By Kerry Pechter

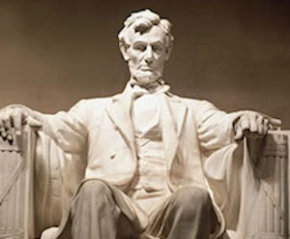

'Lincoln Core Income' offers 4% guaranteed lifetime income with a 2% COLA, plus a choice of three iShare exchange-traded funds and a death benefit for an all-in cost of about 190 basis points.

By Kerry Pechter

‘I’ve been on the bleeding edge as much as I’ve been on the leading edge, and it’s not always a comfortable place to be,’ said Judson Bergman, Chairman and CEO of Envestnet (above).

By Kerry Pechter

Three benefits attorneys told RIJ this week that the DOL's fiduciary rule became effective last June, and that it may be hard to stop the rule--or even delay the April 10 applicability date--without another lengthy review and public comment process.

By Kerry Pechter

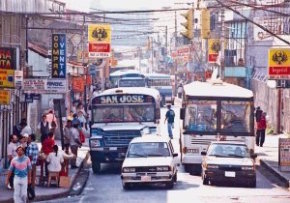

With 4.8 million people, Costa Rica’s problems are comparable to those of a big U.S. city, like Los Angeles or Chicago. Yet the tensions of a large U.S. city seem absent here, as the famously warm and friendly 'Ticos' go about their business. (Photo: Traffic in San Jose)