By Kerry Pechter

'The long end of the curve will stay stable but the front end of the curve will go up, so that we’ll have eventually have 2.5% at the short end and a long end between 2.5% and 3%,' predicted a BNP Paribas managing director recently. (Pictured: Janet Yellen.)

By Kerry Pechter

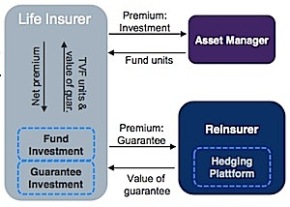

“Almost every major variable annuity writer has absorbed large write-downs on ‘policyholder behavior assumption updates,’” said a Munich Re executive. “So how do we take out that risk?”

By Kerry Pechter

At the Society of Actuaries Equity-Based Insurance Guarantees conference in Chicago this week, the use of 'predictive modeling' to unearth buried or cryptic data was strongly encouraged.

By Kerry Pechter

With his new venture, ReLIAS LLC, the well-known retirement scholar-turned-entrepreneur Mark Warshawsky plans to market a process for helping retirees build ladders of single premium immediate annuities with part of their savings.