By Kerry Pechter

Has the time finally arrived for the variable income annuity? At TIAA, where the VIA was invented, they say it never left. New research from the TIAA Institute compares the VIA with a variable annuity with a lifetime withdrawal benefit.

By Kerry Pechter

The Department of Labor decided not to send an invited panelist the Insured Retirement Institute's Government, Legal and Regulatory Conference on Monday--perhaps because the IRI is party to a federal lawsuit calling for the annulment of the DOL's "fiduciary rule."

By Kerry Pechter

To benchmark the public’s level of knowledge about HECMs, The American College’s New York Life Center for Retirement Income sponsored a survey that included a 10-question quiz. We invite you to take the test.

By Kerry Pechter

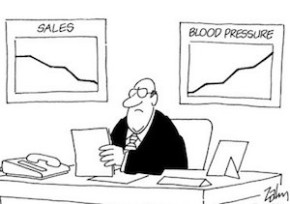

'We are seeing a significant shift in the annuity market,” said Todd Giesing, assistant research director at LIMRA's Secure Retirement Institute. 'We have to go back 20 years—to 1995—to find when the VA market share was 45% or lower.'