By Kerry Pechter

'My proposal was to link the growth of Social Security benefits of the upper third of earners to CPI growth while letting the benefits of the lower third of earners continue to rise with the wage index,' said the former president of Fidelity Investments in this wide-ranging interview.

By Kerry Pechter

Jim Otar has explained his "zone" approach to retirement income planning in hundreds of presentations to thousands of advisors since 1997. He spoke at the IMCA retirement conference in Scottsdale earlier this month.

By Kerry Pechter

'The long end of the curve will stay stable but the front end of the curve will go up, so that we’ll have eventually have 2.5% at the short end and a long end between 2.5% and 3%,' predicted a BNP Paribas managing director recently. (Pictured: Janet Yellen.)

By Kerry Pechter

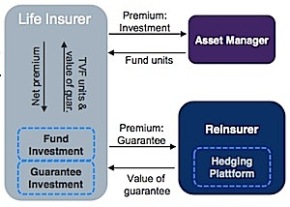

“Almost every major variable annuity writer has absorbed large write-downs on ‘policyholder behavior assumption updates,’” said a Munich Re executive. “So how do we take out that risk?”