By Kerry Pechter

Today’s financial Goldilocks moment—with strong equity returns and robust fixed income yields—creates favorable conditions for the Netherlands to complete its long-planned switch from traditional private defined benefit plans to 'collective defined contribution.' 'You can almost call it a tontine,' a Dutch pension consultant told RIJ.

By Editorial Staff

We feature two deep-dive research papers on private credit. One is from Victoria Ivashina of Harvard Business School and the other from a team that includes Amir Sufi, co-author of "House of Debt" (U. of Chicago, 2014.) Plus two papers on combining income annuities with private savings and a paper on the domino effect that TDF reallocations can inflict on the bond market.

By Kerry Pechter

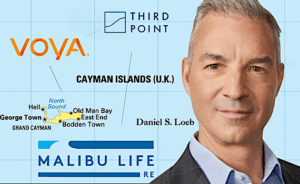

Another asset manager goes subtropical. Third Point Investors Ltd. established Malibu Re in the Cayman Islands, bought a Texas life insurer from Mutual of America, acquired a private credit shop, and received $25m each from Voya and ReliaStar.