401(k) plans

By Kerry Pechter

The ERISA Advisory Council heard testimony on whether to tweak the rules for Qualified Default Investment Alternatives to accommodate—or exclude—annuities. Advisors to 401(k) plans should read this.

By Editorial Staff

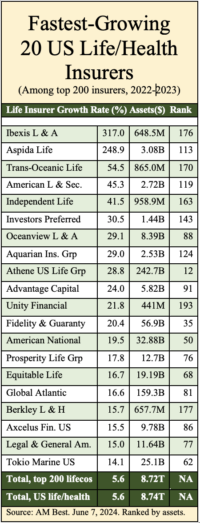

'After years of ultra-low interest rates, LIMRA believes conservative investors, who were sitting on the sidelines reluctant to lock in low rates, have poured money into the market as rates rose over the past two years,' said Bryan Hodgens, head LIMRA Research. First-half 2024 annuity sales topped $215 billion.

Briefs

By Editorial Staff

Milliman to offer Hueler Income Solutions to its recordkeeping clients; Principal issues its second RILA; John Hurley joins Ibexis from Global Atlantic.