Anecdotal Evidence

By Kerry Pechter

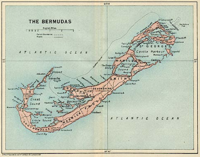

There are clear similarities between the business scheme that brought down Executive Life Insurance Co. in 1991 and the 'Bermuda Triangle' strategy that many US life/annuity companies use.

By Editorial Staff

Nassau Financial gets $200 million from Golub Capital; AM Best affirms ratings of Aspida Group, backed by Ares Mgt; 3M swaps its $2.5bn DB pension for a MetLife group annuity; Bermuda-based Apex Group sells $1.1 bn of payment-in-kind notes to Carlyle and Goldman Sachs; Oceanview establishes reinsurer in Cayman Islands; Bermuda Triangle insurer receives ‘negative’ outlook.

By Editorial Staff

The two firms have already worked together on connecting MetLife’s retirement income services with Fidelity’s Guaranteed Income Direct and State Street Global Advisors IncomeWise platforms.