By Editor Test

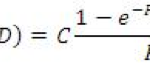

In this edited version of a monthly bulletin from the Qwema Group, Moshe Milevsky (left) and Simon Dabrowski show advisors how to demonstrate the value of an income annuity to their clients.

By Editor Test

Starting from a level of great wealth, North Americans and Europeans feel a sense of decline, while Asians, starting from a level of deep poverty, feel a sense of upward mobility and optimism, according to a recent global survey by HSBC.

By Editor Test

About a third of the 65-and-older households that owned a home in 2009 had a mortgage, according to the Census Bureau’s American Housing Survey.

By Editor Test

“This was one of the top-five best-selling quarters for indexed annuity sales,” said Sheryl J. Moore, president and CEO of AnnuitySpecs.com.

By Editor Test

The average retirement age for men, which was 65 in 1962, fell to about 62 between 1985 and 1995 but has since risen to 64, according to a new paper from the Center for Retirement Research at Boston College.

By Editor Test

Although taxpayers are allowed to make the exchanges, they have not been sure how to report the exchanges, or how the exchanges might affect their income taxes.

By Editorial Staff

Brief and late-breaking items from ING, Strategic Insight, TrimTabs, Great-West Retirement Services, Brinker Capital, Frontline Compliance LLC, and John Hancock Retirement Plan Services.