CPI growth while letting the benefits of the lower third of...

No-Nonsense Income Planning

Jim Otar has explained his "zone" approach to retirement income planning in hundreds of presentations to thousands of advisors since 1997. He spoke at the IMCA retirement conference in...

Quartzite’s Most Famous Pianist

Paul Winer, aka Sweet Pie, is a 72-year-old blues musician, nudist, used book seller and one of tiny Quartzite, Arizona's principal tourist attractions. If you visit his store, be...

Waiting on the Fed

'The long end of the curve will stay stable but the front end of the curve will go up, so that we’ll have eventually have 2.5% at the short...

Why Roofers Retire Earlier than Professors

To learn more about the link between physically demanding jobs and early retirement, researchers at the Center for Retirement Research developed a “Susceptibility Index” that assigns ratings to different...

Fidelity and Betterment: From Collaborators to Competitors

Fidelity Investments is testing 'Fidelity Go,' a robo-advice portal aimed at Millennials, and building a digital interface between its affiliated advisors and its clearing service to replace the interface...

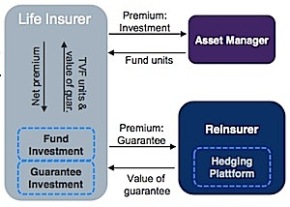

Removing ‘Lapse Risk’ from Variable Annuities

“Almost every major variable annuity writer has absorbed large write-downs on ‘policyholder behavior assumption updates,’” said a Munich Re executive. “So how do we take out that risk?”

Deep in the Data Mines

At the Society of Actuaries Equity-Based Insurance Guarantees conference in Chicago this week, the use of 'predictive modeling' to unearth buried or cryptic data was strongly encouraged.

Don’t Touch the Jenga Tower

Many observers think the Fed doesn’t need to raise rates. The actuary I met in Chicago this week was one of the few who believes that the Fed can’t...

Warren Whitepaper Missed the Mark

Sen. Elizabeth Warren (D-MA) thinks clients should be able to see the non-cash incentives offered to annuity salesmen. It would more useful if they could see the solutions that,...

RetirePreneur: Mark Warshawsky

With his new venture, ReLIAS LLC, the well-known retirement scholar-turned-entrepreneur Mark Warshawsky plans to market a process for helping retirees build ladders of single premium immediate annuities with part...

TIPS for the Long Run?

Whether you'd prefer the new Dimensional Target Date Retirement Income Funds over one of the "big three" TDFs might depend on whether you share Robert Merton and Zvi Bodie's...

DFA’s Gerard O’Reilly Explains His Firm’s New TDFs

Dimensional Fund Advisors calls its new target date funds "Retirement Income" funds. How does DFA justify that ambitious title? O'Reilly, DFA's co-Chief Investment Officer and head of research, explains....

On Background: An Insider Talks about the DOL Proposal

What do broker-dealer executives really think about the DOL proposal and it's potential impact on their business? One executive spoke with RIJ recently.

Wisdom from Advisors to the ‘One Percent’

To satisfy super-rich clients, be as inventive as Ray Croc when he invented the 15-cent hamburger, advisors at UBS, Merrill Lynch and Manchester Capital Management told members of the...