Without special 'see-through' trust provisions, a retirement asset with a trust as beneficiary may need to be distributed by the end of the 5th year following the year the participant...

Beware of double taxation on distributions: Wagner Law

If your clients live in Massachusetts, Pennsylvania or New Jersey, they might inadvertently and erroneously pay significant additional state income taxes, according to the attorneys at Wagner Law Group...

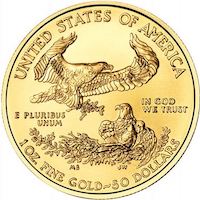

‘Eagle’ gold coins in a self-directed IRA? That bird won’t fly.

Ms. McNulty bought American Eagle gold coins for her IRA but stored them in a safe in her home. That's not legal, the tax court ruled. Attorney Barry Salkin...

Advisers, Beware of PTE 2020-02: Wagner Law

ERISA expert Kimberly Elliott of the Wagner Law Group tells wealth managers how to avoid running afoul of the Department of Labor's Prohibited Transaction Exemption 2020-02 when counseling plan...

TIAA Broker-Dealer Settles SEC Allegations for $96 Million

TIAA-CREF Individual and Institutional Services, LLC, a subsidiary of Teachers Insurance and Annuity Association of America is alleged to have failed to adequately disclose conflicts of interest and to...

A Surprise from IRS about Inherited IRA Distributions

IRS Pub 590-B presents a conundrum. It appears to deprive owners of inherited IRAs (already deprived by SECURE Act of the 'stretch IRA') to take distributors annually, rather than...

What’s up with the ‘ESG’ rule: Wagner Law Group

'Given that the slimmer Final Rule is no longer the stranglehold on ESG investing that the original proposal had been, the Biden Administration could decide not to expend its...

New law to show who qualifies for a PPP loan

This article, provided by the Wagner Law Group, explains the modifications made to the Paycheck Protection Program (PPP) by the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues...

Another Objection to DOL’s ESG Proposal

The Department of Labor's recent move to chill the use of "Environmental, Social and Governance" investments in retirement plans has drawn broad criticism--including this comment from the Wagner Law...

Can employers contribute less to their retirement plans?

In the current stressed environment, "employers must take steps to remain in business, which means reducing expenses, including their contributions to their qualified retirement plans," say Wagner Law Group...

Interpreting SEC’s new ‘principles-based’ advertising rule: Wagner Law Group

This interpretation of the SEC rule was written by attorneys Stephen Wilkes and Livia Quan Aber of the Wagner Law Group and published this week.

New safe harbor for electronic retirement plan disclosures

Retirement plan sponsors can now satisfy disclosure requirements by making the information available on a website, Wagner Law Firm experts explain. Photo: Marcia Wagner.

House Passes Family Savings Act of 2018

This bill could open a path to great changes in retirement plans. The Senate may take action on it during the lame-duck session, a new bulletin from Wagner Law...

DOL issues regulations regarding multiple employer pension plans

The proposal doesn't address 'open MEPs' that would allow retirement plan providers to sponsor plans. It establishes seven requirements for groups or associations that want to co-sponsor a plan...

For advisors, DOL enforcement holiday still in effect

'The Field Assistance Bulletin is somewhat difficult to understand,' said the pension attorneys at Wagner Law Group in a public memo about the DOL's announcement. ...

New York, New Jersey, NAIC propose investor protections

New York regulators have proposed a “best interest” standard for sales of life and annuity products, the Wagner Law Group reported. Some New Jersey legislators want non-fiduciaries to disclose...

Department of Labor Declares 18-Month ‘Transition Period’ for BICE

Though the DOL has said it will focus its enforcement policy on compliance assistance, 'private litigants' won't be so gentle, the benefits law firm warned, adding that even the...

President Trump to require ‘two-for-one’ regulations

'To the extent allowed by law, any new incremental costs associated with new regulations must be offset by the elimination of existing costs associated with at least two prior...